3/26 Recap

Sending this out a little early as we are in a bit of a lull right now. Look at the volume yesterday and today halfway through the day on the SPY below. We’ve barely traded 17m shares today vs 79m+ 2 last friday. There is just nothing going on at this moment. Maybe people took the week off with the short holiday week, but this is almost as dead as the market is during the period between Christmas and New Years. Overall the market remains above the 8 ema and there is nothing to note in terms of data this week.

Recent Trades

VKTX is up 23% today, I highlighted it in a recap last week on 3-20. There was a huge April 100/120 call spread bought 5000x and another large ITM call buy at $40 for over $3m. If you put on that risk reversal I suggested below those puts have decayed nicely from 3.30 to .90 today and the $100 calls have jumped $3 to $10.70 for an overall pretty substantial gain in a week on that risk reversal.

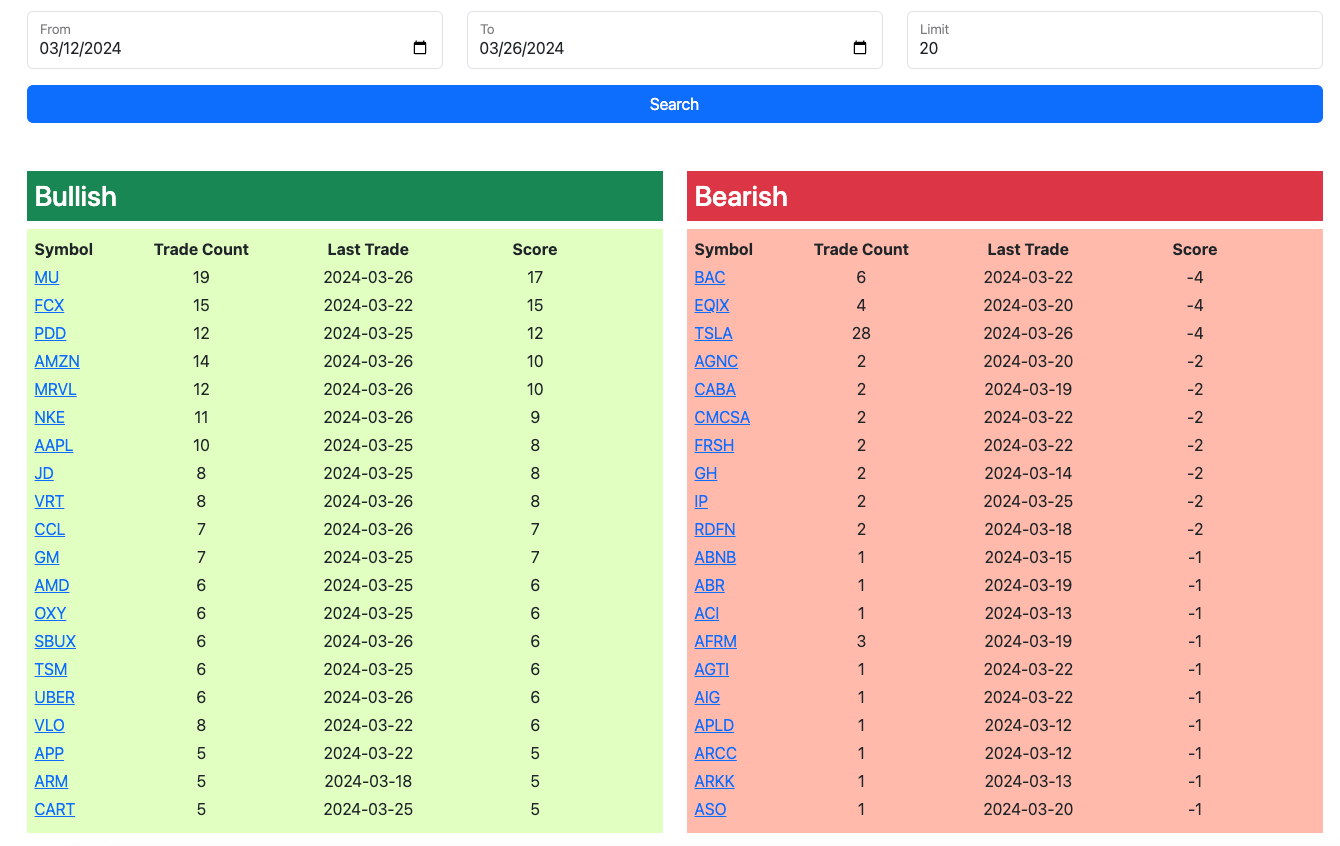

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Below is today’s link to the database, as always it is open until the market open tomorrow. I will have the rest of today’s trades added by the afternoon so check back this afternoon on the link below for the updates.