4/24 Recap

We got a big reversal today as we head into the first major earnings report of the season in META. We’re getting some weird action in the market. Visa told us yesterday consumers are doing fantastic but the trucking names are telling us a whole different story. It is confusing to get a read on what is going on. As for technicals, we’re in no man’s land right now, sandwiched between the 8 and 21 ema on the daily, today’s report is going to have a big impact on where we go. A move up and we can begin to discuss the possibility of the 8 crossing up over the 21 and this downtrend we’ve been in nearing a completion, a break lower and this was nothing more than a small counter trend rally in a downturn. I want to believe we go higher after these large cap reports but as I said recently, we just broke a 6 month uptrend, traditionally 2-3 weeks isn’t where the pain stops. This could be different, but history says it isn’t likely.

As for META, below, the financials are fantastic, FCF is growing very nicely and it isn’t expensive, nonetheless this was forming bearish engulfing candle earlier today, it has reversed a little but remains below most of the key short term moving averages. That just says some people are getting out today before the print. Whatever META does today, I wouldn’t be concerned unless you have short term positions on, I think this is a $600-800 stock in 12-18 months, it has so much upside positioning pointing there, I think this company is making alot of great moves and longer term you will do great here unlike the other tech name that reported yesterday.

As for Tesla earnings yesterday, I have a rant, I’m sure many of you know I dislike Tesla, deeply. It’s not that I dislike the company or the workers, I don’t like what the stock is and how Elon Musk constantly makes up things that don’t exist to pump it. You have to know the company history to know he lied for years and promised so many things over the last decade to constantly be able to do offerings and raise capital and keep it afloat. Who remembers the fake buyout he got in trouble in promising a $420 price as a marijuana joke and he got in trouble with the SEC. He just isn’t an honest person. He has promised full self driving for years, he took deposits for a roadster and semi in 2018, the roadster still doesn’t exist and there are a handful of semis running around like less than 20. He constantly flip flops on all he says. Yet, this company is worth 10x what other automakers like GM are worth and it has nothing material on the tech side just a level 2 driver assist he called Full Self Drive until recently where pressure forced him to call it Assisted Full Self Drive. He has somehow convinced this legion of fans to keep thinking Tesla is some sort of tech leader.

From the time I began writing this in 2022, I’ve rarely been bearish on things, I’m usually the type to find sectors of strength and just focus on those, there’s no need to focus on shorting stocks in this liquidity driven market, but Tesla is the 1 stock that is just so overvalued it is hard to ignore. The stock is down something like 70% off highs in 2021 and still dramatically overvalued. I think realistically it is probably worth sub $20 on 3.5B shares as $20 would be a $70B market cap which is a big premium to GM. There are no good funds in it with sizable stakes, you won’t find one top fund manager holding Tesla as a top position.

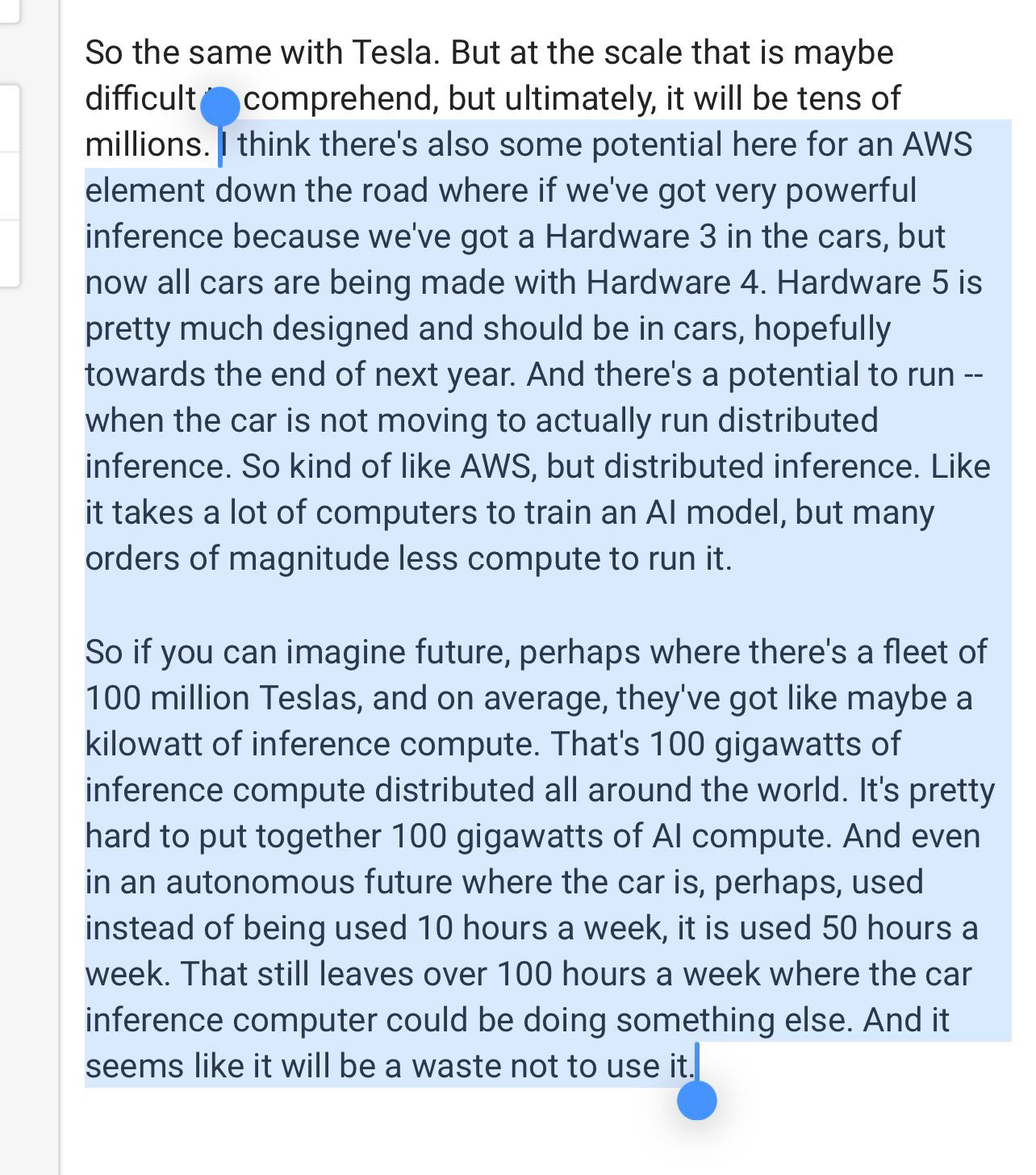

As for yesterday, what a joke, truly aside from missing on every metric that matters and being cash flow negative, Elon in classic Elon fashion said we should stop thinking of it as a car company but an AI/Robotics company even though 90% of revenue is from cars then he promised this AWS like segment, below is a pic from Prepared Remarks. This segment is nowhere near existing. Mind you Tesla doesn’t even make 2m cars a year and he was promising it using 100m cars as his baseline. This was classic Elon pumping made up stuff, the robotaxi he promised yesterday still has no license to operate, meanwhile many other companies have licenses to test robotaxis right now. Just a fascinating short squeeze today because going into yesterday Zerohedge reported Tesla short interest was the highest in years. Either way, this name remains in a long term downtrend lower with no material technology no matter what he promises, it has faded almost $6 off highs. In the short run the company “growth” segment, energy, grew 7%, that’s terrible, margins were horrible at 5.5%, worse than regular carmakers, and it burned through ALOT of money. This is not good at all for a $500b company trading at a massive premium to its sector, automakers.

Recent Trades

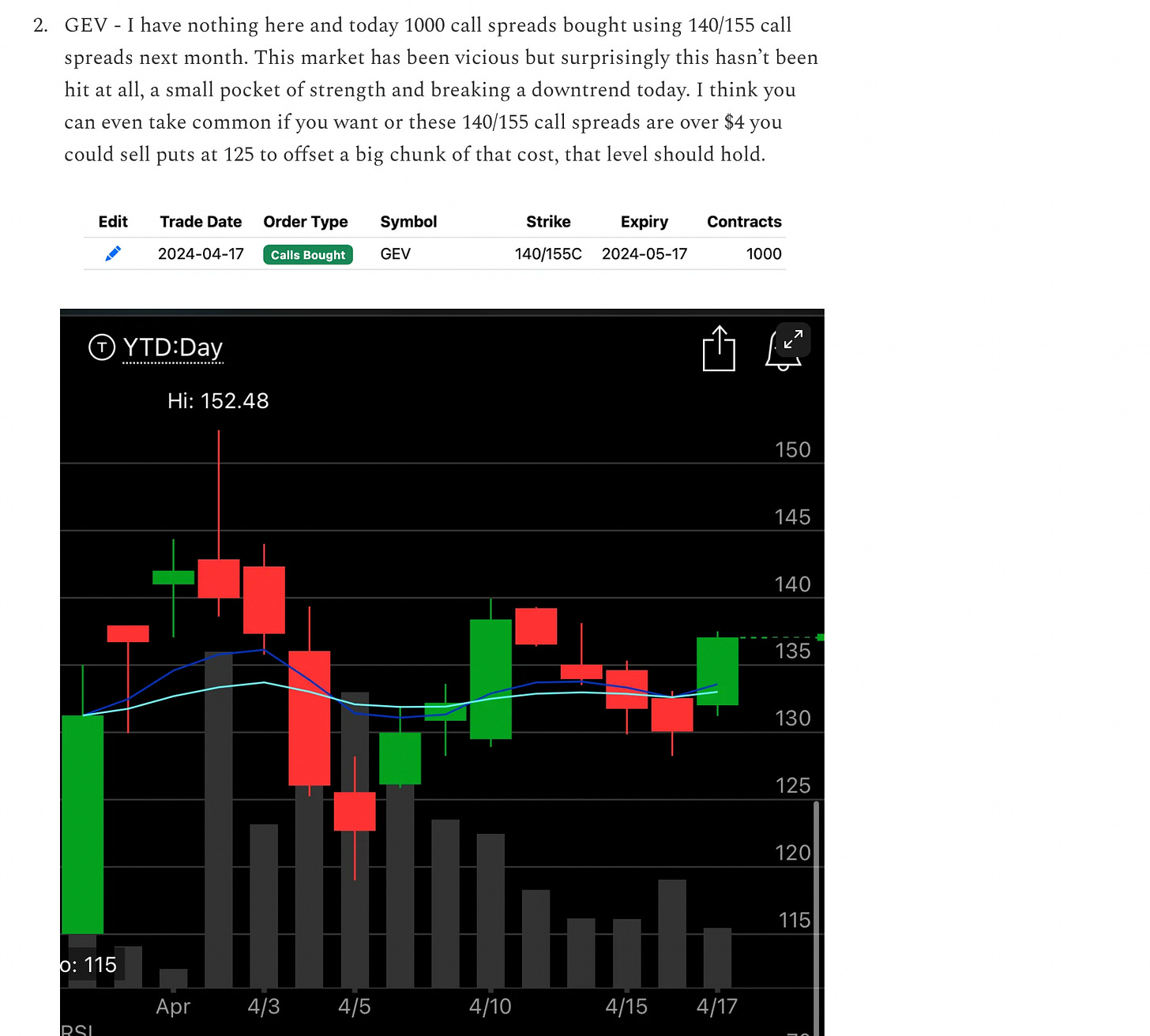

GEV

I highlighted this last week on 4/17 and it is up 8% since, if you’re up in this, just know it reports tomorrow morning if you want to close out, this has been a nice gain quickly in a defensive name that usually does not move like that.

Trends

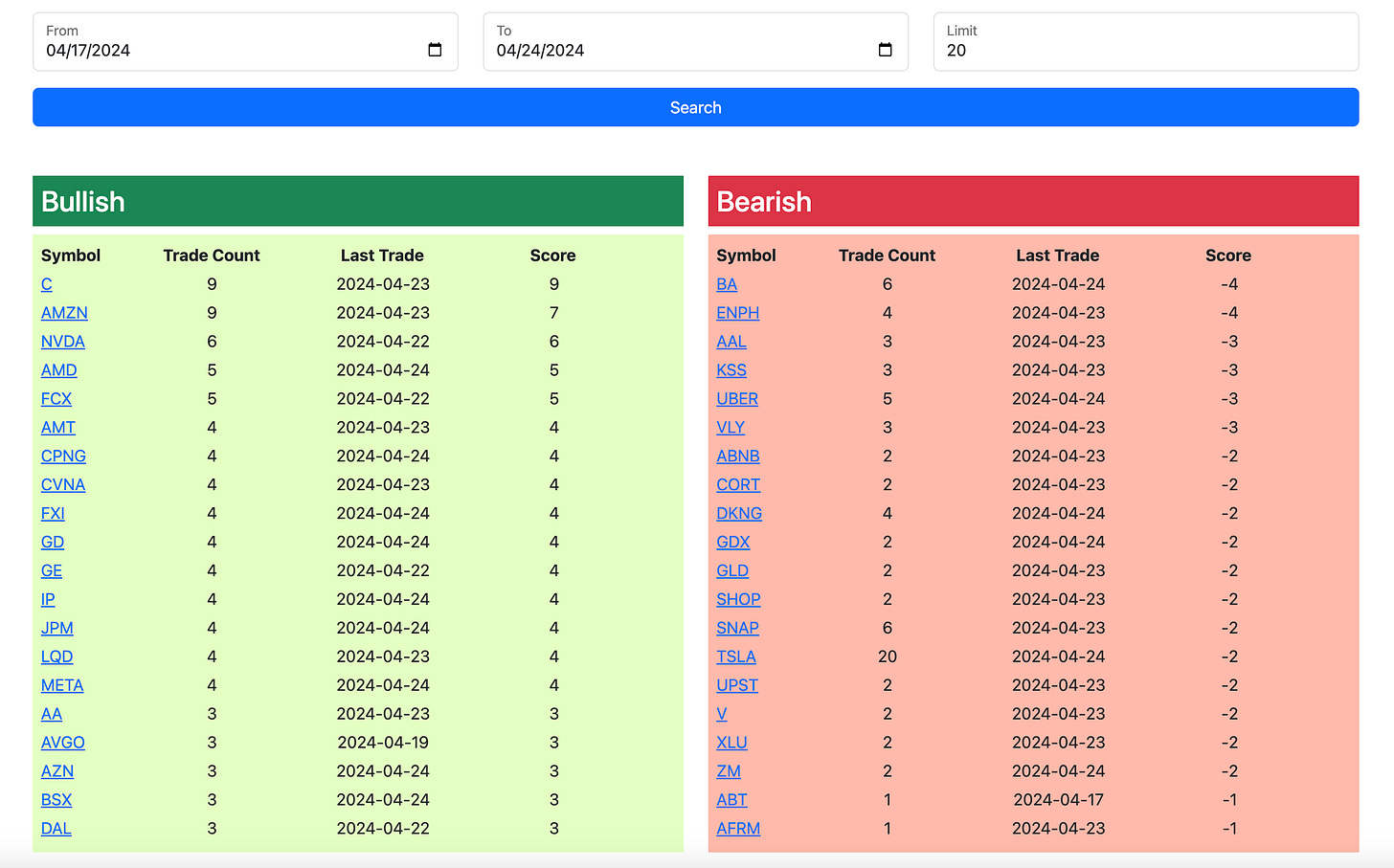

1 Week

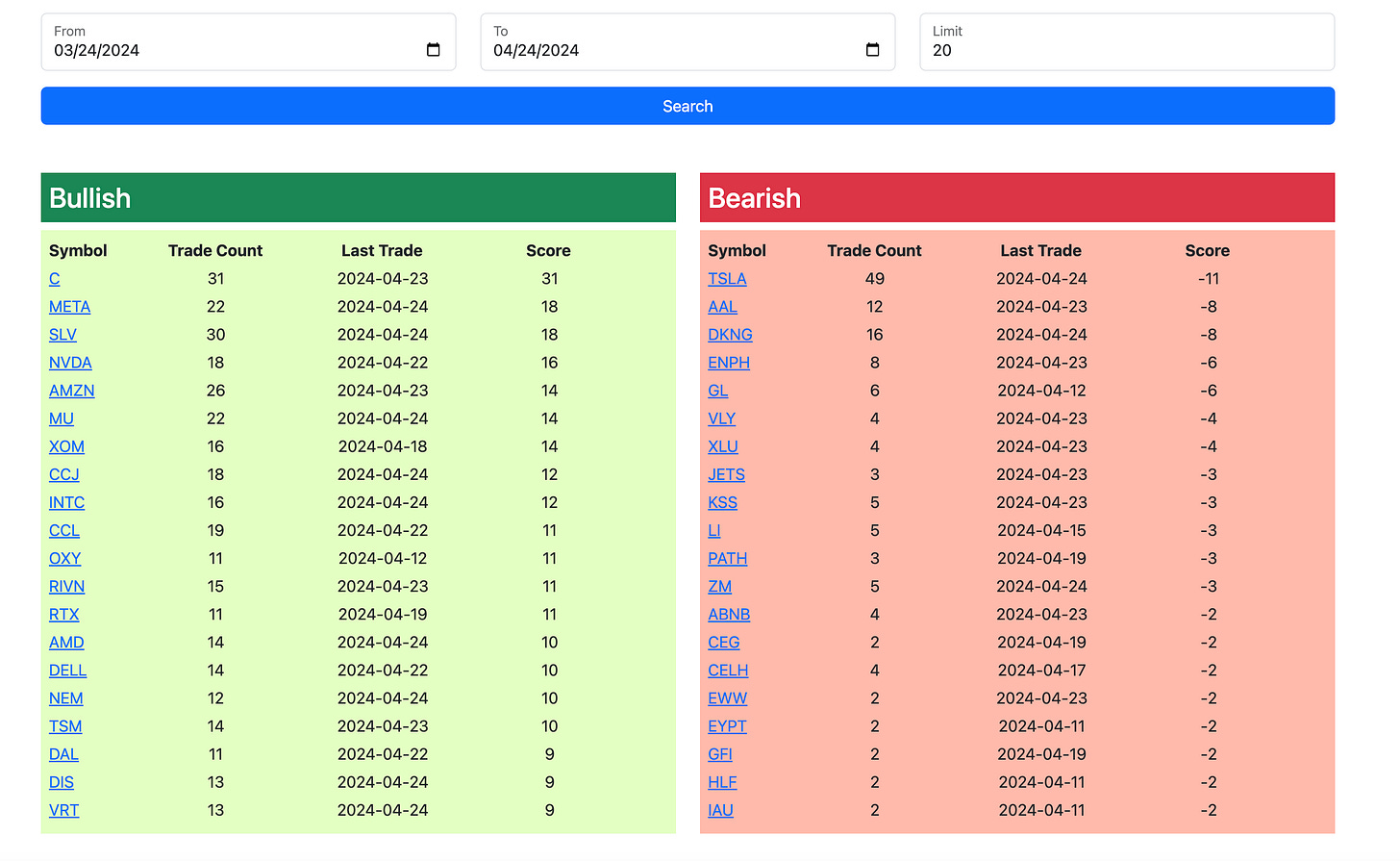

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires tomorrow morning at the open and I will have the rest of today’s trades added by this afternoon. Today was a slow session so far seems like many are being cautious before META earnings.