3/28 Recap. BABA + 16%, The Flows Don't Lie.

Im wrapping this up a little early today, I’m on a plane headed overseas for a few days, don’t worry you will get your recaps, I will do my best to get them out during market hours as I always have.

SPY

This remains very weak, as I mentioned yesterday, sideways appears like they most likely outcome and today was another day of that. We still have some key data points this week, but the flows do not support a bullish outcome. The RSI remains very weak here. The oil names are finally bouncing, but now the tech names are the weak ones. We can’t ever seem to line up all the moves together.

The QQQ if finally breaking below the 8 ema, a sign of short term weakness. This has been leading us for weeks and is now deciding to show signs of cracks. A test of the 290 level below seems likely and lines up with a breakout re-test and the moving averages you see below. If tech is weak, what will carry the market? It certainly won’t be banks this time. The MACD is slowly rolling over here and likely to go red in a few sessions as this plays out.

Trends

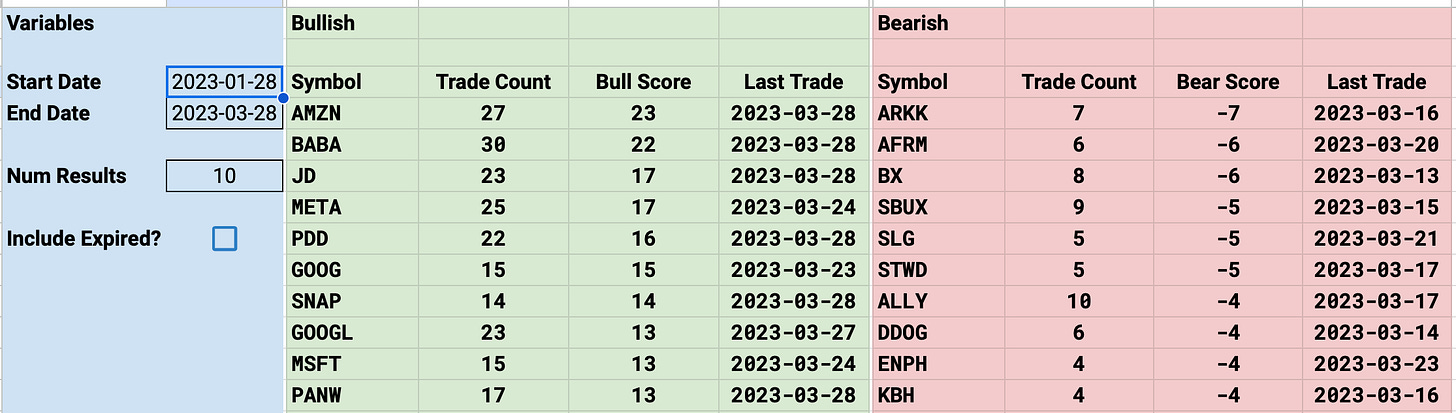

The interesting things with these trends is for weeks I’ve been mentioning BABA over and over as the top trend if you look below it was for the past month and 2nd over the last 2 months. It took a little bit to play out but BABA is up 16% today as I type this on news of a potential split. It makes you wonder if this is what is coming to Amazon which is also very high up on my trends.

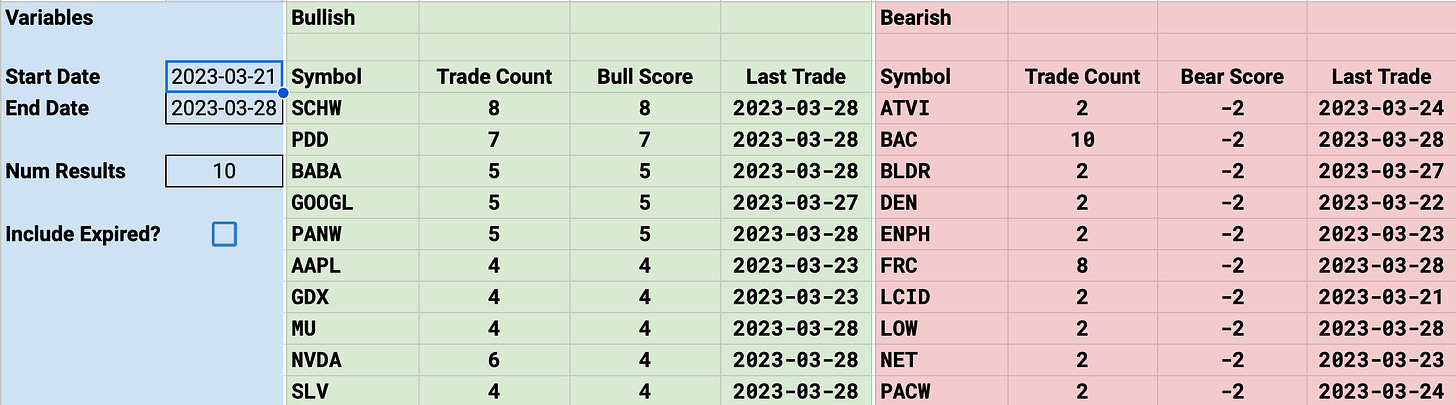

1 Week

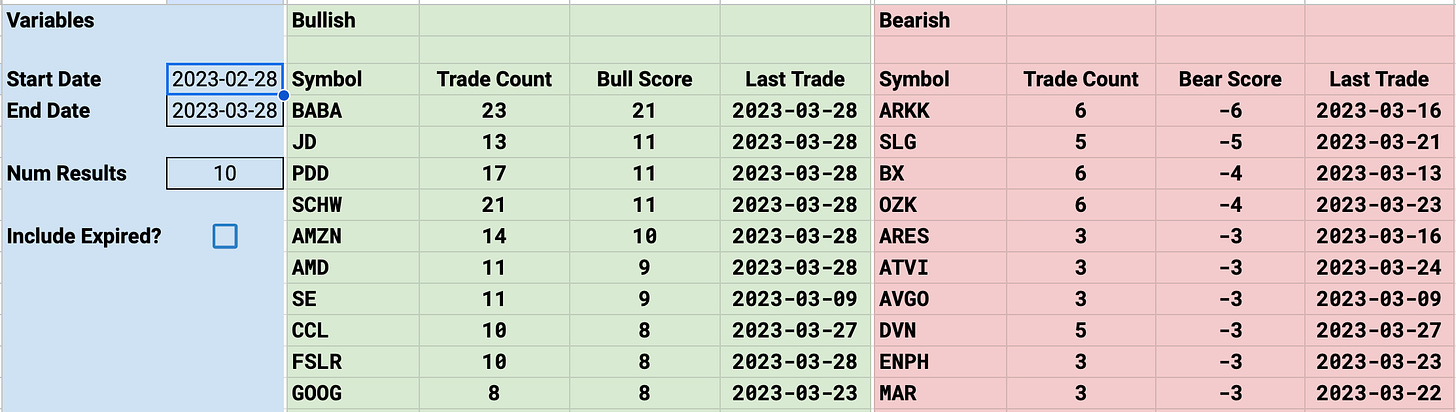

2 Week

1 Month

2 Month

Today’s Unusual Options Flow & What Stood Out