4/11/25 Recap

The is SPY stuck below that 8 ema, we tested it today and rejected lower. We are going to close over the 100 week it appears barring a terrible afternoon. Nothing notable just normal downtrend behavior continuing a series of lower highs and you can see the death cross occurring right now with the 50 day(yellow) crossing right into the 200 day(green). Typically with these you have a prolonged period of weakness following which fits right into what I mentioned last sunday in the weekend post about my feeling of 6 months of weakness ahead. Now if Donald Trump backs off the trade war then you can throw all that out the window and the possibility of that happening is increasing by the day.

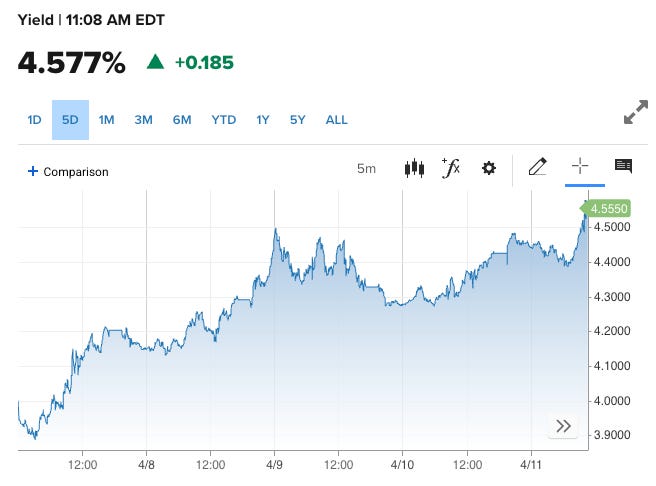

Why is Trump possibly backing off soon? The chart below is the 10 year treasury and it is higher right now than where it was when he panicked and paused 2 days ago. He paused because the bond market was forcing his hand and rates were getting too high, now they’re even higher than they were 2 days ago, highlighting how disastrous his plan and execution have been so far. The reality is there is so much foreign money in our treasuries and they’re now seemingly ganging up on him and calling the shots by squeezing rates higher. This alone may cause him to do something drastic and give up this battle because we cannot afford rates rising like this and it is causing him a big headache. Nevermind things like the deficit rising or DOGE yesterday announcing $150B in 2026 cuts when the initial goal was $1T meaning they delivered nowhere near the savings that they were promising. Confidence is really waning in what is going on and markets and rates are always simply just a reflection of confidence.

More than that, the DXY is plunging hitting 99 this morning, the dollar is in freefall and since Trump won the Euro has climbed 10% against the dollar. That is another mess he is battling with right now and it seems like everything that could possibly go wrong is going wrong at the same time for him and the dollar has been a clean move lower since it broke that uptrend. Also at the moment VIX futures are rising even in a green tape, bouncing between 5 and 10%, so catastrophe on all fronts here for the President.

On the good news front, it looks like short term, the worst is behind us, below is net new lows and early in the week we spiked up to almost 1150 names making new lows, today it is under 150. So there have been people stepping in and buying. Are they front running the unthinkable? A potential pause on all tariffs or even china tariffs? I don’t know but the lack of new net lows is saying that buyers are emerging.

My Open Book