4/19 Recap

The brutal week continues, tech stocks are leading the way lower with the QQQ, below, breaking the 100 day today. Every megacap except Google is now below the 50 day including Amazon and Meta which were the last holdouts till today. Today is also OPEX which by itself leads to some wonky moves.

They’re selling these tech names and it isn’t war related. Well to a degree, today, nobody wants to hold things into the weekend after last weekend. However, if you believe both countries, that’s it, they’re not going further with it. The VIX, below, exploded higher overnight and completely sold off, that isn’t a move you see when WW3 is on the horizon. Look at this VIX move, the initial worries last night were not a concern today in any way the VIX is 50 cents higher right now than it was in a world before Israel attacked Iran last night.

Again 20 VIX isn’t even here, which was normal markets at one point in time. This move lower we are seeing is because discounted cash flow models are being adjusted to higher rates for longer and maybe even higher rates. Multiples have to adjust and thus things are being sold. Why would all these megacaps care about a war that both countries are saying isn’t going to escalate? It won’t materially matter to any of them. We are pricing in an environment where rates stay elevated for longer than previously expected and the war is just another reason to sell in there. The trend break last week was the tell this weakness was coming, but, we did this in October too after the Israel/Gaza issues right before earnings and the megacaps saved the market.I just do not see anyone like Microsoft or Google citing this potential war as any sort of concern when they report starting next week. I said this last week in the post I sent out saturday regarding this week being a chance for bears to take control for a little bit. They did just that.

The SPY is still a tad stronger and has not touched the 100 day yet but interestingly the RSP, below, the equal weight SPY is green today basing at the 100 day so that tells you that they’re selling the high multiple tech names and buying the cheaper names but of course that doesn’t matter because the SPY is so heavily weighted to tech.

Recent Trades

AXP is up 5% today to $227+ in this awful tape on strong earnings. I wrote up American Express as a best idea back on October 7th, here

At the time the stock was $150 and they were loading up these max strike calls out in 2026 at 240+. This trade went alot like the Kroger and Meta trades I noted where they kept buying far out of the money leaps and it worked. They don’t really buy leaps in size that often on many names so when they do you need to take note.

I suggested just buying shares, they’re up 50% since. The risk reversal I noted was a free trade selling 130 puts to buy calls at 200. Those calls at $200 in 2026 are now $56. That’s the beauty of using these risk reversals I always point out, they really give you a chance at immense upside if the trade works while lowering your basis and possibly letting you buy shares at a strong support level.

Trends

1 Week

2 Week

1 Month

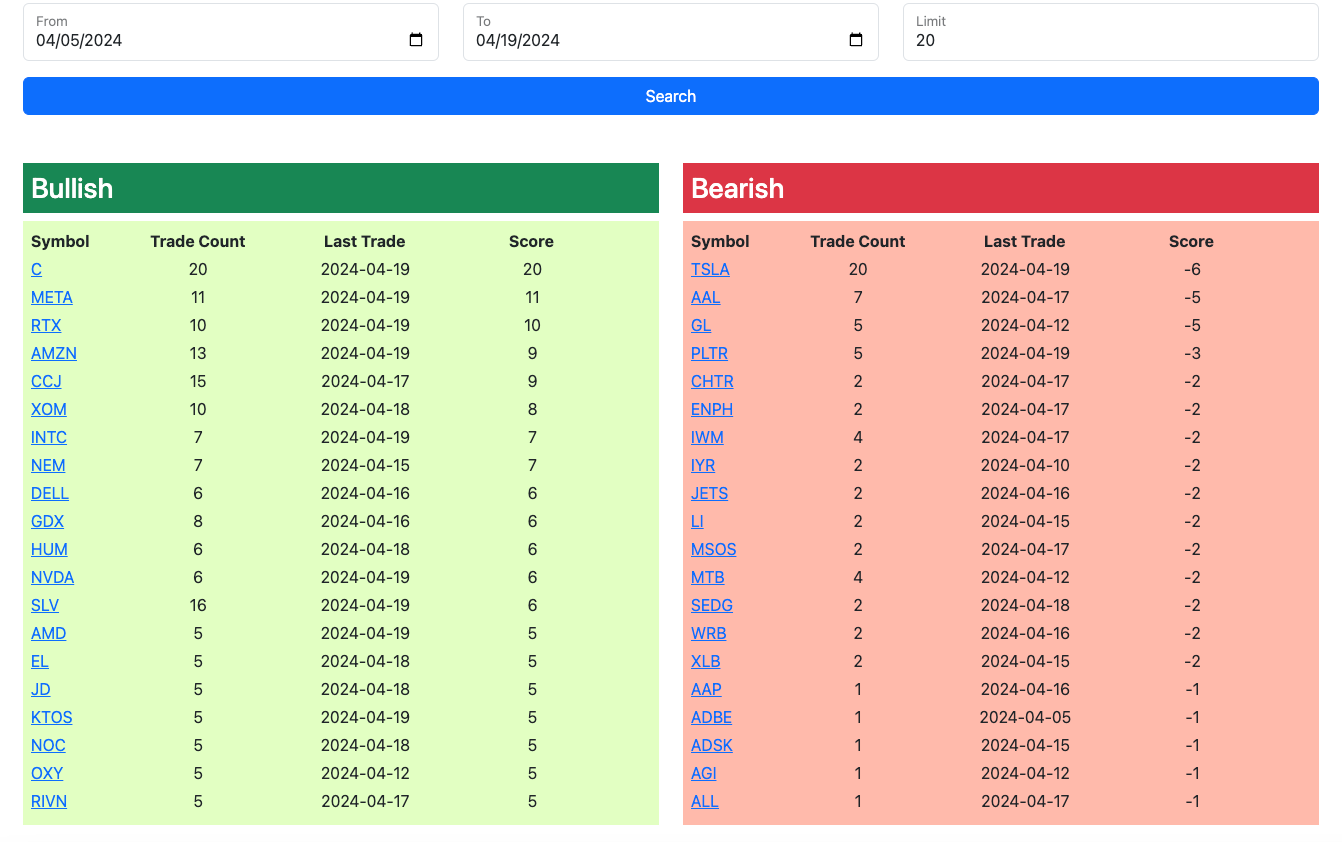

Today’s Unusual Options Activity

Here is the link to the database, it expires monday at the open. I will have the rest of today’s action added by this afternoon.