3/9 Best Idea For The Week Ahead

Yesterday ended up closing the week with a pretty nasty candle on the SPY. It’s damn near impossible to be bearish these days, 3 weeks back we had an indecisive candle and sure enough we went higher. I even said recently I think we’re in a multi year bull market for tech stocks on the back of “AI” simply because we’re so far away from seeing what AI will actually offer that nobody is going to not pile in from today even if AI ends up not being material down the road.

The candle below is one of indecisiveness. Buyers tried for higher, they were met with sellers and we did nothing all week. We still remain well over the 8 week which is down at 500, but you can feel something isn’t right with that tech move yesterday but then again, in an effort to keep the constant pump going, Joe Biden spoke last night and said the federal reserve would be cutting rates soon even thought Powell hasn’t even really alluded to that in any of his speeches.

Then, you had the market leader, NVDA, post a horrendous bearish engulfing candle yesterday on higher volume than the day after earnings yesterday. Make no mistake about it, some very big money exited NVDA yesterday. That doesn’t mean people are bearish on the future, relax, it just means the 3rd biggest company in our markets went up 50% in 12 days and people decided that was enough. Actually yesterday was the highest volume day for NVDA since that big pop to 375 that fueled this whole move last summer. Even with that, because NVDA had run so much last week, it closed with a green week and remains over the 8 ema which are technically bullish things. Still the amount of volume yesterday was very big and tends to point to a change of direction beginning.

Rivian

That Rivian trade from last weekend worked way faster than I was expecting so I got alot questions about what to do with it. If you all remember the trade I suggested left you with a credit so if you followed it, as long as Rivian doesn’t go below $5 by 2026 you make money, but with this weeks calls, you’re up alot now. You can close the trade whenever you want, there is no rule, but when I post these weekend best ideas they are meant to be longer term names/trades to add to your book that’s why I highlight them on their own in deeper dives on the weekends. Rivian got nearly 70,000 preorders in the first 24 hours after the R2 release, but the company is very far from a product on the road and the stock did gain alot this week so if you want to cash in, go for it, but the way I structure trades when it is a long term bet is what matters more than the idea itself. I use options to place a trade that benefits me even if the trade doesn’t actually work out, that’s why options exist in a manner beyond what most think of simply buying a call or put.

Take that KR trade I brought back up the other day, I highlighted that in October 2023, look where that stock was then at 43 and look where it is now 5 months later after the run this week over 56. This is a grocery store chain, they don’t move quick.

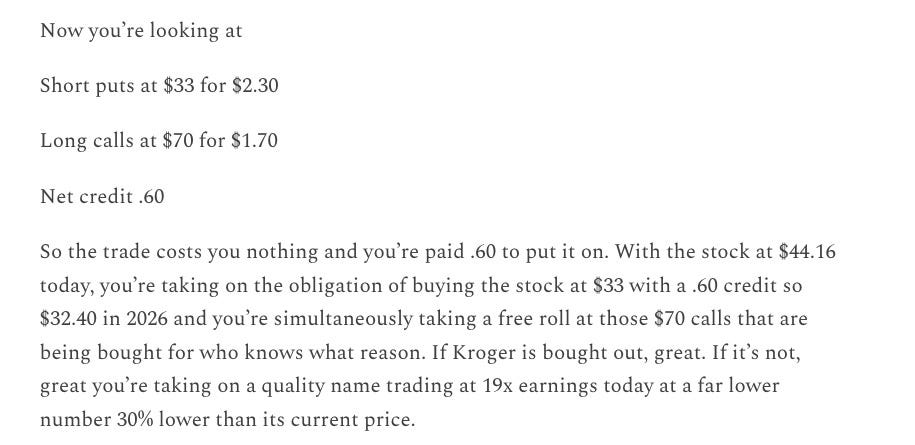

The specific trade I noted at the time was a completely free trade if it worked out, where you got paid upfront by receiving a credit of .60 if you put on the January 2026 risk reversal I noted below. If you held that to today, the puts sold at $33 are up 60% and the calls bought at $70 are up 125%. The trade took months to unfold, but even then the players were buying 2026 $60 and $70 calls, they were right on the trade, but it took time I just manipulated their call buys by implementing my own twist with put selling at a massive support level from the covid crash to offset the cost of the calls.

Substack

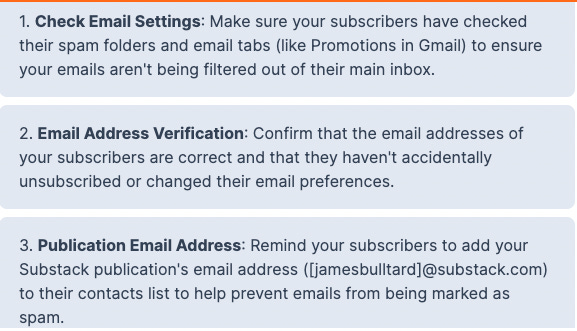

Before I get into the best idea for the week, I’ve gotten a few emails from people regarding not getting these recaps in their inbox anymore, a small amount, maybe 5, but that means there is an issue and I’m sure more have it. Substack finally reached out to me and sent me these

If those do not work, someone else left a comment the other day on one of my posts

Either way if it doesn’t work, please let me know and I will reach back out to substack.

Ok to this week’s best idea, while I don’t think tech stocks are the right play right here short term, there is one that stood out to me this week with alot of bullish activity and some serious relative strength in the selloff. I’m going to structure another unbalanced trade at the end to give this trade time to work out while minimizing risk on your end.