3/7 Recap

We got a big bounce in tech today early in the session with news of a TikTok ban potentially picking up steam. The social media like META,SNAP, and PINS all loved it. I don’t see how we maybe ban that without banning TEMU too. That would send e commerce names flying if that ever happened. The QQQ, below, broke down 2 days ago below the 8 ema, bounced right off the 21 ema and is now fully back in an uptrend. This market is seeing every little dip bought and this afternoon is a very big one with a couple large semis reporting afterhours in Broadcom and Marvell along with Costco so lots of readthroughs.

The SPY too came down and hammered off the 8 ema so far today, the trend remains unbreakable for the time being and we’re seeing very nice strength considering the weakness in such large components like Apple and Google recently. Breadth is widening and more names are participating.

Yields continue to fall with the TNX touching 40.50 today, that has been the culprit behind this recent move higher.

In other news from the weekend best idea post, Rivian just moments ago released their R2 to compete with Tesla and their best selling model Y. This is a really good looking car with some incredible specs. I think although 2 years from actual deliveries, the amount of preorders this will see will not be good for Tesla. It’s only $100 to reserve one now so I expect to see very big reservation figures.

Recent Trades

We had a couple big ones today

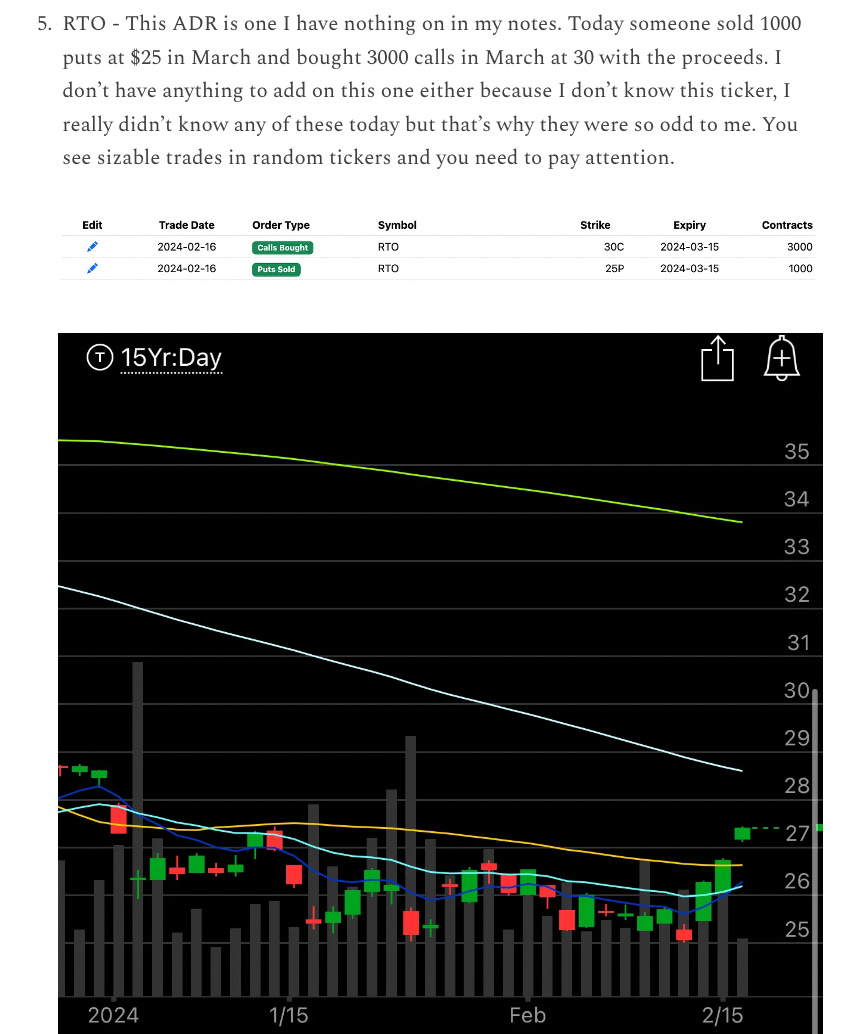

RTO was one I highlighted in the 2/16 Recap, thees little weird tickers that most of us don’t know tend to have alot of alpha and this one was no different. Up 18% today to over $32 a share from 27.xx a couple weeks back

The big one though today is Kroger, I wrote it up as a best idea on 10/15 Here . The best idea trades on the weekend are more longer term buys for your holdings. KR at the time was $44 and it is $55 today after a huge move up. You can see all those 2026 calls I highlighted in that recap being bought. Those calls are up big now and have nearly 2 years to continue working.

At the time I suggested a very conservative risk reversal that would have paid you .60 to place, the trade was completely free and you got money on top. Now that trade is up massively and the calls are running for free for 2 years.

That is why I always suggest put sales, people always talk about buying calls, but there’s a smart way to utilize options and set yourself up in trades and you can structure trades however you want to fit the narrative you want. Risk reversals are my preferred method and this KR trade is a perfect example of why. Expanding your horizons as a trader is my goal for you in here. Anyone can buy puts and calls, but using options data to structure trades in a more favorable manner and bouncing ideas with others in the discord is my real objective here.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Option Activity

Here is today’s link to the database. It expires at the open tomorrow and I will have the rest of today’s trades added in by tonight. Like yesterday, there are just too many calls so far today, 77 calls alone so far, that I can’t post the table in here but its easily viewable in the link below.