4/1 Recap

It’s a new quarter and so far it is the same song and dance we’ve seen all year. All weakness stops right at the 8 ema. We had a huge fade overnight in the /NQ which went from +130 overnight to -50 an hour into the day today. The slow meltup we’ve been in continues until we get some trend shift but the market really does feel ripe for a move lower here with the VIX and Dollar sending off warning signs today.

The dollar went green off that ISM print and the breakout continues with the DXY over 105 now. That is going to put alot of pressure on equities.

Oil also continues to move to highs over $84. Energy names saw tons of action today in the table below. The XLE closing last month at multi year highs was not bearish.

Lastly the VIX, below, was up 7% today. The market finally got a shock of volatility after that PCE number friday was followed up with the strong ISM print. It’s been a long time since the VIX actually held a move over 15, we’ve spent just a couple days over that level this year.

Recent Trades

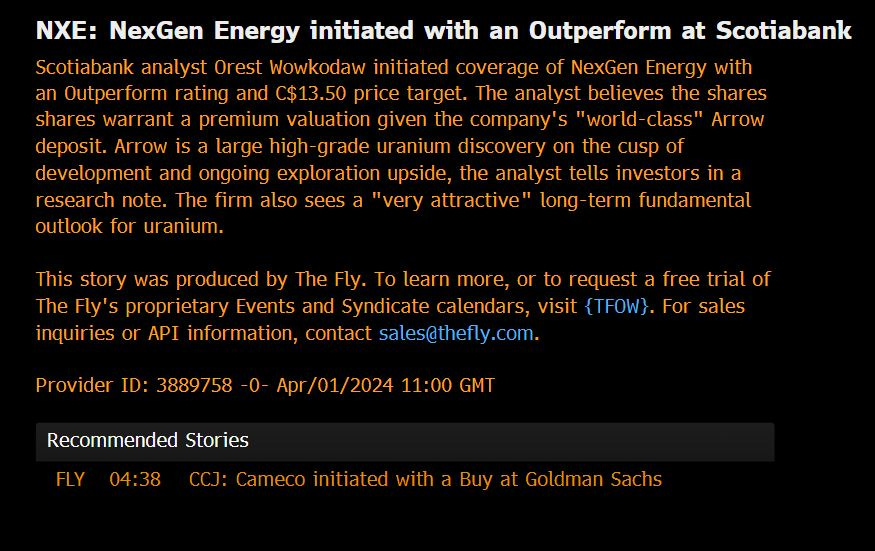

NXE - I noted this one on thursday last week and I said at the time I had nothing in my database on it and sure enough the 3 odd trades that came in were perfectly timed because ScotiaBank upgraded it this morning and it is up 6.3% today as I type this.

Here was the upgrade this morning. The options players friday that came out of nowhere surely had no idea this was coming just 1 day later…..

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires tomorrow at the open and I will have the rest of today’s trades posted by the end of the day so check back for the updates.