4/2 Recap, I Added A New Position

What a nasty sell off today, you could see this coming yesterday with all those things I pointed to in the recap with the VIX up, the DXY breaking out, Oil breaking out. Those are all things that happen when the market is about to dump. We are down over 250 points on the Nasdaq today, and one of the biggest growth darlings of the past few years Tesla, completely missed their delivery estimate by 50,000 cars sending the market even lower.

The SPY is sitting on the 21 ema again, this is my barometer for where the market trend is. We’ve spent 1 day below this in nearly 6 months, will we close below that 21 ema today? Tomorrow? I don’t know, but if and when we do, you need to prepare for some weakness, mostly in tech. Other sectors can do fine in market weakness, you’re seeing the strength in Energy for instance. That is why I wrote up Exxon this weekend as a best idea. Remember the NEM trade I wrote up 2 weeks back as a best idea? Gold is doing tremendous right now, so market weakness doesn’t mean everything, just mostly tech because tech is most of the market.

I want to say a few things about how to play market weakness. You’ve got 4 choices:

You just sit and hold your positions

You sell things and go to cash

You sell covered calls and make money while you wait

You buy puts

If you are a longer term player, you can sell covered calls vs your positions and make some money as markets are flat or down, that is always a great option. If you’re uncomfortable doing that, you can always go to cash, I do not recommend that ever. If you hold on, whatever weakness we may have likely blows over in a few weeks as there is not really anything major on the horizon until after earnings season.

If anything, should we break the 21 ema, just close up the positions you aren’t comfortable with and definitely DO NOT USE LEVERAGE to sell puts or anything. No pullback in history has ever occurred without the 21 ema breaking, that will always happen first.

Recent Trades

I wrote up EDR as a best idea back in late October, here is the Link. At the time I said

I was wrong on timing there but that’s why I prefer risk reversals where you can be wrong and lose very little or nothing. Then on 2/27 I saw more big put sales targeting April and highlighted it again.

Today we got the news, it was taken out and they were offering 27.50/share

The lesson is here is with these takeover names, give yourself as much time as possible on options or just hold shares. Everyone wants to pinpoint the exact date, but you want to be in the trade and not miss it first and foremost.

Trends

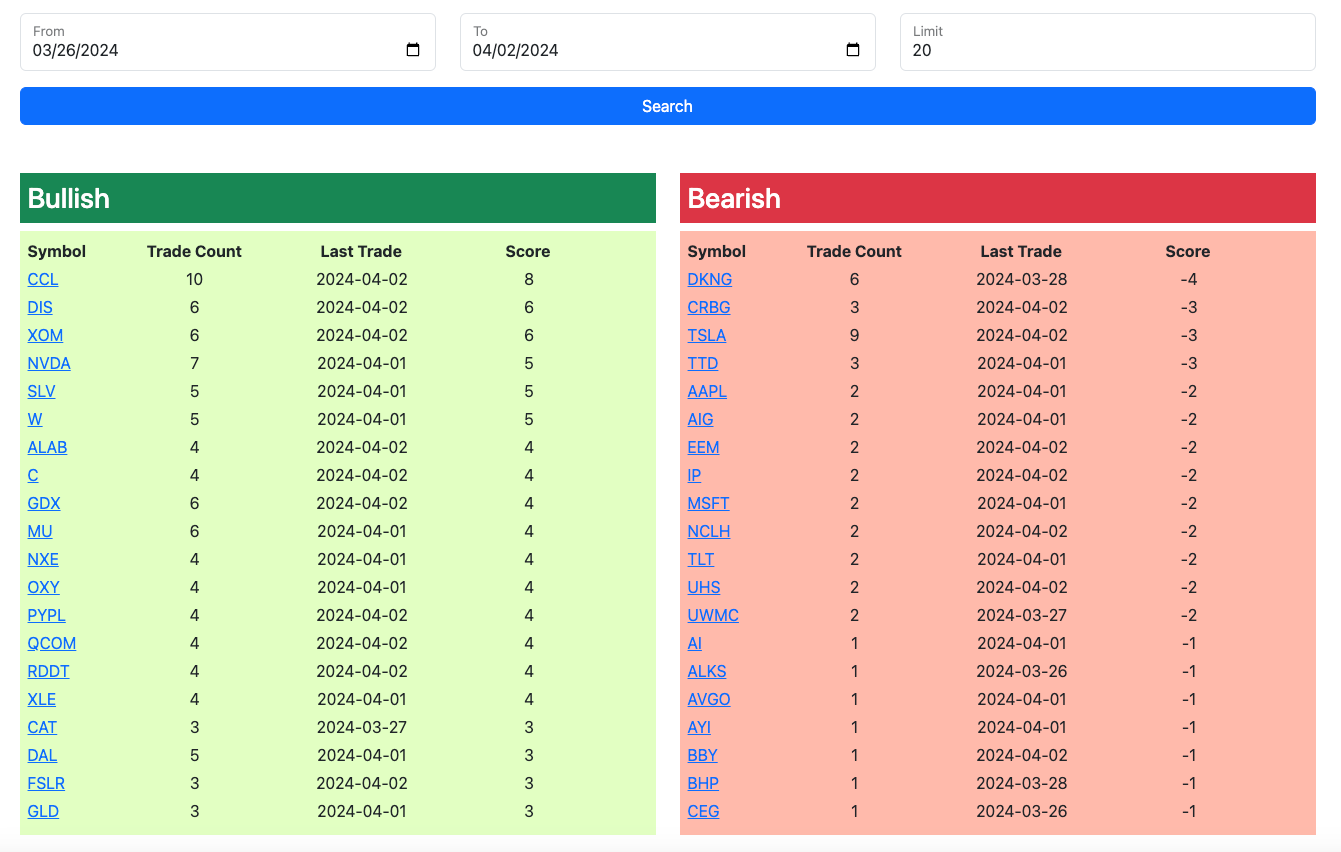

1 Week

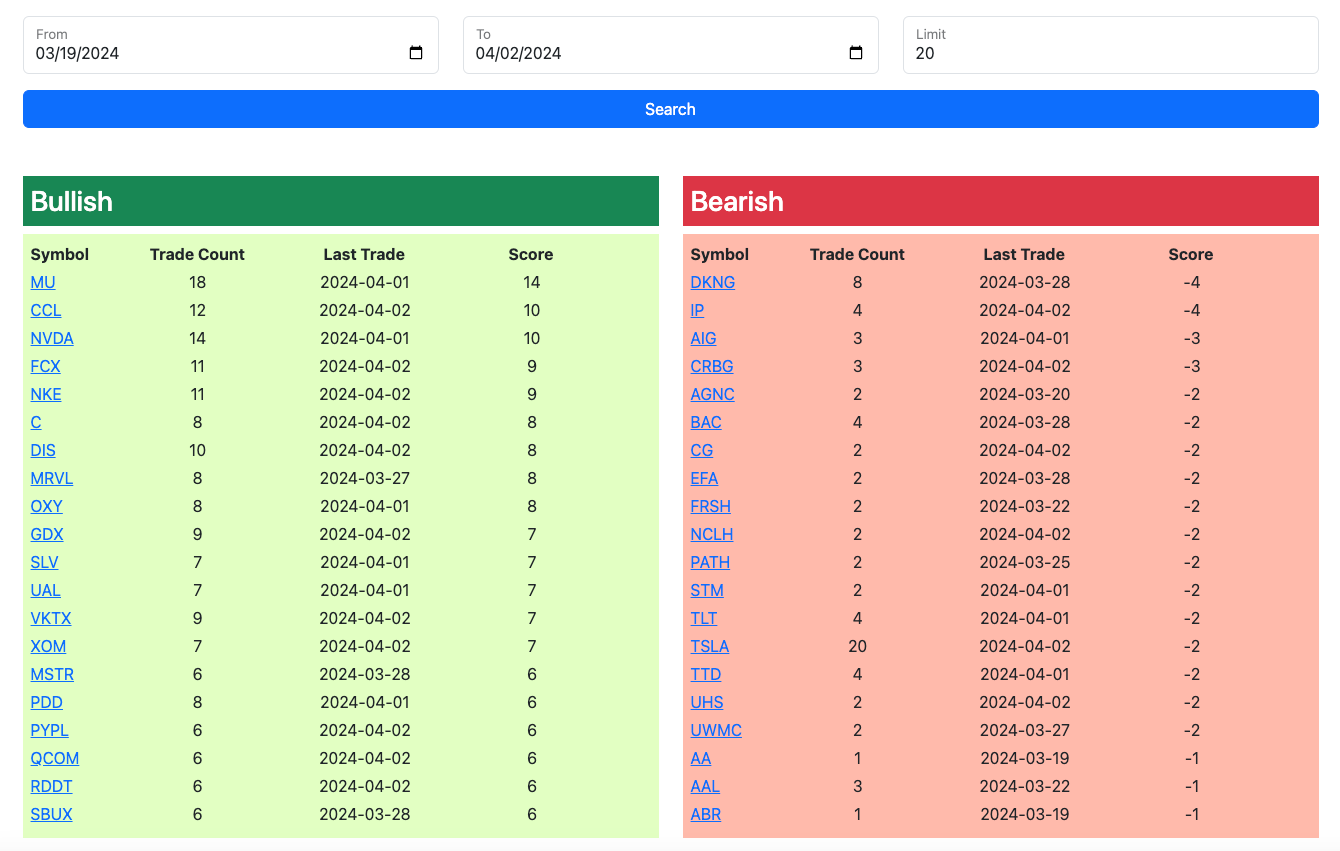

2 Week

1 Month

My New Position

I haven’t added a position to my trading book in a long time, I haven’t wanted to add money to my trading book because that would throw off my goal which was to turn what I started with in June 2022 to something much larger and document every trade along the way. Today, thinking about there being some potential weakness in tech here soon, I decided to roll down my January 240 short calls on Amazon to 230 and it allowed me to raise alot of cash. Again if Amazon is 230 in January I would still be very thrilled and that $10 difference wouldn’t change much as I’d be letting some of my position go.