3/4 Recap

Low volume session, again. Today was an odd one where Tesla was down 7%, Google was down 3%, and Apple was down 3% but the /NQ was barely down as NVDA is currently up over 4.5%. There is a rotation going on that is clear as day to anyone who cares to acknowledge it. Money is exiting Apple,Google, and Tesla as they underperform daily and NVDA,META, MSFT and AMZN have been the beneficiaries. The Mag 7 is over and it is really a Mag 4 right now.

The SPY, below, just continues to ride this 8 ema higher, it is just a slow grind up everyday. Chairman Powell does speak this week and that is our next catalyst but this legendary run the market has had just continues.

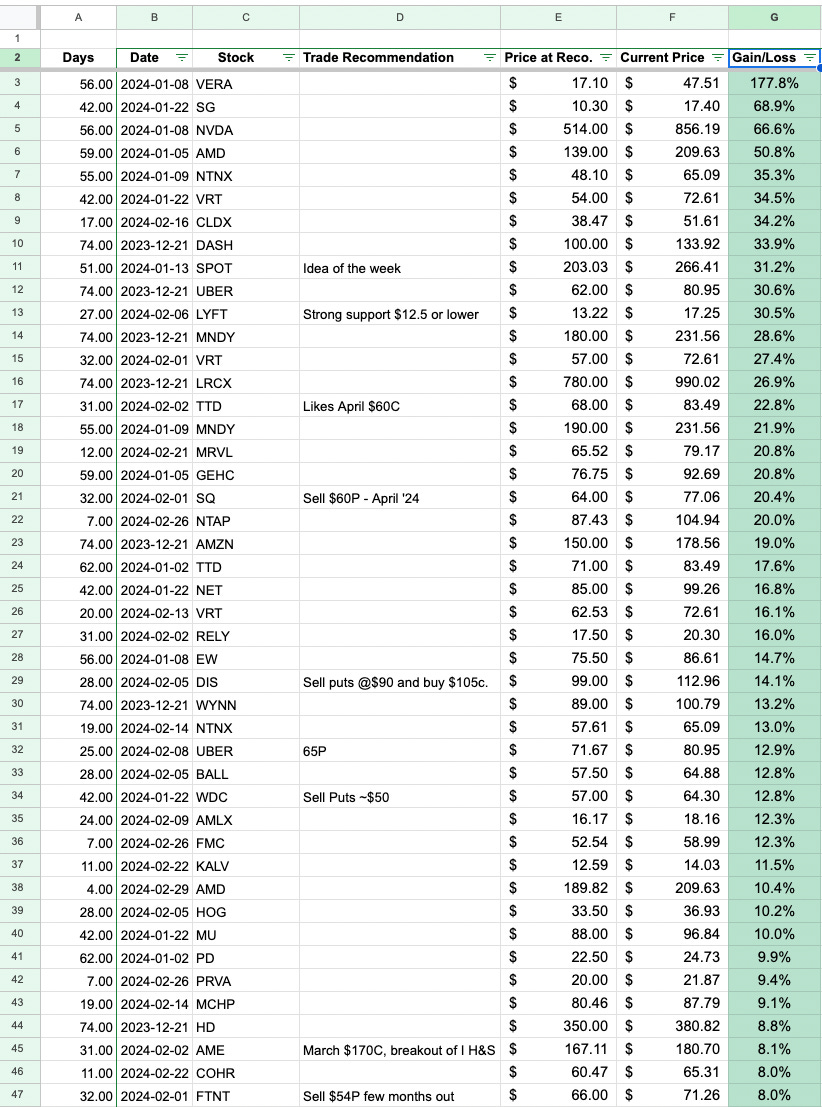

Something I wanted to discuss regarding the trades I highlight everyday, as you know they are being tracked and their returns from the time posted this year, you can see the dates and verify them in the recaps from that date. Here is the number that have gone up over 8% since the time they were posted. There are 44 of them, now remember I only post 5 a day so that means almost 15% of the names I’ve posted have gone up over 8% in that short timeframe. The timeframe is from the 2024 preview + all of the 2024 ones I’ve posted so far with the biggest gainer at 177.8% on VERA.

and on the the amount down over 8% there are only 15 of them, Boeing is there twice, with the biggest loss at -30% on CYH.

So the odds are pretty favorable so far on trading the names I highlight directionally. Even the ones that haven’t worked out, you can always sell covered calls and work your way out of them so they’re not complete losses. The odds are even better if you sell puts lower like I typically suggest.

Trends

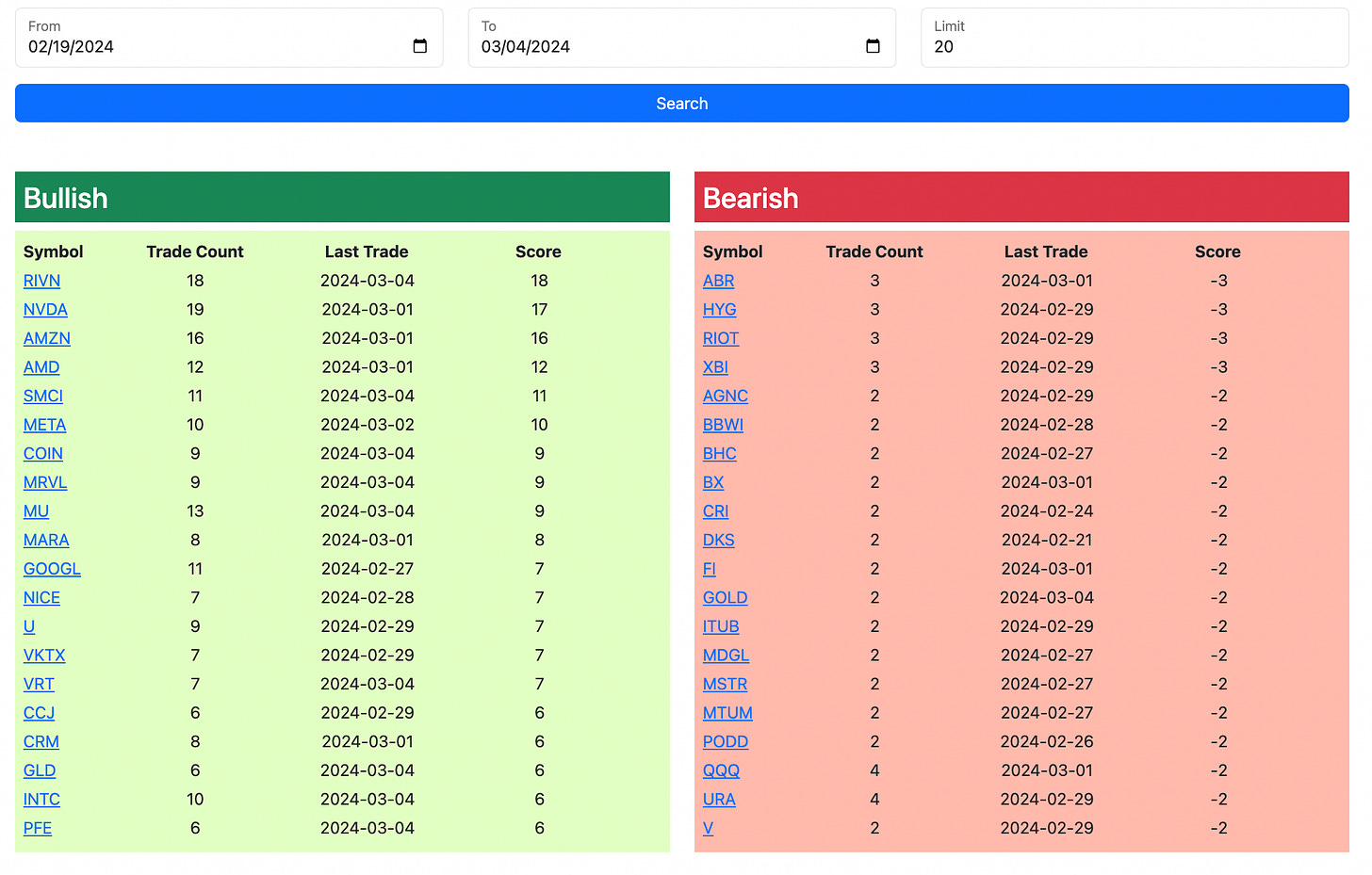

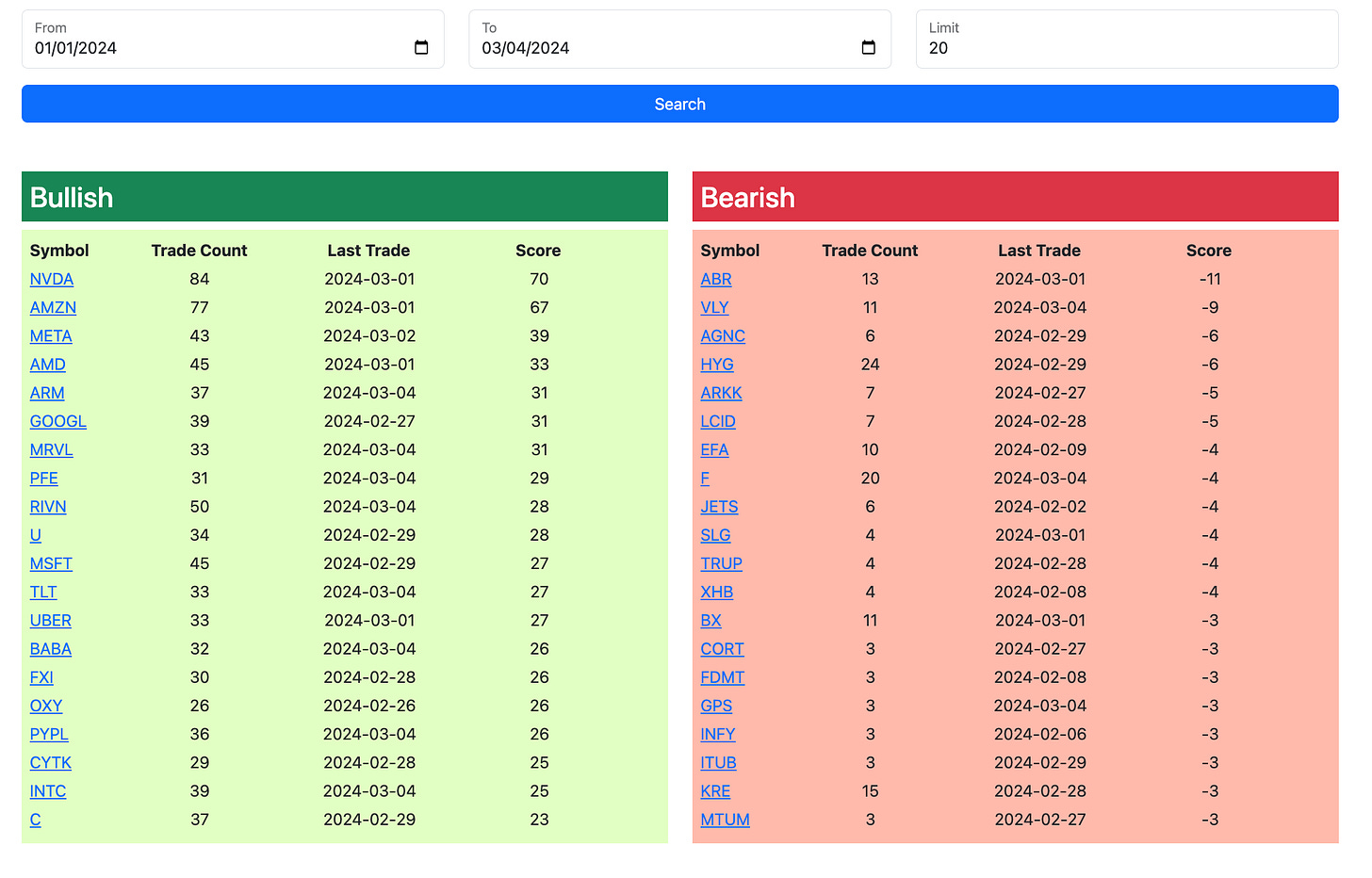

This is only the top 20, you can all click the link below into the app and see the top 40 or 50, but for the sake of making this fit here, I’m only posting the top 20 now. Look at the year to date trends, the top 5 especially, those have pretty much been the best performers in our market this year in large cap land.

1 Week

2 Week

1 Month

Year To Date

Today’s Unusual Options Activity

Here is today’s link to the database, as always this expires by the open tomorrow morning and I will have the rest of today’s action posted by this afternoon.