4/17 Recap. Is The Dollar Sending A Warning Sign?

Another ho hum day in markets. We have a big week ahead of earnings so lots will change. We’re gonna hear about companies like JB Hunt and Union Pacific which will give insights to the consumer economy, we will see names like JNJ report on healthcare spending, so many things that could shift our course quickly. For now, it’s just the same uptrend we’ve been in with continued strength hovering over the key 8 ema. The bears need to make a move soon because once these longer term moving averages start curling up, it is going to be hard for them to break things. The MACD remains in a bearish divergence, it just has not played out, yet.

Worrisome for equities is this dollar finally picking up some steam today. The $DXY, below, is making a power move for the moment and a close up here would be the sign of a trend change for the dollar. Look at the MACD about to flip green. A prolonged dollar run wouldn’t be good for growth names.

Trends

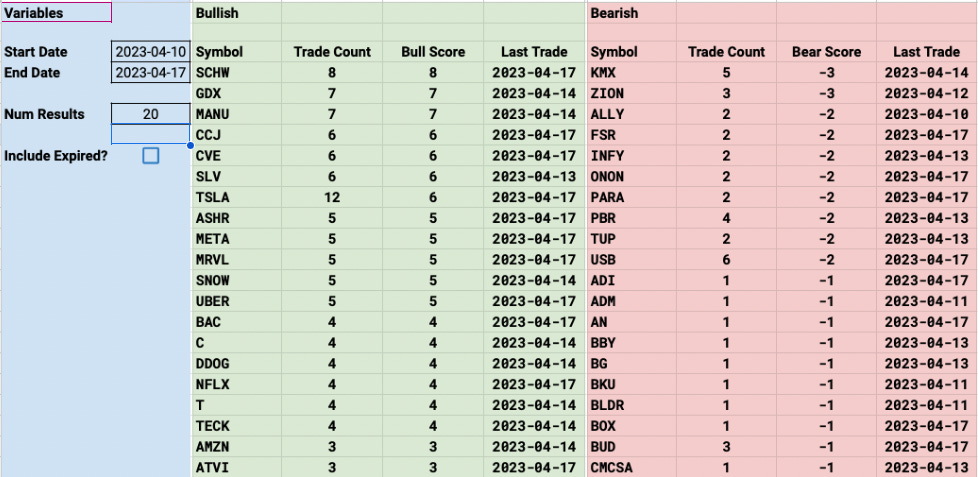

Ok I want some feedback from you all here on these trends. The way I currently post them shows you the totality of the timeframes. I had a request this weekend to change it to just showing week by week what is going on, I’ve never had anyone complain about the trends so I figured why fix what’s not broken, but I do want to accommodate everyone so let me know in the comments below if you’d like to see changes made here. For now I will keep it how it was. Also I’m increasing the number of trends to 20 names to give you more variance, I wish there were more bearish trades to share but there just aren’t enough.

New names popping up in shorter term strength:

TECK,UBER, DDOG,MRVL, EQT

1 Week

2 Week

1 Month

2 Month

Today’s Unusual Options Activity & What Stood Out

108 trades today