3/5 Best Idea For The Week Ahead + 10 Charts That Interest Me.

What a week we just had. Thursday morning it looked like we might potentially break that uptrend we’ve been in since October, we t

ested it and promptly rallied over 3% in the next 1.5 sessions. We closed friday over every key moving average in the SPY and the bullish structure we’ve been in remains in place.

The weekly chart shows a nice hammer on the largest volume in 4 weeks. I’m not exactly sure how anyone could be bearish, chart wise, at this moment. Yields keep rising, the likelihood of a soft landing continues to decrease, but, stocks look good. What an odd time.

Friday itself was easily the weirdest trading session I’ve ever encountered myself, you all see me post my daily p/l but I’ve never had a book of short puts rise over 5% in 1 sessions. The S&P was up 1.6% and I was up 5.2%? What on earth happened.

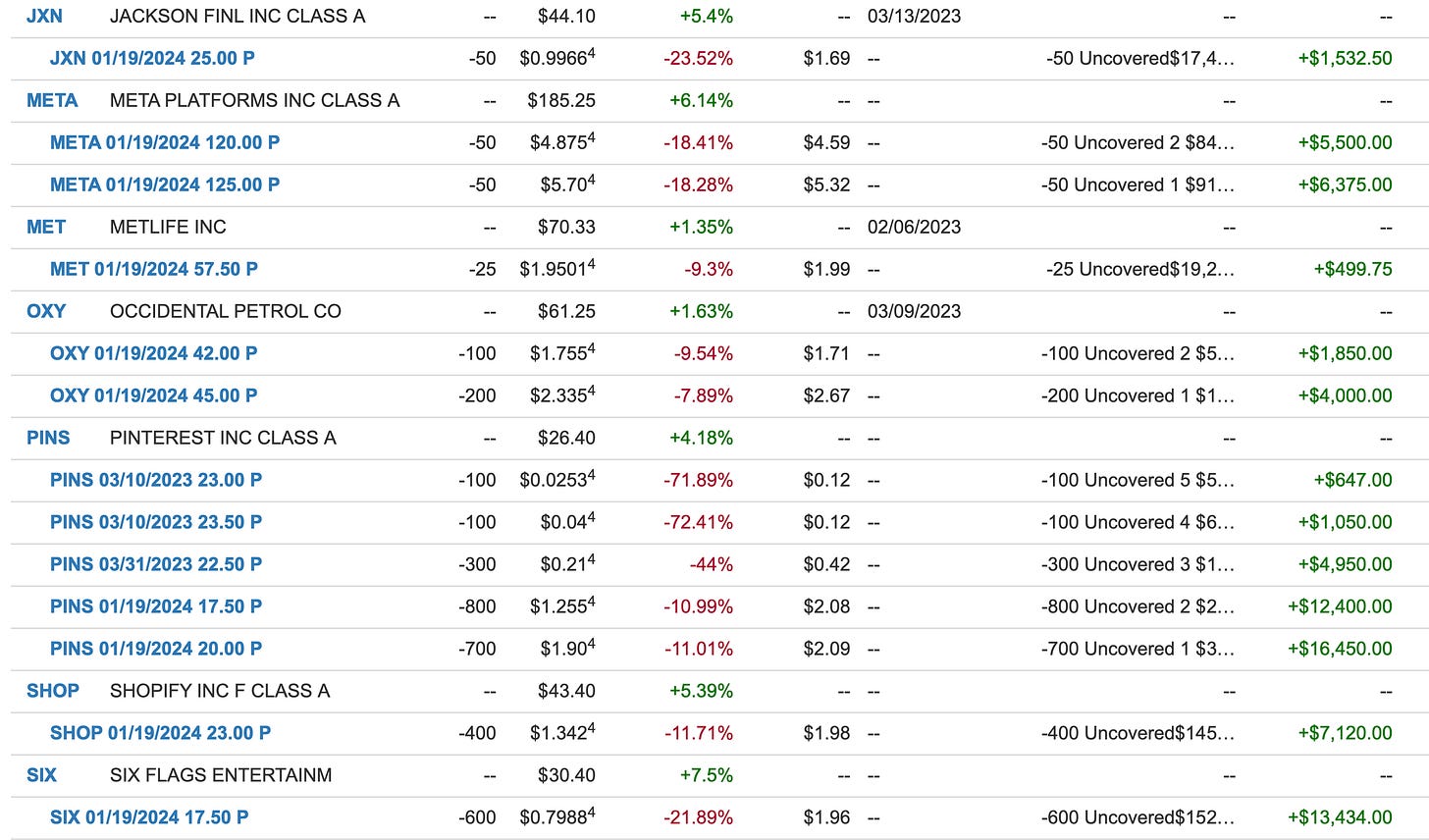

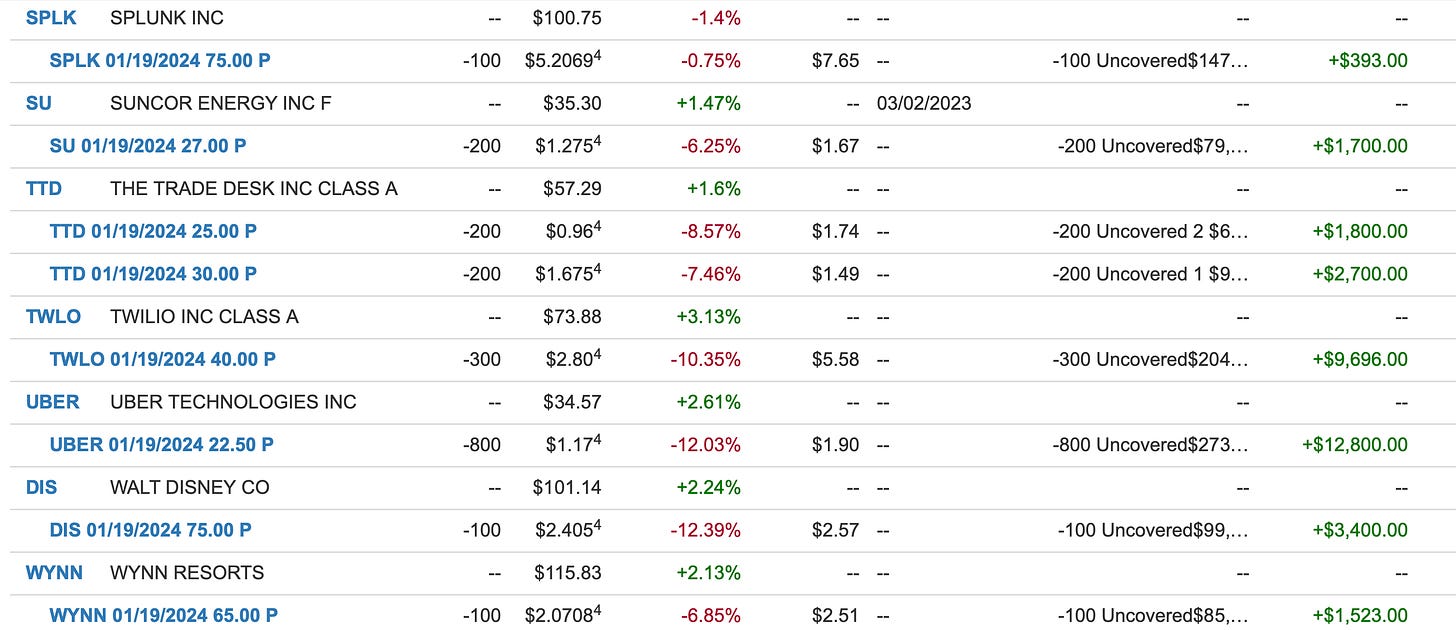

So I took a closer look and not one position I had was red on friday, usually something will be red when you have this many positions on, but not even one. Have a look, I could not believe what I was seeing.

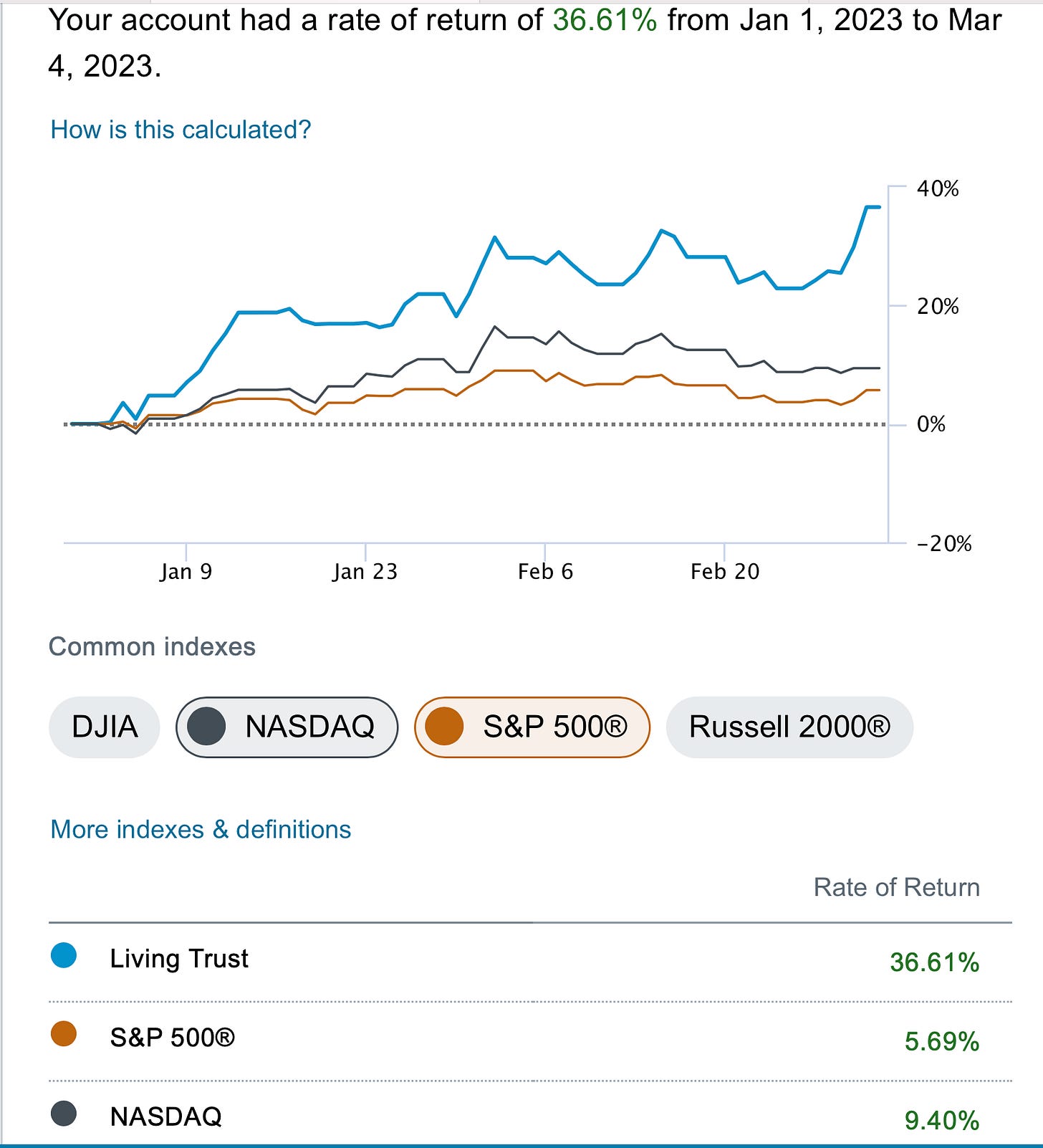

With all that said I was up over 11% last week in 5 days, as a put seller, you never expect a return like that in a couple of days. This whole year is impossible to put into words for me, the leverage I utilized at Christmas has turned out to be about as perfect a move as I could have executed as I’m now up 36.6% in just a little over 2 months into the year.

My outperformance vs the market is getting a little crazy even to me as I step back and look at it from the inception of this substack last June. It’s hard to believe I’m up 91% vs the market now. I’m very methodical with my moves and try to not think about the overall market but even I never expect to outperform by this much in such a short timeframe. I really want some of you to reply down below especially those who’ve been here more than a few months, how are you all performing vs the market?

Best Idea For The Week Ahead

As you all know the trends in my database recently showed names like CRM,META,PANW were all seeing a ton of unusual buying potentially meaning they were set to rip and they did. Looking on a smaller timeframe of just the past week, I identified 10 names with the most net bullish activity. Let’s take a look at which one I like most and how I would play it. Note CCJ is in 2nd and that was my best idea just a few weeks back as a longer term put sale.