3/6/25 Recap

I’m sending this out a little early because we’re flying back home today so I won’t be updating the database until late tonight and only got in 60+ trades so far today.

The SPY once again with a big bottom wick as we neared the 200 day. This is just a very broken chart right now and the 8 ema is racing lower to catch up. If there is upside, it is going to come after the 8 ema flattens out an then gets reclaimed but the 21 ema crossing down through the 50 and 100 is not ideal. Tomorrow we have NFP and if it isn’t good we might lose the 200 day. Along with that barring a big close to the week, we may also be breaking the 21 week on a closing basis for the first time since October 2023 tomorrow. That is going to be my focus into tomorrow as that would be a huge change of character for the market.

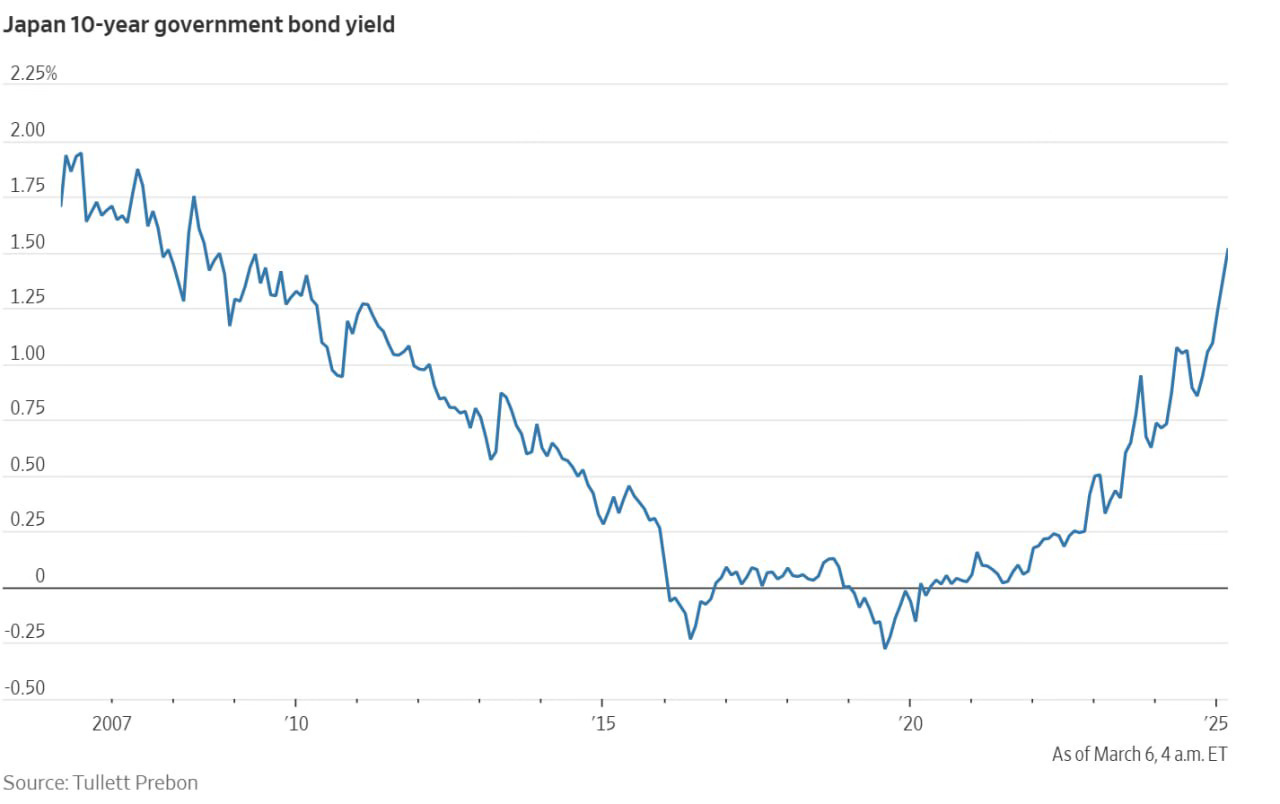

The big fear right now with our market is the potential of the Yen carry trade unwinding. Inflation is roaring in Japan and rates are spiking to their highest levels in 15+ years. For years people have borrowed there and bought our stocks with free money and as that unwinds, you could have a messy selloff. So this past 2 weeks has not strictly been about tariffs, there is alot going on at once globally and the meteoric rise in Japanese rates is a very big deal.

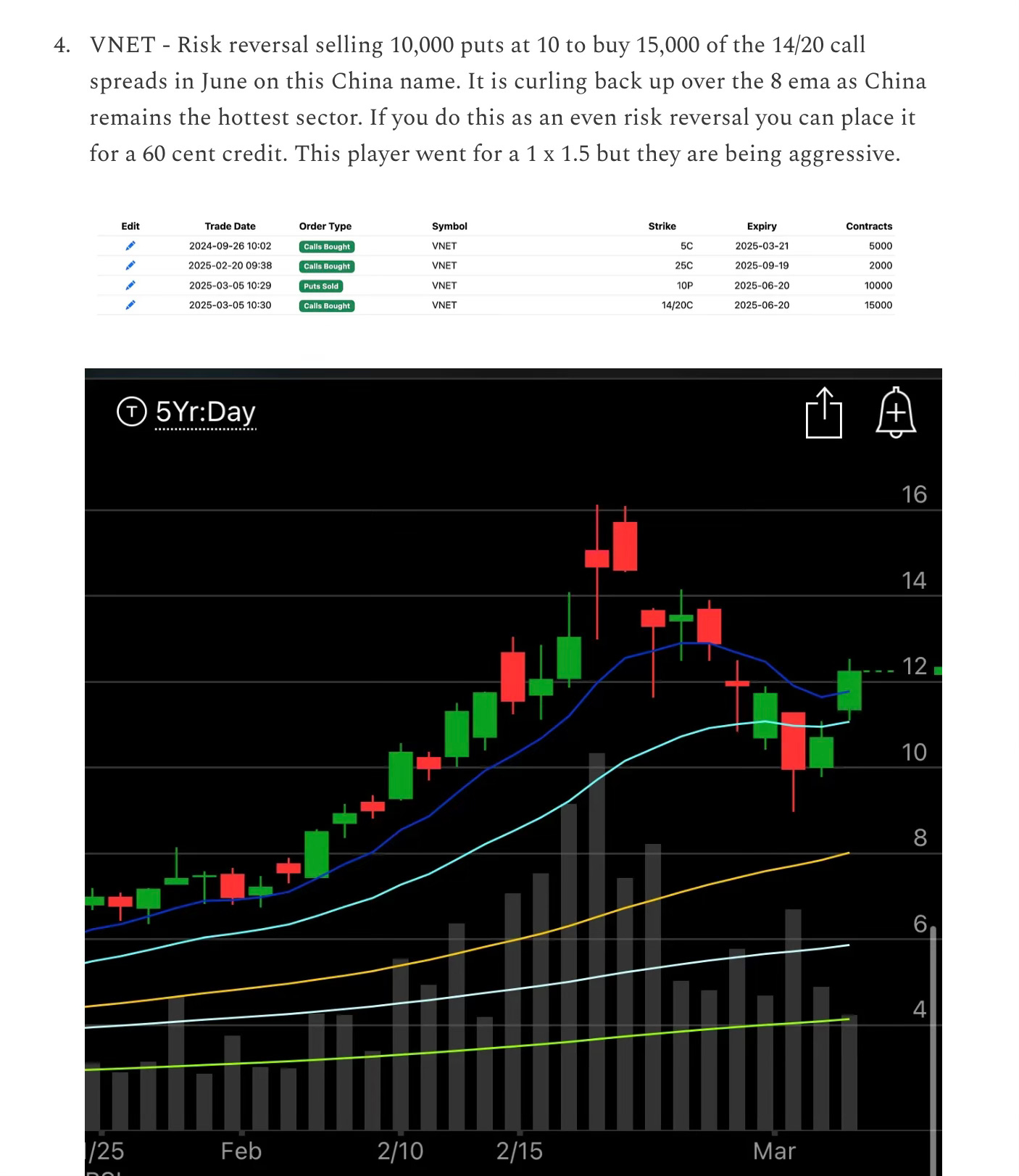

Recent Trades

VNET - This was highlighted in yesterday’s recap and popped over 4% this morning. This was great timing putting this on as the short puts sold 10,000x yesterday are up 10% today quick.

My Open Book