4/20 Recap.

So far so good, the market brushed off one of its largest components, Tesla, being down 10% today and has clawed back to flat on the day as I type this up. We tested below the 8/10 ema today and got bid right back up, will it close that way in 2.5 hours? I don’t know, but for now, we remain quite resilient. The warnings Tesla had been giving us for weeks with all their price cuts finally materialized into a pretty awful quarter that spooked investors. Will the other megacaps have the same issue next week? It’s very possible many have warned plenty of times whether it was Apple with declining Mac sales or Amazon with slowing AWS sales. The buyers to this point have not cared. Oil continues to decline down another 2% today, the VIX remains below 17, and the dollar remains just hair over 100. Overall, bullish sentiment is all around.

Trends

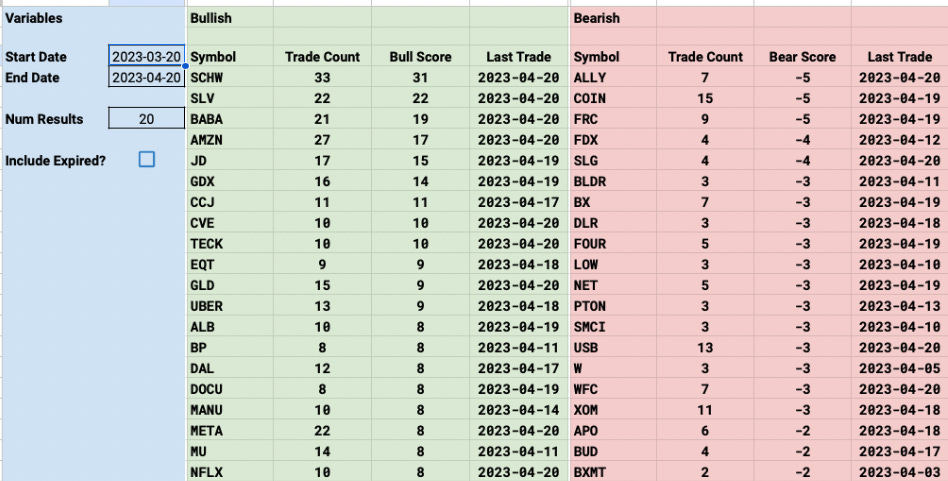

Short term most of the names remain the same CVE,SLV,TECK,AMZN,SCHW continue to dominate the flows, but now BA has come into the conversation. On the bearish side, FHN jumped to the top along with FOUR which saw a nasty short report written on it recently.

1 Week

2 Week

1 Month

2 Month

Today’s Unusual Options Flow & What Stood Out

101 Trades Cataloged Today