4/18 Recap.

Sorry for the early recap today, but it is my birthday and I have a group of people waiting to take me out to lunch today. With that said, I still was able to catalog nearly 100 unusual trades today, so we didn’t miss out on much, and of course I will still database the rest of the days action tonight or tomorrow morning so it will be in the trends. I’m not going to post a chart of the SPY and dollar because I’m wrapping up too early, lot’s can change.

Speaking of the trends, how about SCHW? That’s been the top trending name for weeks on end and look at this power move the last 2 sessions. It closed with the bullish engulfing candle yesterday and had a big followthrough today. Look below so we can discuss the chart some.

The bullish engulfing candle yesterday was simply a candle showing that we tested lower levels, but demand from buyers was so strong that the candle closed back up over the previous day. That means there was a large backstop and a sign of a reversal, with Schwab up 2.5% as I type this today, that turned out to be the truth. That’s why charts do not lie. Just remember that, fundamentals are fine, but charts show the direction money is moving, and if you’re a trader, that is what matters. The trends aligned with the chart and naturally we got the move up, and now a prolonged move seems likely with the moving averages close to a golden cross. This is definitely a candidate for the continued Post Earnings Announcement Drift I always discuss.

Trends

I got alot of feedback from you all yesterday in the comments/emails and the consensus was everything is great as is, so I won’t be changing it up as I was asked to.

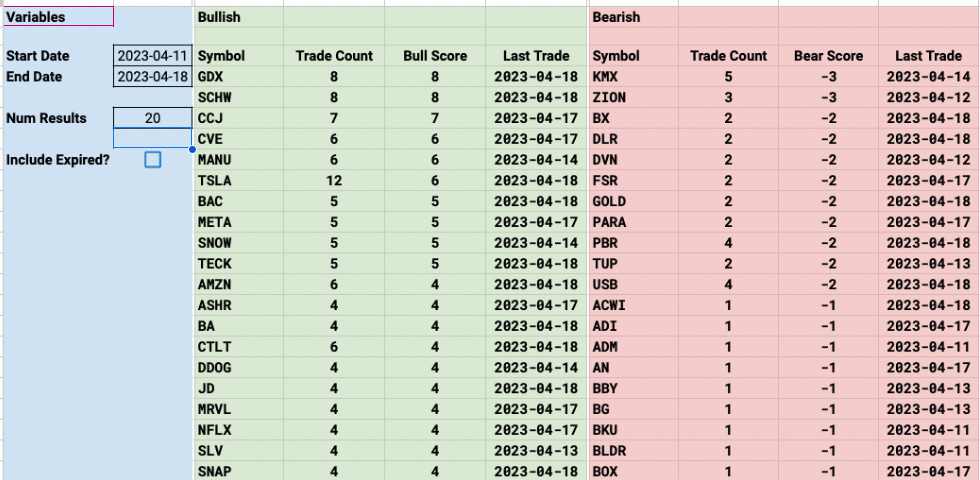

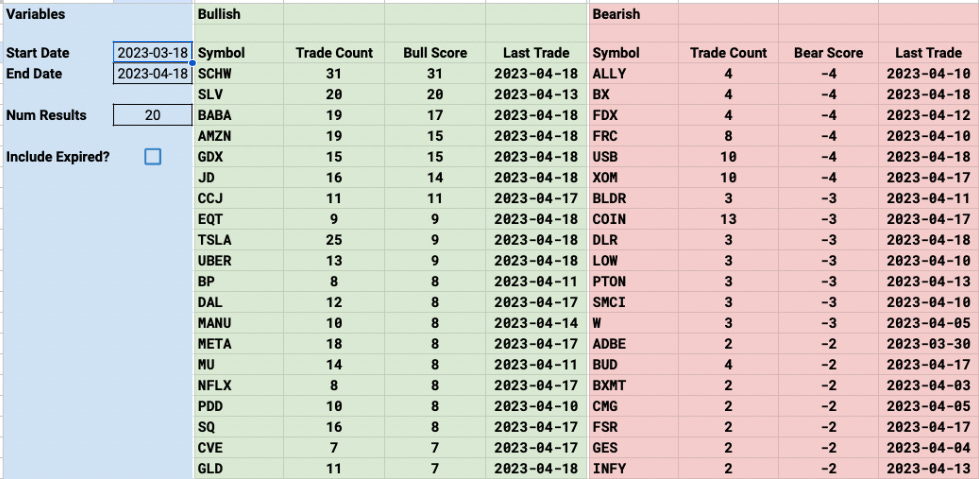

1 Week

2 Week

1 Month

2 Month

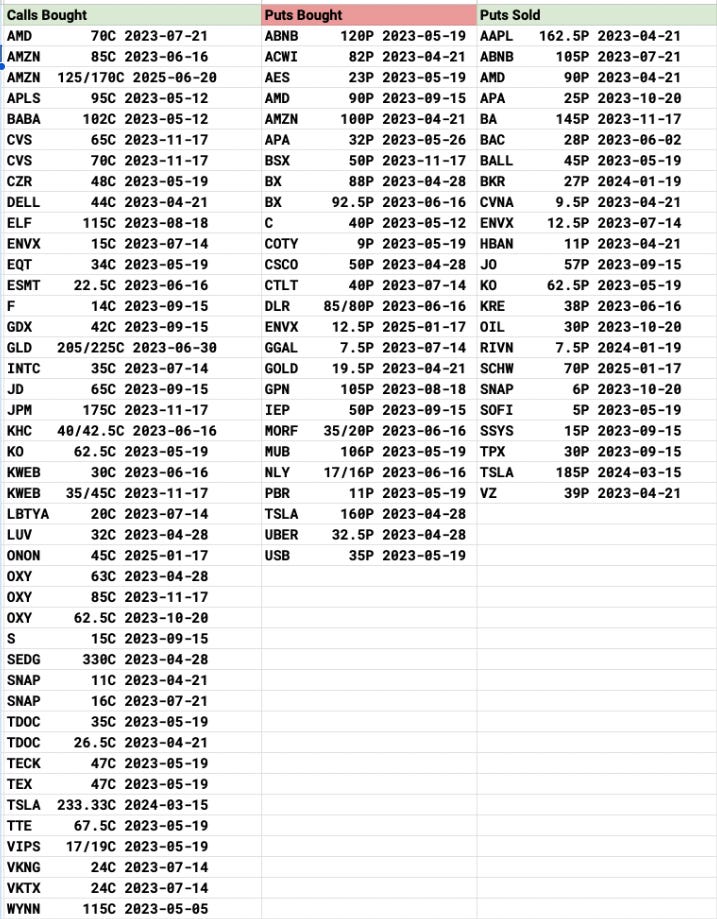

Today’s Unusual Options Activity & What Stood Out

93 Trades Today, you will notice I also added in the ability to see the number of contracts and where it is relevant meaning I think it’s big, I will add it in.

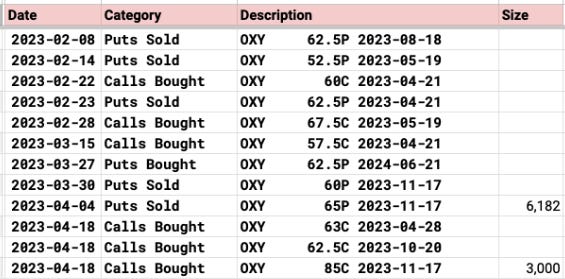

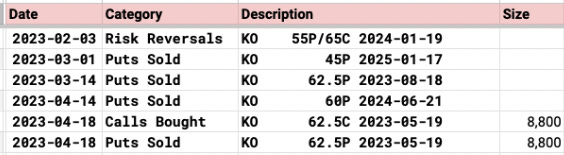

OXY - We all know about Buffett and his stake. Today though there were 3 large trades you can see above but the one that caught my eye was the November 85 calls. Is that the Warren takeover play? It very well could be as he now owns over 1/4 of the company. Here is what else I’ve seen the last 2 months.

KO - another favorite of the oracle in Omaha. This isn’t the type of name to see much options action, but today it saw a huge risk reversal selling 62.50 puts in May and using the proceeds to buy 62.50 calls. This is a great defensive name.

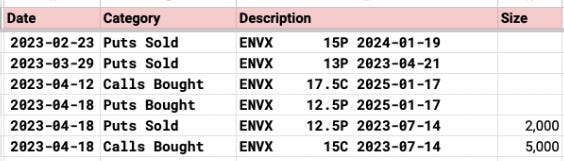

ENVX - saw a lot of bullish action today with puts sold in July at 12.50 and 5,000 calls bought at 15 in the same month. This isn’t a name that sees action often so we have to pay attention when it is there.

China names. They keep buying so many calls across the board here, look at KWEB, I noted that last week, that’s a tech etf and today there were 2 more big call buys there. Add in the $65 calls bought on JD for September with the stock at $37.xx and all the BABA calls daily and you can’t help but wonder what is coming.

TECK - this continues to be a buyout name and it continues to see odd flows coming in. Of course we recently had the buyout rejection, the shaking of the tree where it fell 30% and then made a full comeback in no time. Today they bought May $47 calls in size. Look at all the unusual sized call buys since April started…..

Trade Of The Week Update

CVE with another strong day up 1.5% right now. It’s reclaiming some key moving averages as you can see and has a clear path right into that cluster of resistance you see right below $18.50. The RSI is curling up, this is looking like a nice one now.

What Did I Do Today?

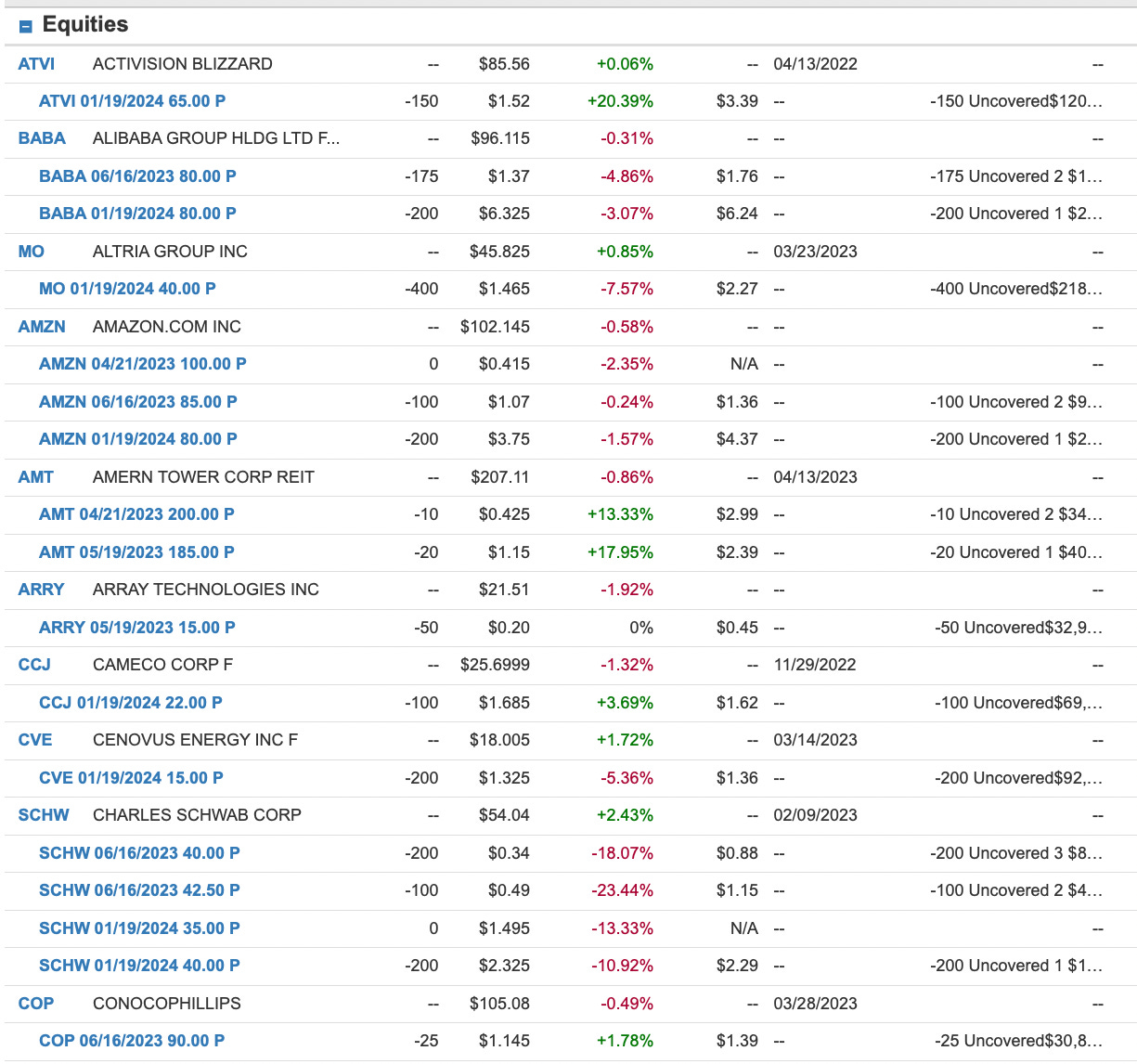

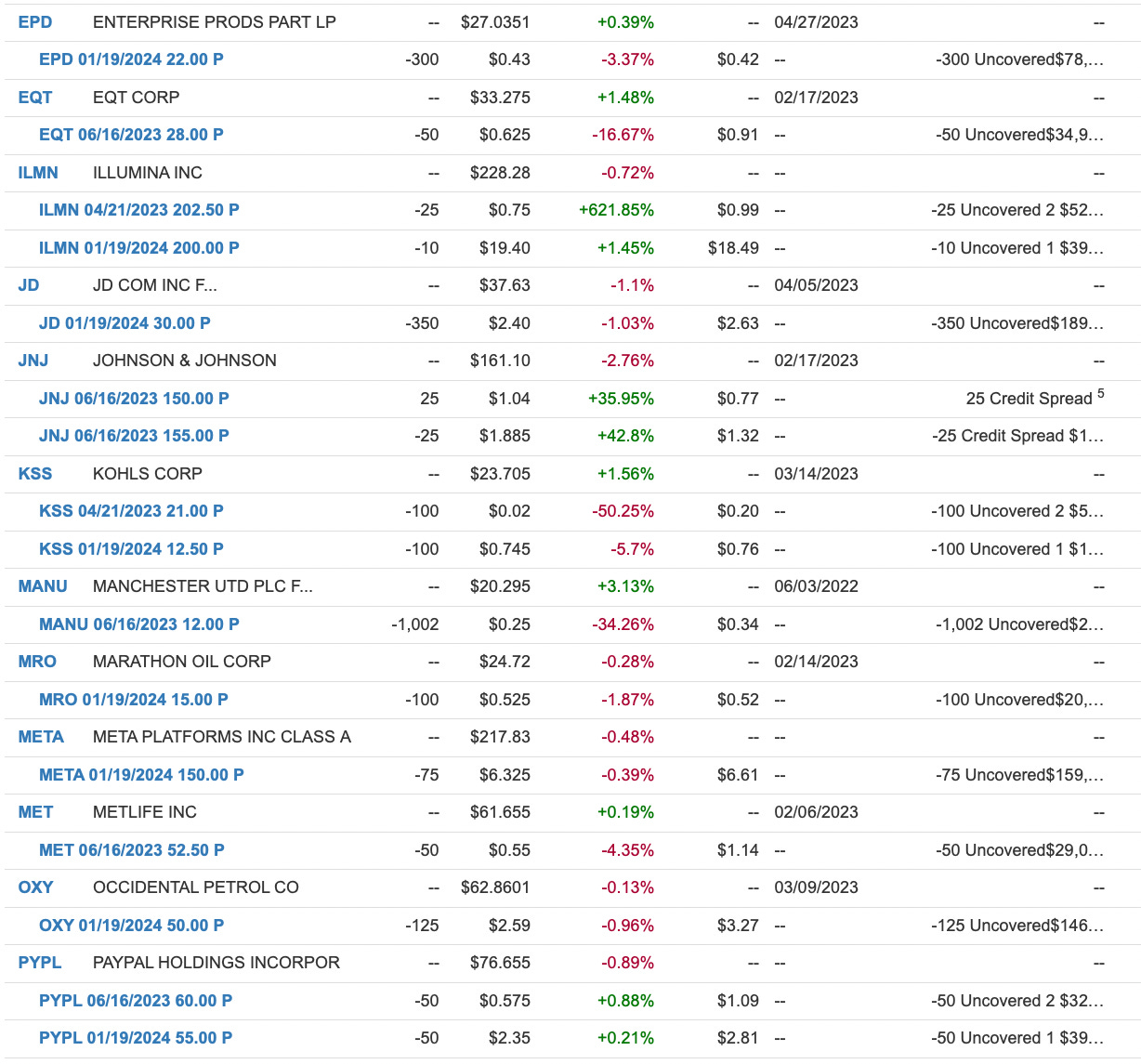

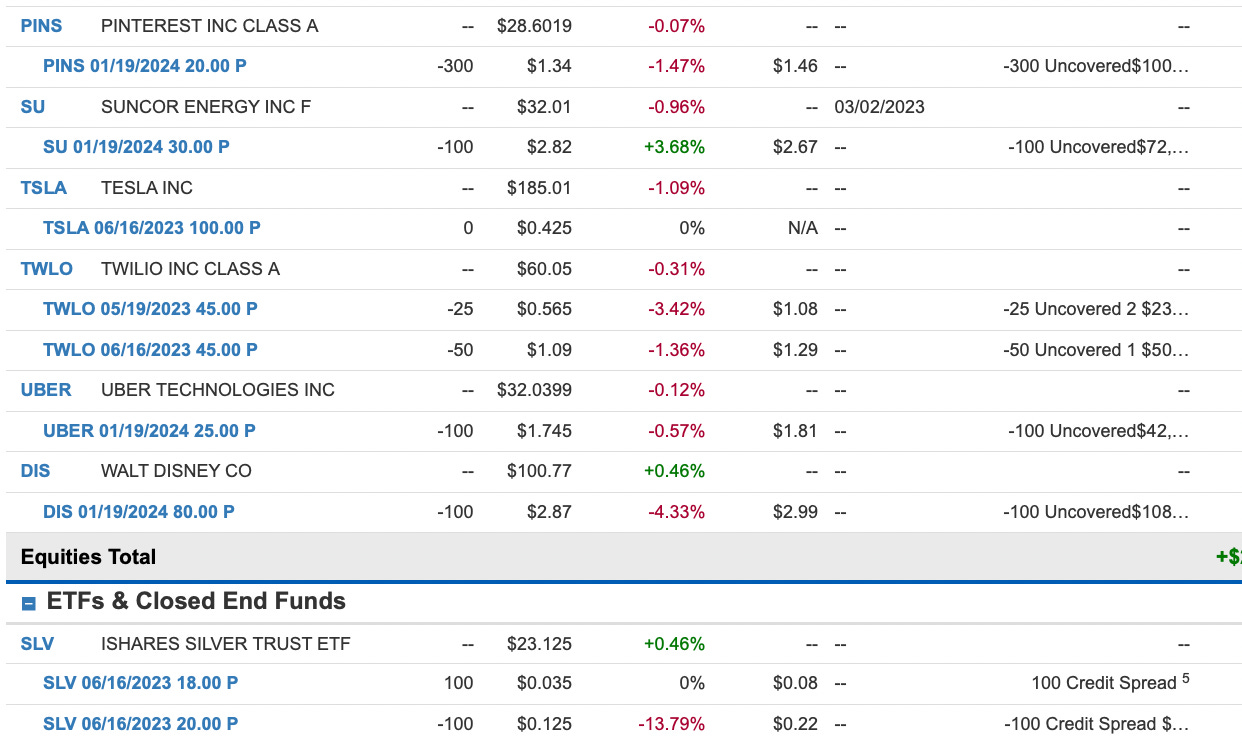

As of right now I’m outperforming pretty nicely up 1.11% vs the market red. As you can see in my book below, alot of the heavy lifting today was SCHW,EQT, MO,& MANU combined with overall a flattish day like this and theta decay kicks in. I remain fairly heavily levered and as long as we’re in this uptrend that will remain the case. Will that change soon? Possibly, but until I see a breakdown, I am not worrying about it.

I added short puts which you can also see below on

AMZN

EPD

SCHW

CVE

MRO

My Open Book

I hope you all have a great day and I will see you tomorrow.

Happy Birthday! I hope you are having a great day.

I started subscribing to your Substacks last week and am looking forward to learning from you. I have bought options before, but I have never actually sold them. I am starting with funds that are just enough for day trading. I still don't know the best approach with this small account. I think I can learn more by reading your daily recaps and other posts from the past. I know that if I buy a call, I can also sell a put in my account but it takes some funds. I would like to see how and when you realize the profits.

Happy Birthday!

BTW, I would have picked the current approach over the alternative as you described it. I suspect the results would be different if people saw the current approach and the approach I am recommending (along with its rationale) side-by-side. (Sorry for dragging this out.)