3/8 Recap

Pretty slow session, I’m thinking it is because of this unbelievable move today. We may be putting in a short term top right now. It’s still early in the session but we got an unbelievable reversal in the Nasdaq this morning and it started with the indisputable market leader NVDA. Look at the 15 minute chart below. That is what a blowoff top usually looks like. It fell nearly $100 in an hour. Again NVDA is the world’s 3rd largest company right now, well I don’t know the Aramco market cap, but it is either 3 or 4, and it is up around 50% in a 10-12 sessions since earnings. That was a bit overdone…..

If we zoom out to the daily chart, below, as of right now this is one atrocious bearish engulfing candle. Now it is still way over the 8 ema and the 21 ema is way down at 800 so this isn’t exactly bearish yet but it was just ridiculous overheated after that run the last 2+ weeks. Make no mistake about it, this whole run has seen NVDA as the leader and if NVDA is reversing, I’m not sure what is going to pick up the slack.

Overall the SPY too remains over the 8 ema so far, 3 hours left in today’s session, but this isn’t looking so hot right now. Again, that doesn’t mean panic sell everything, it means sell some covered calls, take off leverage, just be cautious is all. The SPY was just at 518, the most bullish analysts are at 530-40 right now, the upside just isn’t there for the overall market, it is for individual names, but so many leaders have been lagging for weeks and that should’ve been a warning sign but NVDA and the AI run has left everyone wanting more and more. With NVDA down nearly $50 on the day now, this is a major red flag.

Recent Trades

Im gonna discuss one that worked and one that didn’t today.

PRGO was highlighted in the 3/6 recap it was below $28 two days ago and is nearly $31 right completely ignoring the brutal day in the market right now, that was a massive call buy those 20,000 in one swoop and that player has been right the last 2 days as those calls are up enormously now.

On the wrong side of things was AMLX. I said at the time it was a zero or hero trade that can go -80% overnight

as of right now it is down exactly 80%.

People love to gamble on biotechs and it is fun when options go up hundreds of percent in one day, but most do not work out and this was one. That is why I said you never ever sell puts on these. Whenever you see a biotech that intrigues you, either run away or bet only what you’re willing to lose because these things get nasty quick.

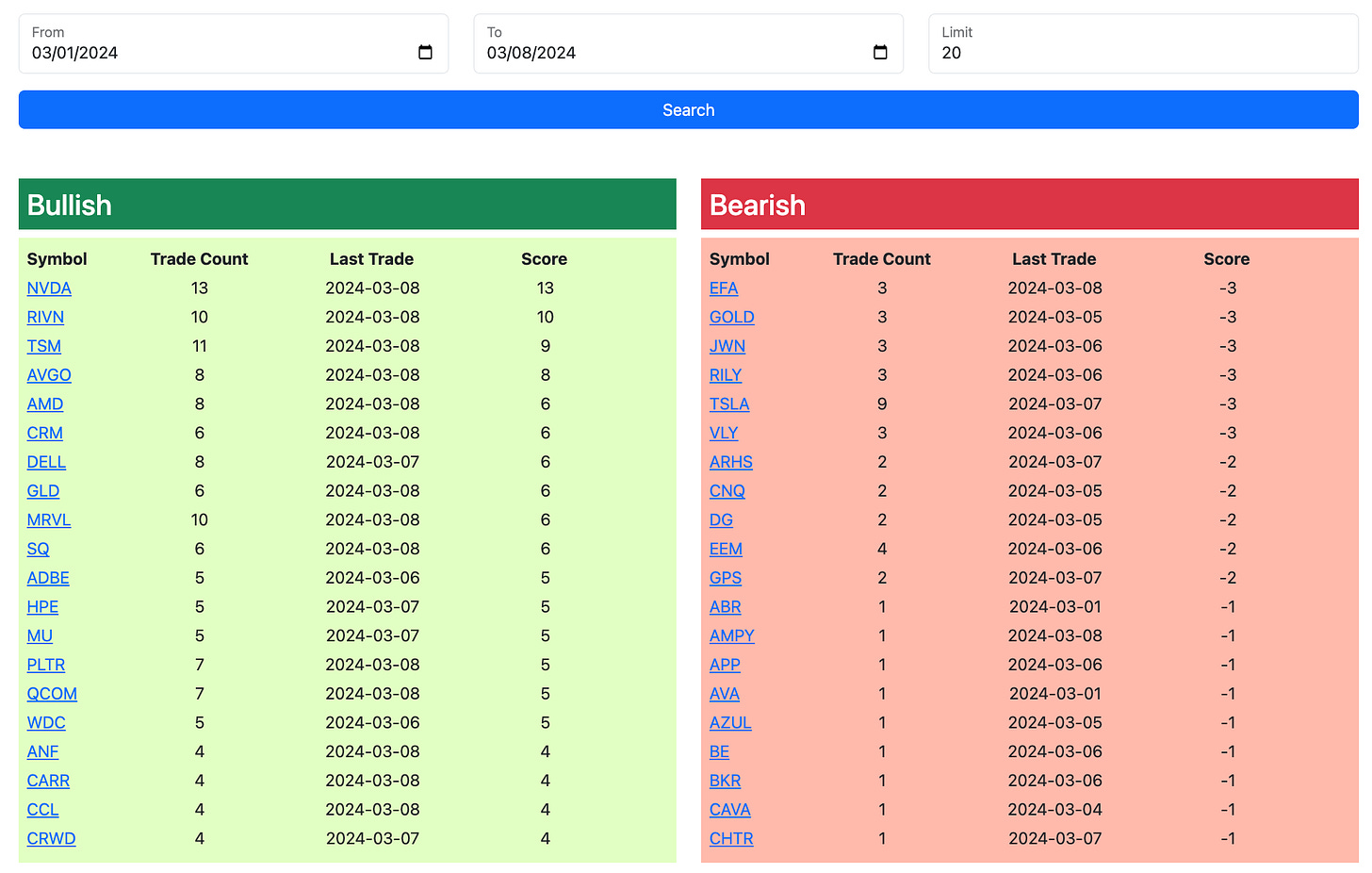

Trends

Rivian has been notable as one of the top trends this week and it hasn’t disappointed, it is up 20% this week and another 2% today after yesterday’s reveal of their new car. The best idea writeup I did on it over the weekend was more of a longer term trade in the name but this week has seen a nice move, it got nearly 70,000 preorders in its first day on the market, but these call buyers had been loading up on it for a week before then. I remain a fan moreso than I was last weekend after actually seeing the car.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s access link to the database, this will be up all weekend long and expire monday morning at the open. I will have the rest of today’s action posted by tonight, but this was a very slow session so far, only 87 trades logged by now that’s why I’m sending this out early. I assume with the blow off top seemingly unfolding alot were uneasy about putting on new longs.