3/5 Recap

So here we are, the market finally feels like it may be short term topping out. We’ve spent 1 day below the 21 ema in nearly 5 months, one of the most epic runs the market has ever had. Now we’ve got Apple sending warning signs with Iphone sales down 24% in China this morning and Tesla is also bombing sales in China which is their most important market. Both stocks have been spiraling downwards. Google also broke its 200 day today and you basically have 3 of the Mag 7 in bear markets at this moment. Again the Mag 7 as I’ve pointed out a few times make up over 30% of the SPY. MSFT broke the 21 ema today, that is my sign of a trend shift so that makes 4 of the Magnificent 7 with broken charts. NVDA and META remain over the 8 ema which is still signs of short term bullishness and Amazon broke the 8 ema but is still holding the 21 ema so on a longer timeframe, it too remains bullish.

So what now? Nothing, don’t panic, pullbacks are a normal thing, what we’ve done since late October is what isn’t normal. We’ve taken every tech stock to mars pricing in an AI driven improvement to numbers that may or may not materialize. Growth has been terrible at Apple and Tesla for a long time, this move down was long overdue, but its hard to knock Apple down with their perpetual buyback and everyone hiding in it for “safety”. The company has squandered hundreds of billions on buybacks over the last decade and that is great, it pushes the stock up, but now Apple has no growth, and nothing to show for it. Meanwhile, someone like Amazon has done no buybacks and focused 100% on growth and here they are powering along. It’s like the parable of the tortoise and the hare, Apple was focused on gaming their stock and Amazon was focused on growing their actual business. You’re currently seeing Amazon posting growth and profits while Apple posts profits but the stock is breaking down.

We probably see weakness in tech for a little bit here, say 4-6 weeks before the earnings run ups start, in that time you probably see names like banks bought, they have very nice chart setups right now. Things do not go straight up forever and tech has for nearly 18 months at this point. Other names like oil,industrials,etc that have been left behind. Now that doesn’t mean go sell your tech stocks and create a taxable event over nothing. They always circle back to this stuff because again, it is 30%+ of the market, without tech, we cannot go up, you remember 2022. I still think we’re in a multi year tech bull market, but periods of consolidation are totally normal and new leaders emerge along the way and this time it seems like Apple,Google, and Tesla will be on the outside looking in. even companies like Apple they may not be sexy anymore but they still generate a ton of cash and they can buyback stock forever, same with Google. Look at the chart of a stock like AZO, Autozone, they have maybe the greatest buyback of all time and a very mediocre business. The stock is still up 10x over the last decade because of it. Apple and Google are fully capable of the same type of financial engineering and the lower the shares go, the better for them.

If you are concerned with the overall market, you can begin to either lighten up, remove leverage if you’re using it or even sell covered calls, but the problem is every dip we’ve had for 2 years is bought, so it is very hard to be bearish until we get a trend shift and we haven’t even gotten that right now. The SPY, below, is still holding the 8 ema right now, actually sitting ontop of it. The 21 ema right below is the next level of support, as long as that holds the overall market is ok, below that light blue line opens the door to the 50 day at 490.

Tech stocks are different, the QQQ below has already broken the 8 ema and are quickly approaching the 21 ema. If that does not hold a move down to the 50 day right over 420 is the next level to focus on. So you can see at the moment, tech is not our leader for the first time in a long time.

Current Trades

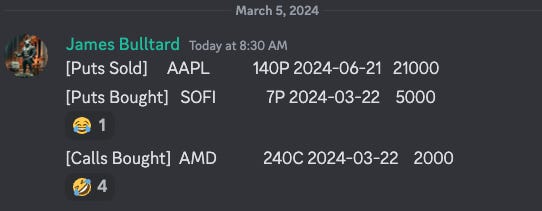

Something I wanted to mention is sometimes you all see a trade in the table below and it has moved alot by the time the recap has come out, try not to pay attention to those trades. For instance this morning on the live feed, I posted some SOFI $7 puts for 3-22 that you’ll see in the table below. They came in seconds after the opening bell, SOFI proceeded to fall 13% over the course of the session after announcing a convertible. That trade worked, but by the time the recap has come out, that move has already happened and that is why I post things live for those who want them. This isn’t common, but it does happen from time to time but please don’t chase names that have already tanked intraday.

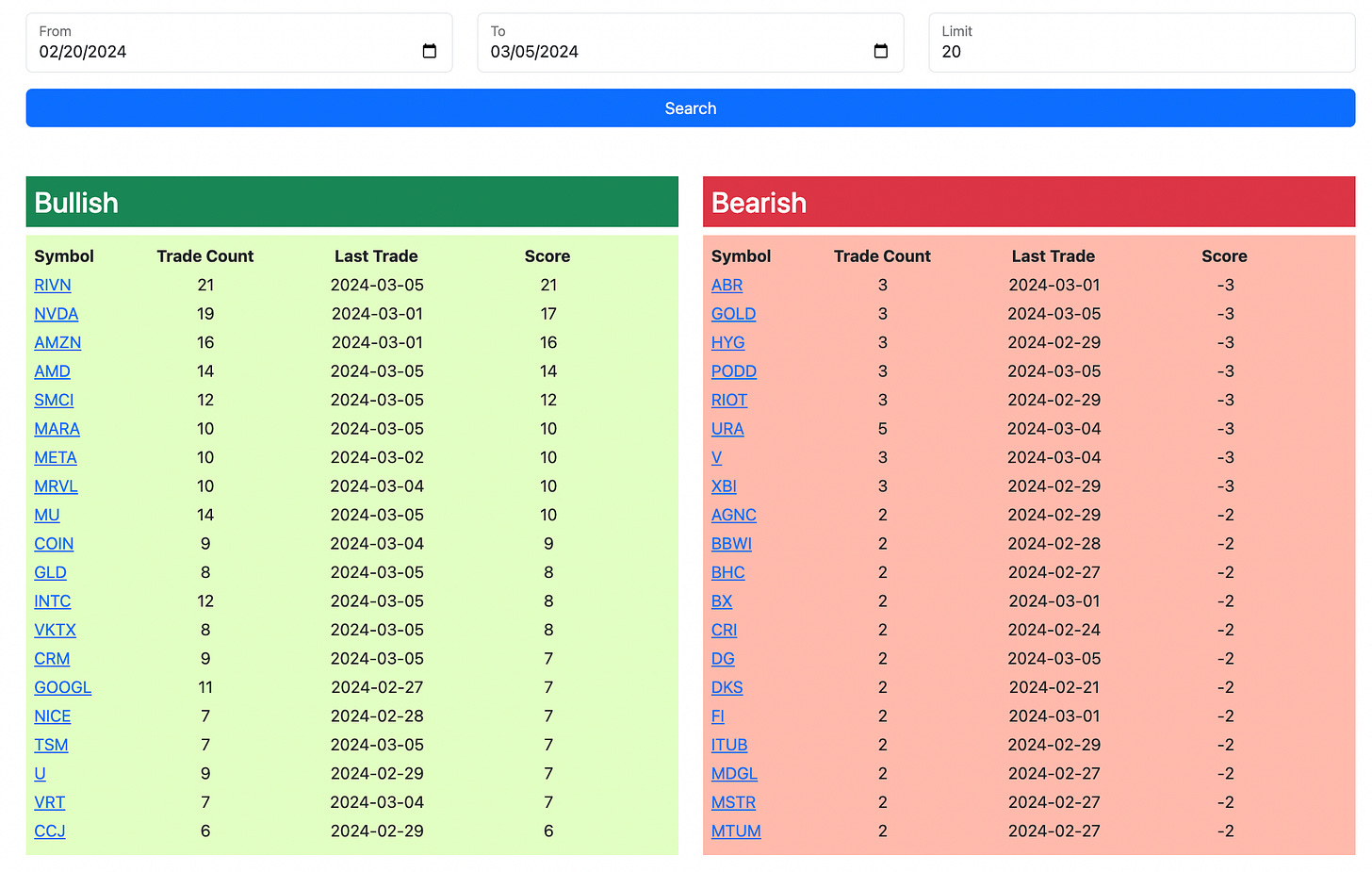

Trends

1 Week

2 Week

1 Month

Today’s Unusual Activity

Here is today’s link to the database, I will have the rest of the trades from today’s session posted by the afternoon so check back in for updates.