4/21 Recap. I Put On A Large Hedge Today.

I know I usually don’t do a full recap on Friday but I felt the need to discuss why I put on a large hedge today and wanted to get it to you with enough time left in the day.

I’m not looking for a crash by any means and I’m still very levered long, just a move lower and my puts will pay off. Why am I finally uneasy after all the horrible data today? A few reasons you can see on the chart below

The SPY is testing below the 8 ema( yellow circle) for the second straight day. Typically when this begins its a sign of weakness which will play out. If you notice we had not tested below it in some time

the RSI is stalling out, look below, it’s pointing down and there is no strength in the market anymore. We have gone sideway for nearly 3 weeks again.

A big bearish divergence is playing out, the red arrow at the bottom. Stocks are remaining elevated while the MACD weakens. This is not a good thing for longs.

We are so close to breaking the October uptrend(the white line) for a second time, a break below would be weakness for a prolonged period.

Notice how not a single one of my points above mentioned anything about the economy or the fed? The reality is all that news is baked into charts through the movement of money, the how or why doesn’t matter, what does is what are “they” doing with that data. Which is why I waste no time discussing that stuff.

If you scroll back through a chart of the SPY for years, you will notice that the MACD rollover the overwhelming majority of the time comes with a period of weakness, here is the last 2 times we had a MACD rollover since the October uptrend began. Notice how in December and February the MACD flipped negative and equities followed lower? We are on the cusp of another, now could tech earnings next week negate it? Sure, but I rarely put short positions on and the risk/reward has to be favorable like it is here. We are 1.5% away from a breakdown in the market, the MACD is going lower, and the stars are aligning for me to take a swing at a short.

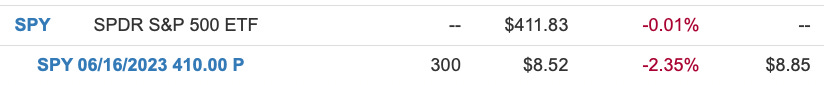

How did I play it? Conservatively. I used June $410 puts on SPY. I bought 300 of them and paid $8.85 per.

Obviously if the MACD doesn’t flip negative in the next few sessions I will close for a loss and move on, that is why it is a hedge, but if the MACD flips negative and we go on a period of prolonged weakness, then I’m set up nicely to protect my book and book some short term gains. As I always say, there is a time to be short, we’re not quite there yet, but we’re very close and with the distribution we’re seeing in the market 3 weeks sideways as the MACD weakens, I think it is prudent to put this on today.

Again this isn’t for everyone, for me, due to the leverage I am using, I think it’s necessary right here to utilize this hedge. I haven’t done this often, the last time I did a few months back it did not work out, but you have to pick your spots and when the technicals align this is where I’m shooting my shot.

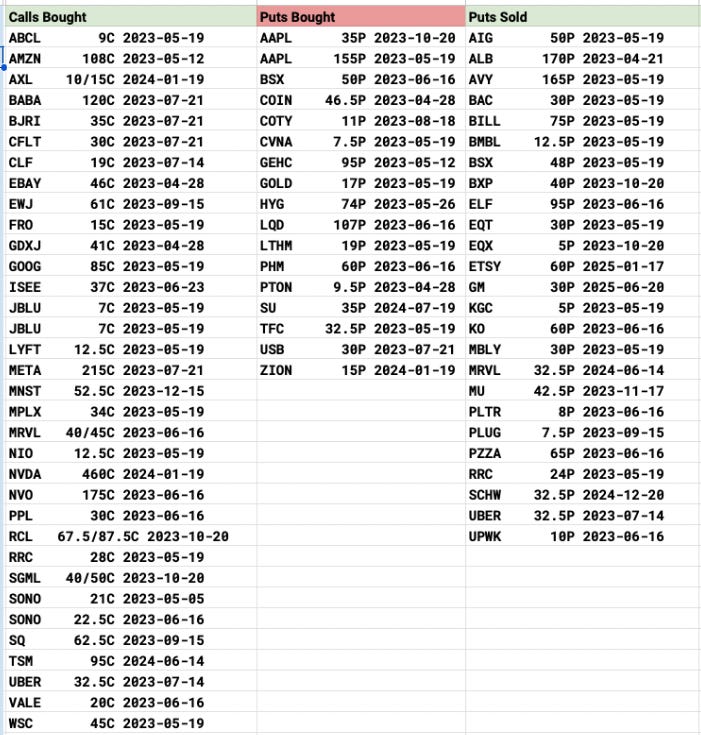

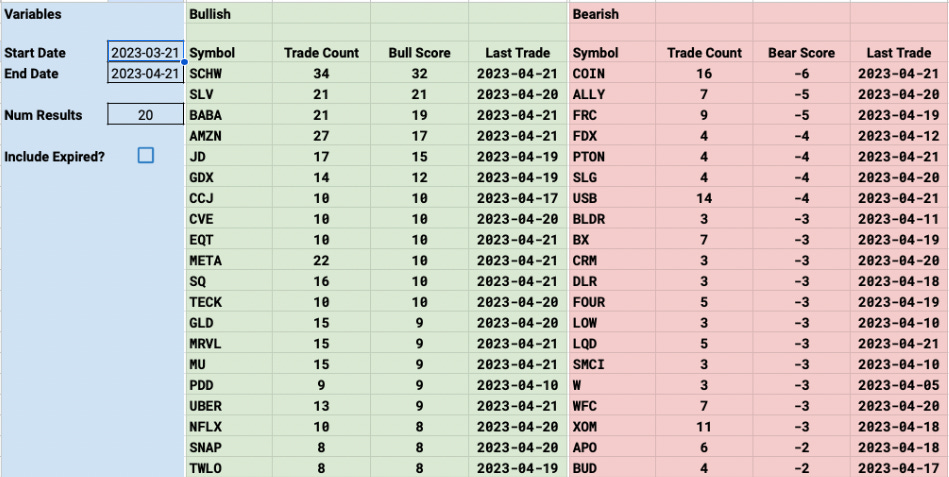

Today’s Unusual Options Trades

77 trades logged today

Trends

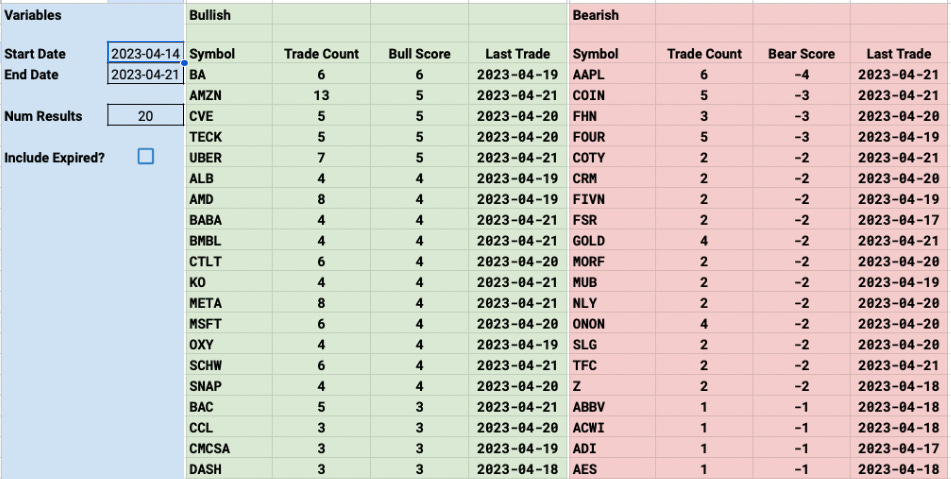

1 Week

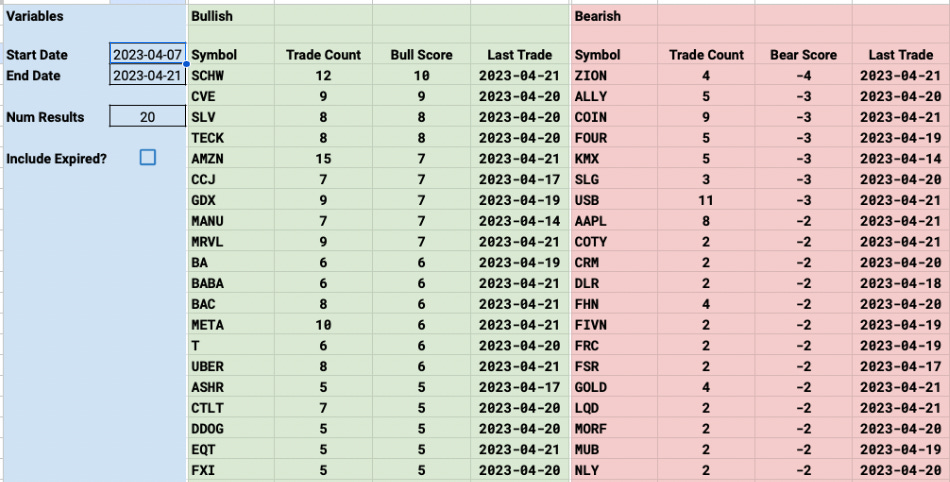

2 Week

1 Month

I hope you all have a great weekend, I will be here tomorrow with my best idea for the week ahead and the preview of the earnings week ahead on Sunday. Have a good one.

Thank you James for your write-up. Good job.

Hi JB, is there a chance to post open book for friday's if there's changes?