3/31/25 Recap

The SPY is trying to hammer here off the 550 level we talked about yesterday, if this happens, we very well could be forming a double bottom 10% off highs and with tomorrow’s April 2nd Liberation Day behind us, we can begin to build. We also have later in the day the JPM collar rolling forward which should give us some buying pressure as well along with end of quarter buying. I know everyone is screaming about how Trump is breaking the economy but I want you to take a deep breath and understand that while stocks have not gone straight up under his term, he is using these tariffs as a negotiating tactic, will it work? I don’t know, but what I do know is he has probably a 6 month window to pretend he doesn’t care about the market before his advisors begin to remind him mid terms are a year away and if he wants his party to retain power, equities need to start going up again. So I’d imagine this tariff saga ends in these other countries giving into his demands or he drops it altogether in a few months if markets continue to struggle. The reality is the 2026 midterm election and retaining power is the most important thing to him and if he feels that slipping away, he will pivot. We’re so far away that he doesn’t care right now.

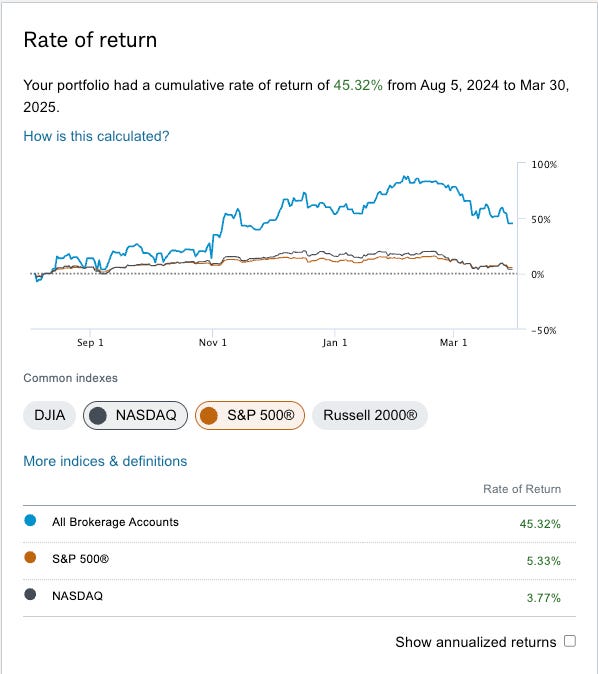

While this move down does feel brutal I want you to realize that we are still up 10% from the flashcrash last August, I’m serious, look at a chart of where the SPY got that day. It’s crazy to think we’re up 10% from lows 7 months ago, it isn’t as dire as people make it out to be, but we got extended. Go look at your performance since last August, you will feel fine, yes the year to date is bad, but I’m feeling ok, I had a couple big trades between then and now and I’m happy with the results. This was actually the first time I glanced back at that date and I’m up 45% since even with this rough start to the year, so I’m not going to lose sleep over this market weakness, I stuck to my principles I sold my AMZN and META when charts showed weakness and avoided alot more pain than had I held. Yes, my short puts are hit in the interim but I’ve explained my view there, I think we flatten out soon, possibly even starting today with a potential double bottom forming.

My Open Book