4/23 Recap

Before I get into today’s charts I want to talk about HIBB

HIBB got acquired today for $87.50/share by JD Sports and Fashion. I highlighted this just 4 sessions back on 4/18 and again the next day on friday another 1000 calls were bought at the same strike. This right here is what this substack is all about. Finding unusual call buys in a small name like this and watching the insider trading take place. It’s amazing how we have an SEC in place but yet they can’t scan and find some small trade like this but I can at home? These calls went up 600% in 4 days and someone made a decent amount of money and I imagine they probably had a few shares too. Now it is possible they just happened to buy calls on Hibbett Sports on back to back days because they were fans of a small athletic apparel chain that started in Alabama but my guess is that probably wasn’t the case and they were deeply involved in the deal process. Well done, I’m happy for them, they made a few bucks, a couple of you made a few bucks playing along and we got case #182789 of why unusual options activity is worth noting. Here was what I noted on thursday.

As for the market, we got another bounce today and finally reclaimed the 8 ema on the SPY. This is the first step in a recovery. The 21 ema sits less than 1% higher and if we are going to recover this breakdown quickly you want to see a few closes above that and the 8 ema crossing up through it. While we’re making some progress, I’m not going to say the downtrend is over because it simply isn’t until the 8 ema reclaims the 21. Today we got solid prints from alot of companies that had question marks coming in like UPS. Their last Q was a disaster so its nice to see a little recovery. Today we have Tesla reporting and then we have the big fish starting soon with Meta, Microsoft, and Google. Overall good progress, but not noteworthy yet.

For perspective on how big that recent move down was, here is NVDA, it is up $70 in the last 2 sessions and still it has not reclaimed its 8 ema. Until it actually goes over it, you have to think this is just a dead cat bounce. Again, NVDA is fine, but from a technical perspective, it is still in a downtrend even with a $70 bounce. A name below its 50 day moving average, the yellow line, is just not a name in an uptrend.

Trends

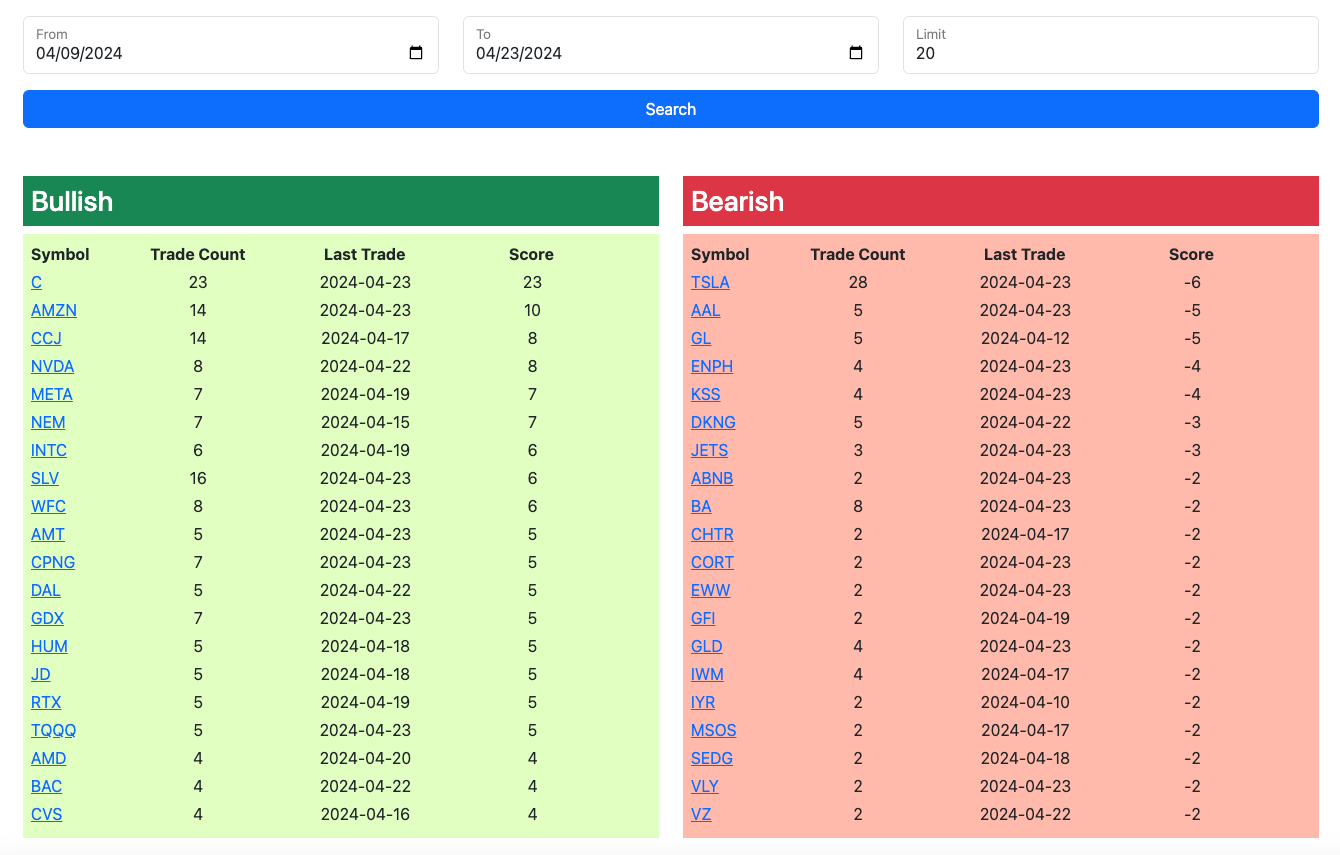

1 Week

2 Week

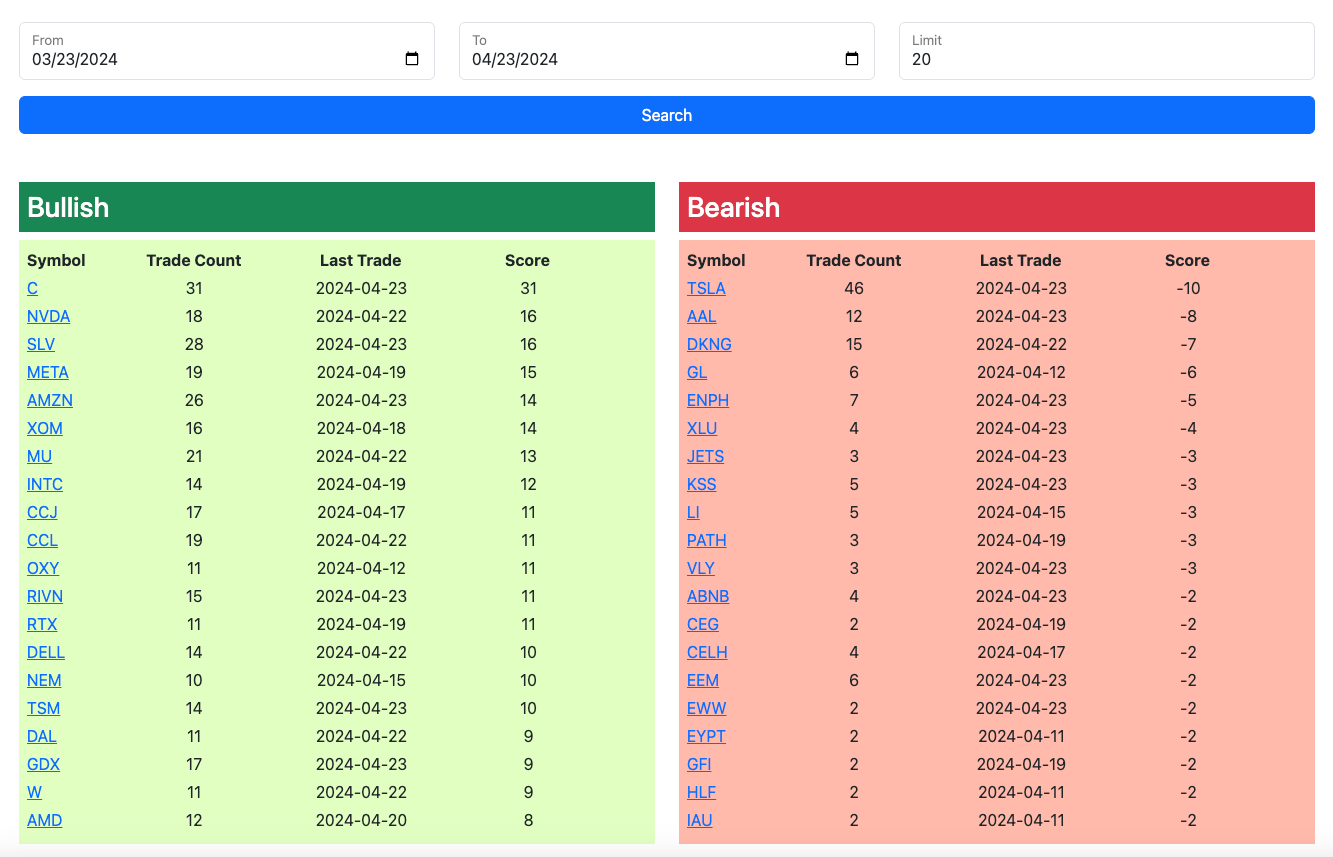

1 Month

Discord Access

I’m not sure what happened but I’ve gotten a couple of people recently who said the discord link in the welcome email did not work, so here is a link to the discord if yours did not work