4/12 Recap

We opened the session with a ton of panic. Aside from the economic data, the VIX spiked 25% at one point, Gold caught a huge bid before selling off, the dollar went to 106 and oil ramped over $2. The panic trade is on. Is WW3 near unfolding, I don’t know. If it does not this VIX is going to collapse and all these things will reverse. My guess is this is a panic trade before the weekend and if nothing more materializes we will see the VIX collapse hard. Of course if a war flares up, then all those will continue on, so place your bets.

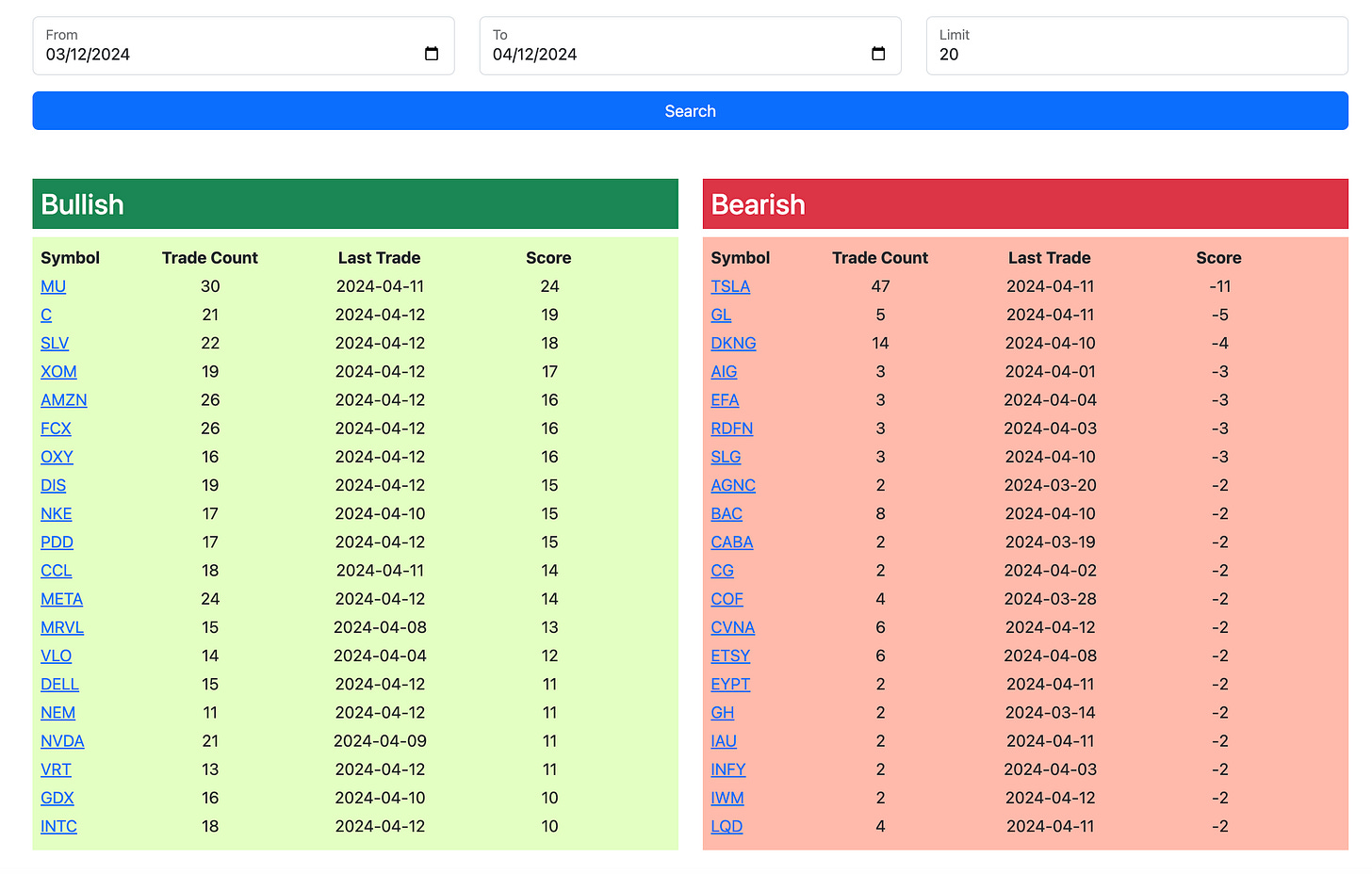

Remember what I said in yesterdays recap about put buys being out of control relatively speaking. The options flow yesterday was sending warning signs about today, I don’t even remember the last time the daily options table looked like the one below where puts far outweighed calls, remember people short are a tiny fraction of the market, so put buys should never exceed calls in unusual size but they did yesterday.

The SPY is not looking pretty back below the 21 ema and finally seeing that 8/21 ema bear cross. It is sitting right ontop of the 50 sma and if it loses that has alot of room lower to the 100 day at 490. This market can only be saved by megacap tech prints but those are 7 sessions away so next week could get ugly without a catalyst.

The dollar is at its highest point since November over 106 and pressuring everything.

We also have the VIX up 25% in a session, that is causing the chaos today and the funny thing is, the VIX is still sub 20. In real panic, this would be bid over 30 easily and really cause havoc.

With all that said, I won’t be posting a best idea tomorrow, the market is not in a good spot, but I’ve been telling you that all week. The thing with me is I always told you I would tell you when trends were shifting and when to exercise caution. The moving averages don’t lie and the computers that run the market trade off them. We broke the 21 ema for the first time a few sessions back, it may not be everyone else’s barometer but it is mine, and look how wobbly the market has been since. No market sell off in history ever occurred without a major trend breaking first. We have alot of ugly looking things here, I really do not suggest putting on anymore short term longs at this point until we get clarity on some them.

Again as I said all week you should be de-levering and consolidating to just the positions you have longer term convictions about, short term calls should not be held her, we’ve had an awesome 6 months, don’t blow it trying to be a hero. We have to wait for the market to settle and reclaim some of these moving averages before pressing our chips in, longer term buys are ok as you know my big trade is June 2026 calls, I have zero concerns, but know it seems likely to get messy for a little bit. You want to push things where we’re in a nice uptrend, not here breaking below the 21 ema.

Recent Trades

I don’t know if you all remember CPNG. Back on November 18th I wrote it up as a weekend best idea here

Today it is up 11.5% on news they’re raising pricing.

At the time the stock was just over $16 and I suggested this risk reversal below which would have cost you a whopping .05. It was targeting all those massive call buys that we were seeing for May. If you took that trade those May puts went from 1.10 to .03 a 99% gain and those call spreads went from $1.05 to $3 right now and could still possibly close at max value over 22.5.

This trade paid out a fortune if you placed it. This is where I took a trade I was seeing over and over, you can see the big buys below, but placed my own spin on it adding the short puts to drive the cost lower. Time is your best friend when you place a trade, this took almost 6 months to finally work out, but it did so right before all those massive May calls that were bought last November expired. Magic.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is the link to the database, it will be up till Monday morning at the open and I will have the rest of today’s action added by the afternoon.