4/18 Recap

Interesting session, the VIX is cooling off and yields are ticking higher. This is really starting to look more like a rate story than a war story at this point. I’m not going to lie to you, today’s bounce was nothing material. It was just a little inside day forming so far as the market attempts to find a bottom. We’re now 5 sessions into this 8/21 bearish crossover and we haven’t even sniffed the 8 ema in 3 days and the market just continues to look weak as every pop is sold. We have Netflix reporting this afternoon and that will have a readthrough to alot of large companies regarding streaming, ad sales, consumer spending. I still think we’re likely to test that white line below, the 100 day, it is only 2% lower. Whatever it is, until we can get a close over this dark blue line, the 8 ema, this is all just nothing of note. If Netflix goes well, we can begin to discuss this possibly being a bottom before megacap earnings begin in a few days.

Trends

1 Week

2 Week

1 Month

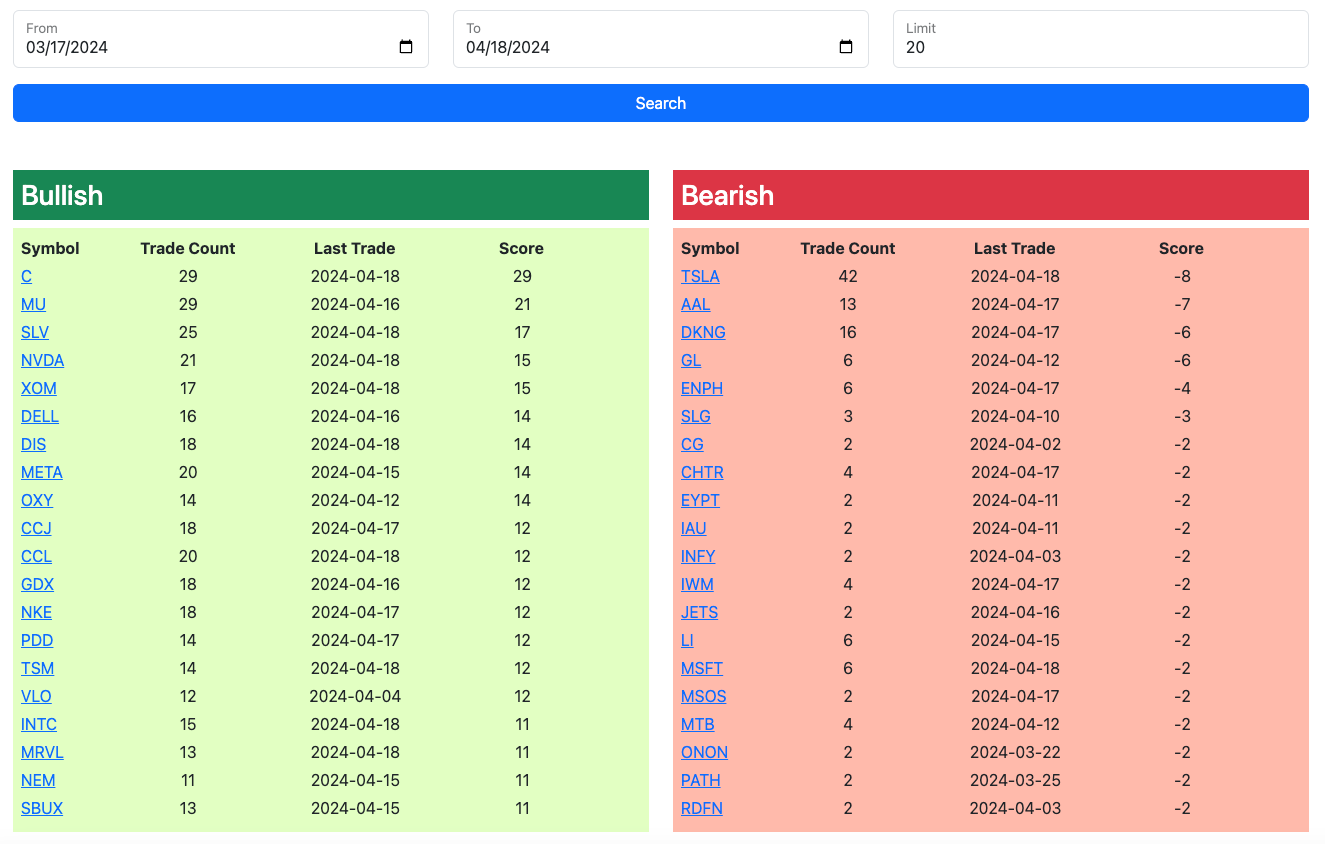

Today’s Unusual Options Trades

Here is today’s link to the database, I will have the rest of the days action up by the afternoon.