3/28 Recap

We wrap up a nice quarter today. Believe it or not the S&P outperformed the Nasdaq this quarter up over 10% vs just under 9% for the Nasdaq. This was with NVDA,META, MSFT and AMZN all having unbelievable quarters, even GOOG was still up 10%. TSLA was the big laggard down 30% and AAPL did poorly but breadth did pick up and this wasn’t a tech stock only rally.

The SPY bounced off the 8 ema yesterday and just refused to breakdown this entire quarter. It’s hard to believe but the 50 sma is now well over 500. This market has big support now only 5% lower. Every time we neared a point of a potential breakdown, we got bought up right away.

Oil is looking for its highest close of the quarter today, it too has been bought every time it approached the 8 ema recently.

Gold has been a star this quarter look at /gc below hitting record highs today. I don’t know what the inflation is dead crowd believes, well they believe the nonsense the media and the fed spew, but inflation is certainly not dead when a horrible asset like gold is breaking to highs at the same time oil is. I hope you all took that big NEM trade I highlighted as a best idea a couple weeks back, it is breaking out right now.

They can tell you inflation is dead till they’re blue in the face but it just simply isn’t. I don’t think we’re going to see the below unfold, I sure hope not, but other countries dealing with inflation have seen equities soar, this isn’t anything new. We’re seeing record national debt, all the commodities that would be in decline if inflation was tame, are up, but they keep telling us inflation is under control. Who knows what to believe anymore. Just thank God that you own stocks right now because people in cash, people in bonds, they are losing ALOT in real terms. Those buys of 5% treasuries a year ago don’t look like such great moves now with the SPY up 40% since the start of 2023.

Recent Trades

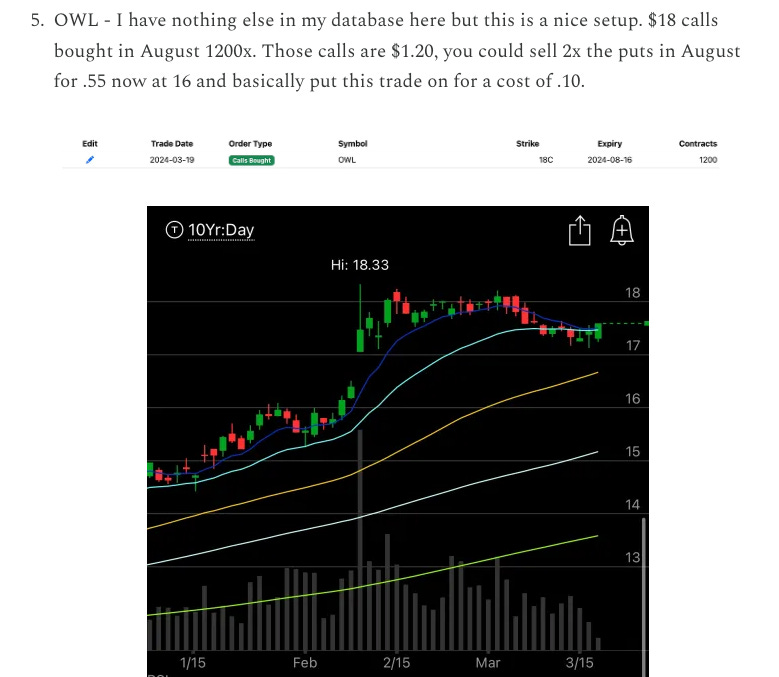

OWL - I highlighted this one on 3/19 when it was below $17.50, it is $19.07 as I write this up almost 8% since, that is a huge move for a slowing moving name like this. Those $18 calls went from $1.20 then to $2 today, if you put on the risk reversal I suggested below you’re up over 10x right now in just 9 days, .50 on the short puts going from .55 to .30 times 2 and $.80 on the calls that’s $1.30 total return on a .10 outlay , think about taking it off right now.

That is the power of the risk reversals I highlight everyday. If you just bought calls, you’re up over 50%, that’s awesome, but if you used risk reversal properly you’re up almost 30x that. That’s how to properly use leverage into the data I provide. Think about using them more, yes they require more margin, but they also can lower your risk should you be wrong on the trade.

Trends

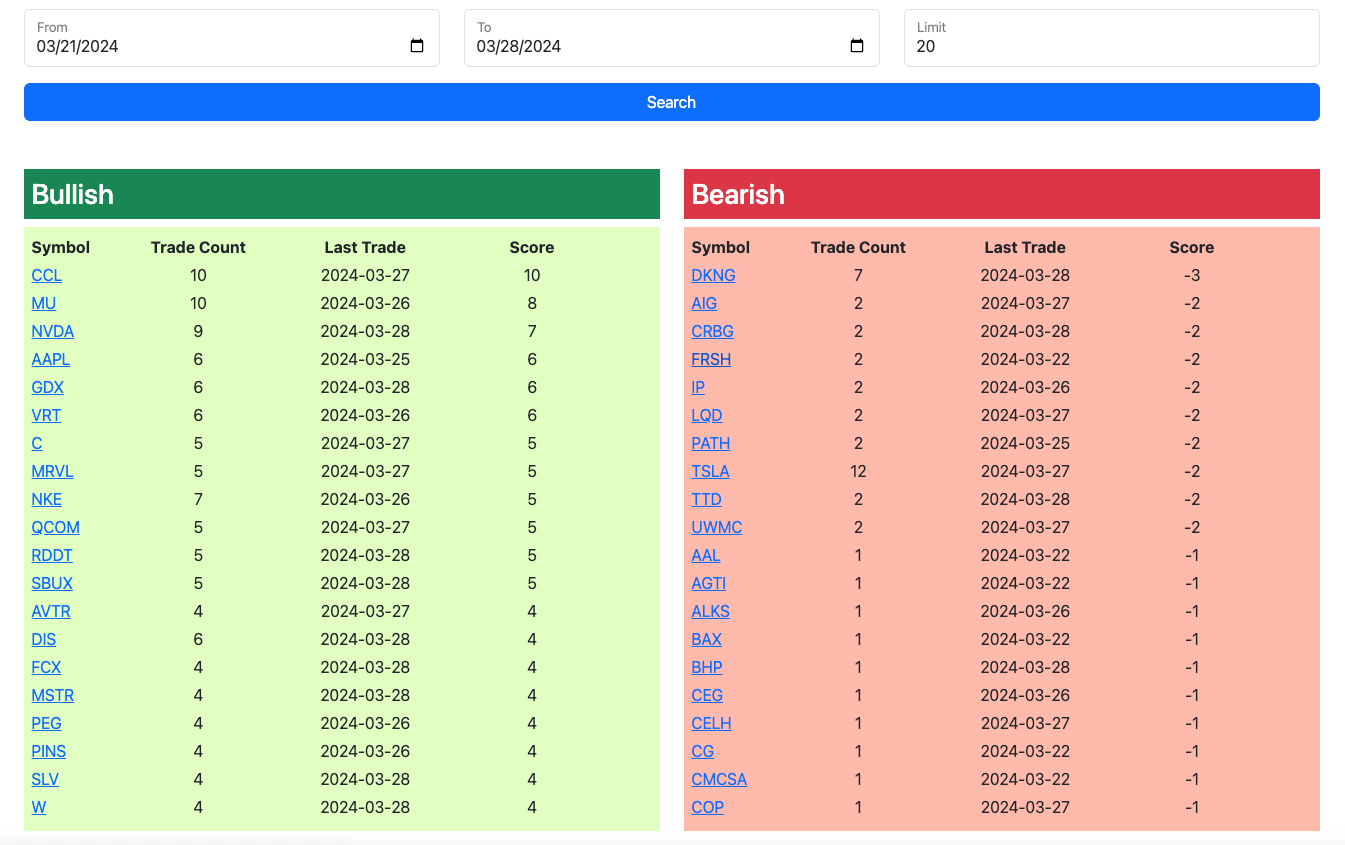

1 Week

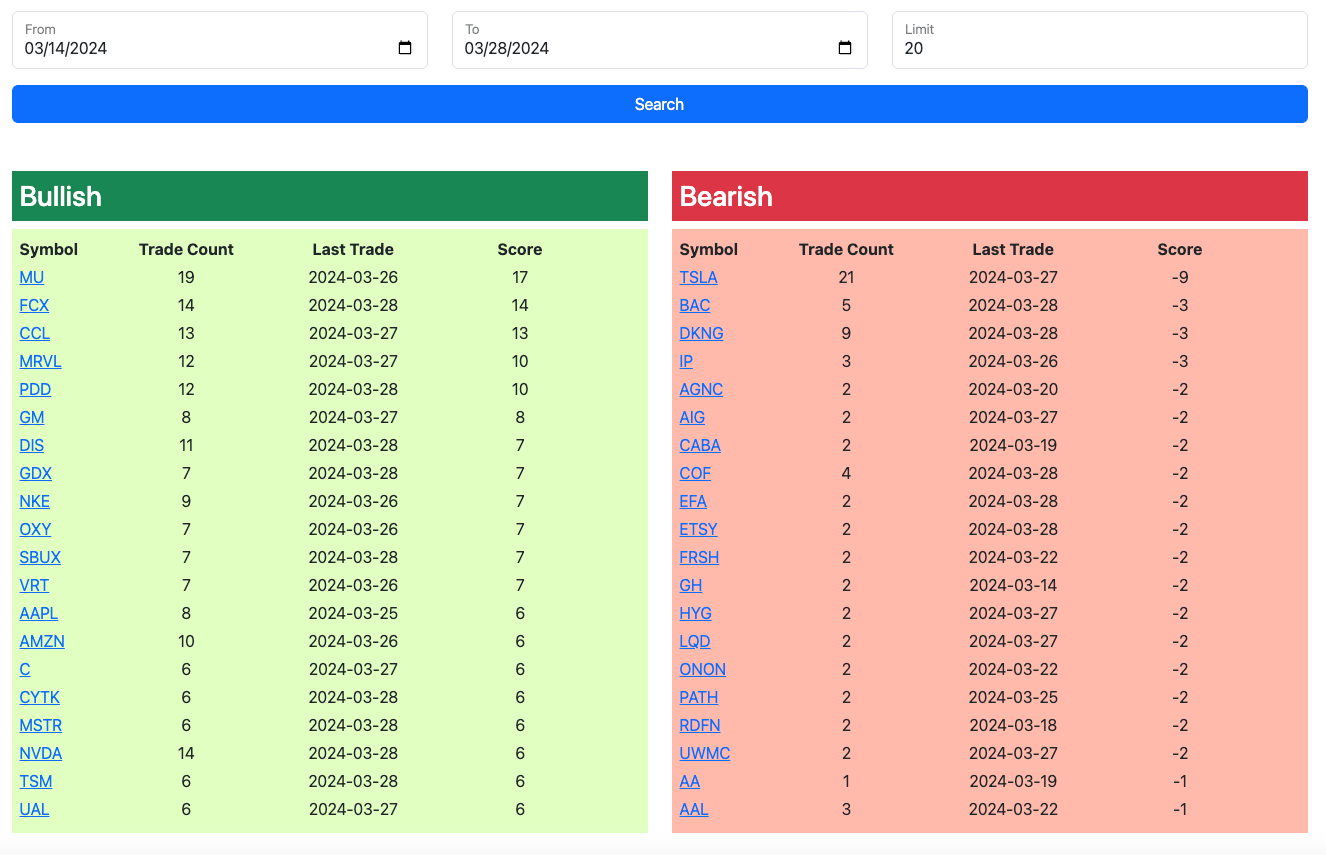

2 Week

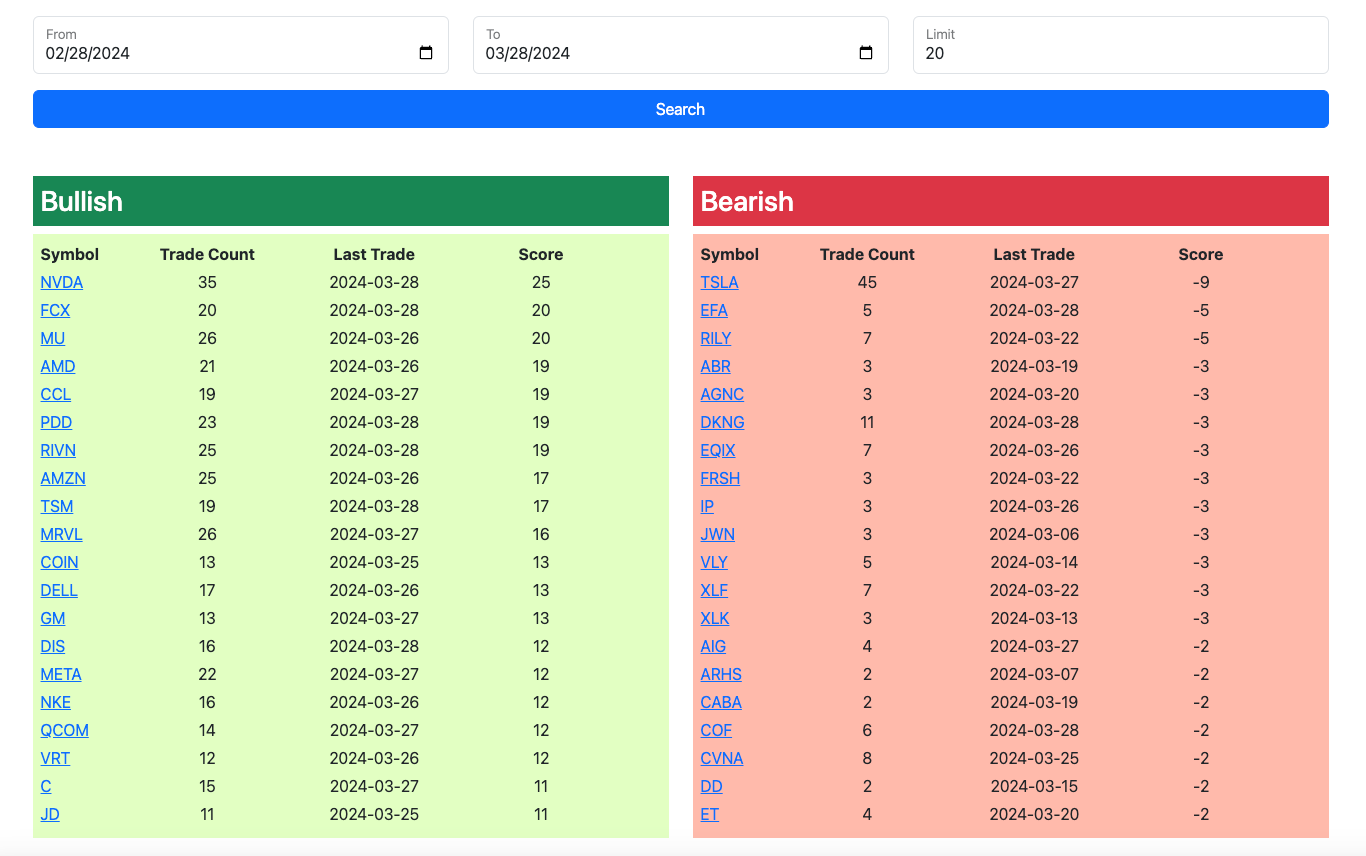

1 Month

Today’s Unusual Options Trades

Here is today’s link to the database, the link will be up until monday because there is no market tomorrow for the easter holiday. Today was a very slow session, way less than normal I logged so far, just normal holiday week stuff. I will have the rest of today’s action updated late tonight or maybe even tomorrow, I’m heading to the baseball game today for opening day right now.