4/25 Recap

Today was about alot more than META missing earnings. The GDP that came is pretty much showing stagflation. This is the worst possible outcome for the fed. It was the lowest GDP print in a couple years and PCE was alot higher than expected. Now we are pricing in zero rate cuts for 2024, I’ve mentioned that possibility a few times recently and now it seems like a reality, another day of adjusting those DCF at funds everywhere and the ensuing sell off makes more sense.. Today we have GOOG and MSFT reporting, unless they pull some sort of miracle and save the market, it does indeed appear like this downtrend is playing out for a little bit longer.

Yields are breaking out of this bull flag with the TNX going over 47 today. The notion of lower rates is a thing of the past right now with us crossing 4.7 today. Again this means these multiples have to adjust lower.

The SPY is back below the 8 ema and struggling with 500 but still has not broken the 100 day which the QQQ did 5 days ago, tech stocks are the laggard right now.

META, below, has tried to recover the 100 day and so far it has been rejected right there.Is META a buy? It’s not expensive that much is for certain, but when the moving averages start sloping down like this, the process is long and tedious to get it all untangled. I do think if you close your eyes and buy META today you will be up 12 months but short term I think there’s alot more headwinds in store, possibly even a test of that rising 200 day which is below 380 today.

Recent Trades

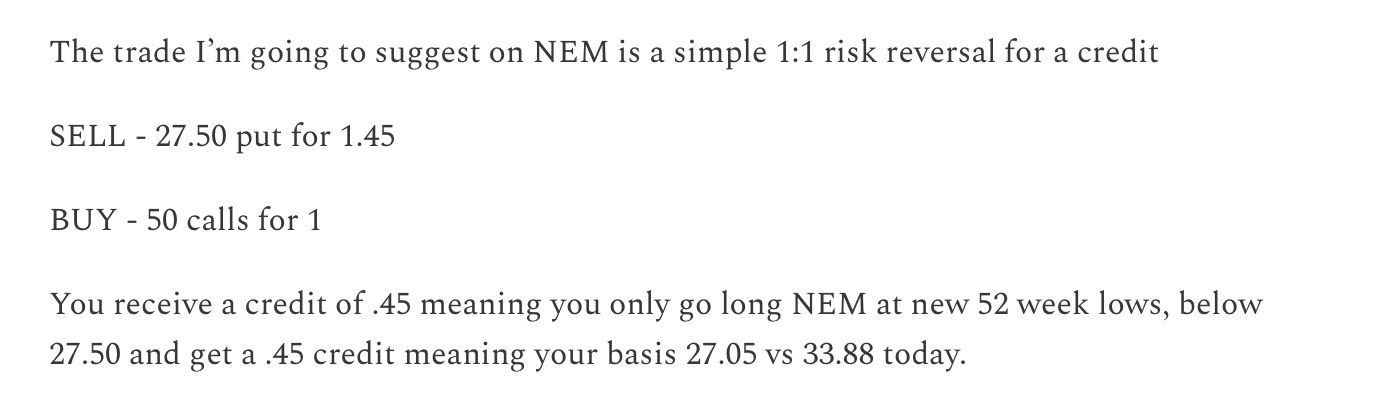

NEM crushed earnings today up 11% right now, I wrote that up as a weekend best idea back on 3/16 here

That risk reversal I suggested below is now up 75% on the short puts at $27.50 and the the $50 calls went from $1 to $3. More than that the trade was for a credit so you not only put on the trade for free but you got paid to put that on and are up a couple hundred percent. That was a really special trade because of all the longer term bullish flow that was coming in for a name that didn’t see much but they were on the money, common is up nearly 30% in a month since, that is an insane move for a gold miner but gold has been on a tear. Trades like this are why you really have to utilize the short puts to fund your calls if you think you’re right on direction, it amplifies the move.

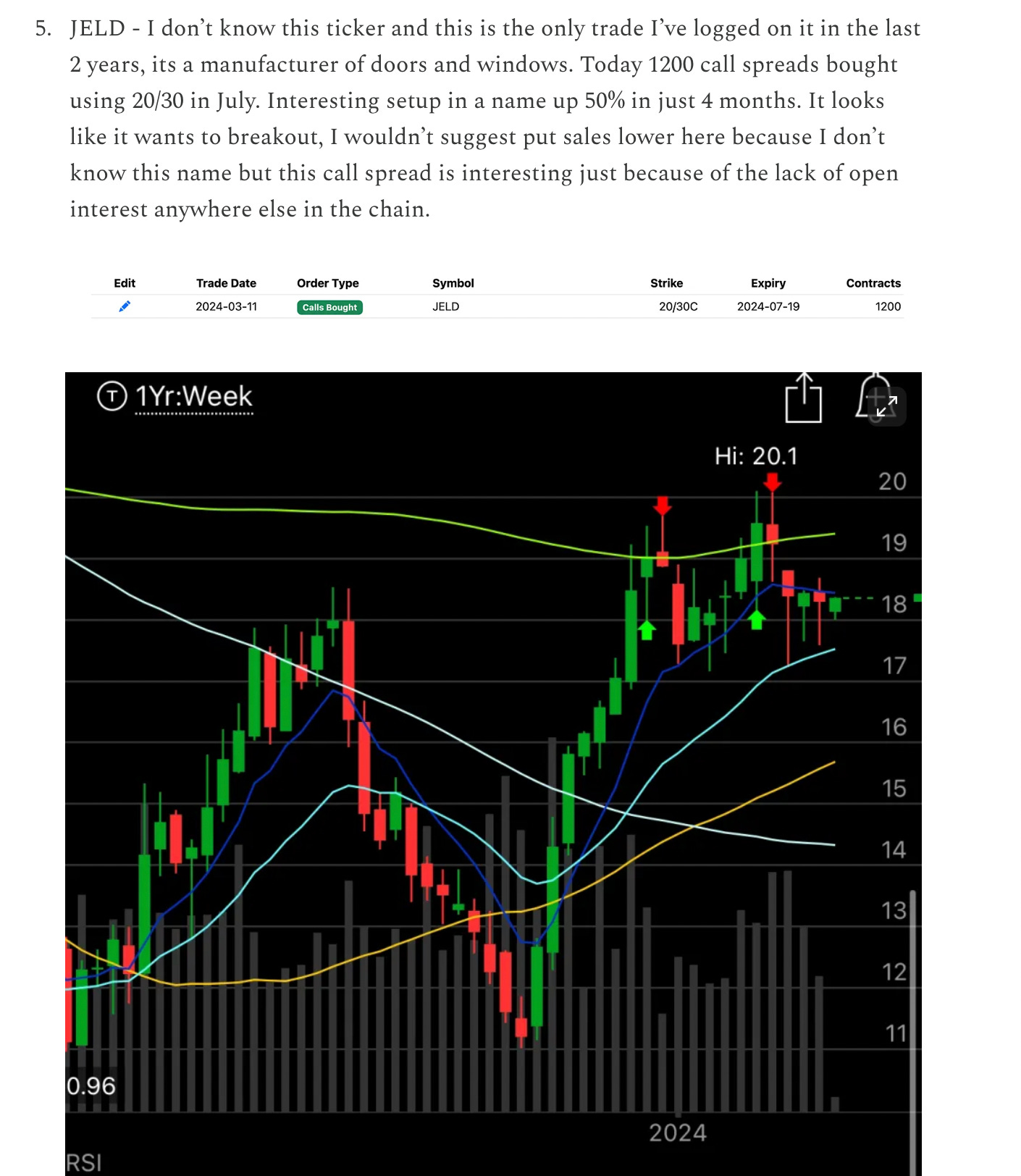

Another name today that is up out of nowhere is JELD, I don’t see any news but its up 11% to nearly $21, I highlighted it back on 3/11 when some weird call spread came in and the stock was just over $18. This name has completely bucked this selloff we’re in.

Trends

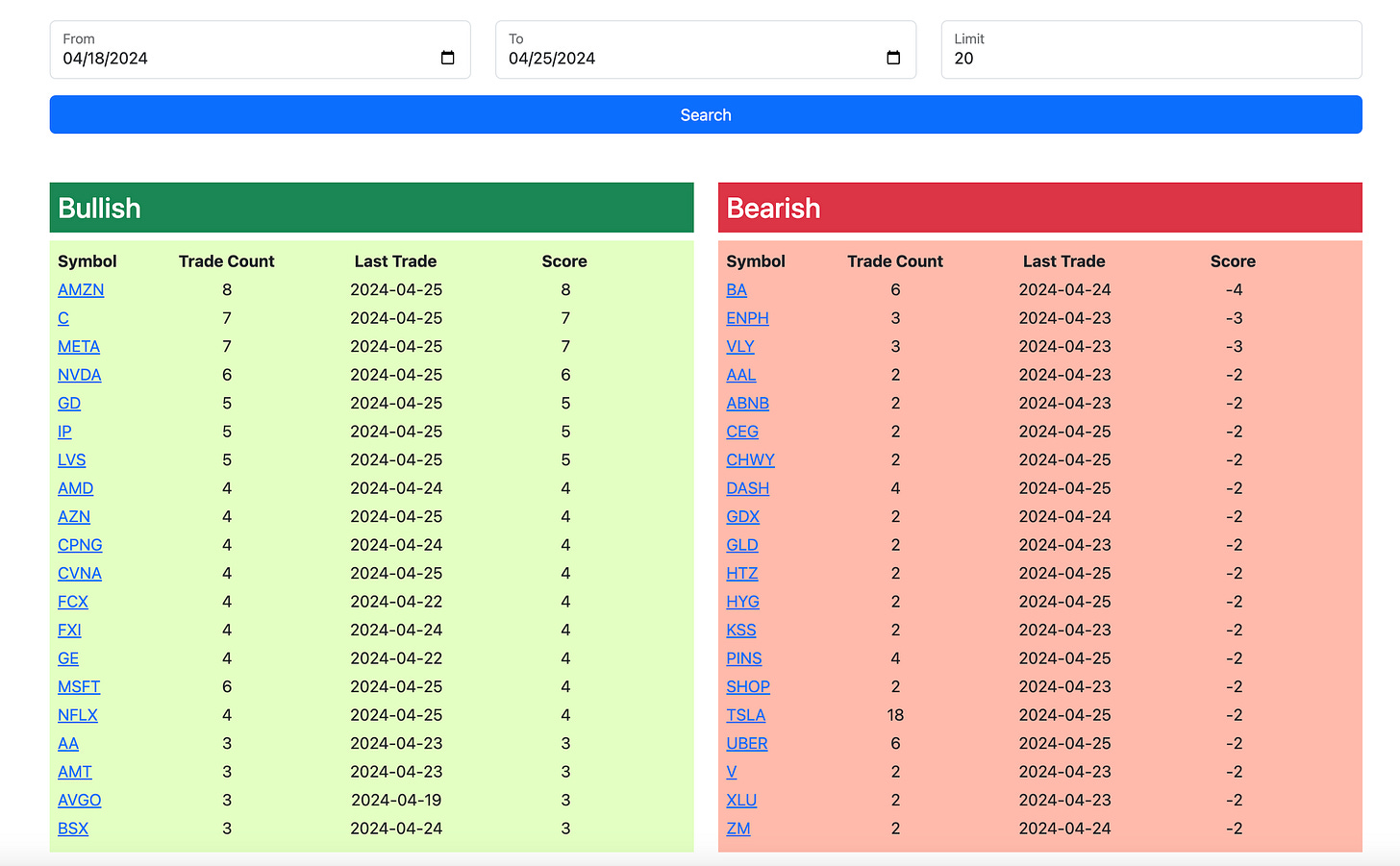

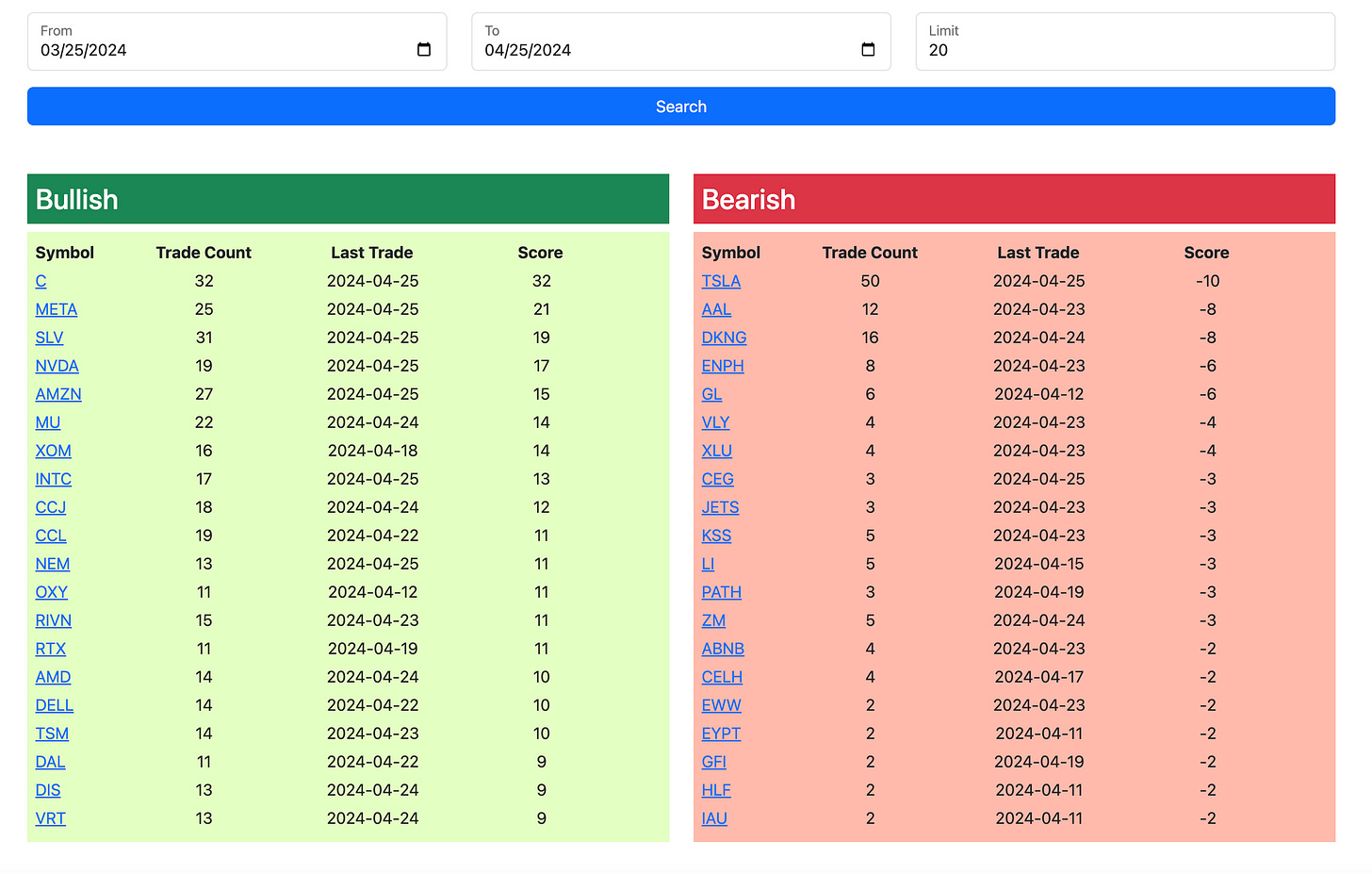

1 Week

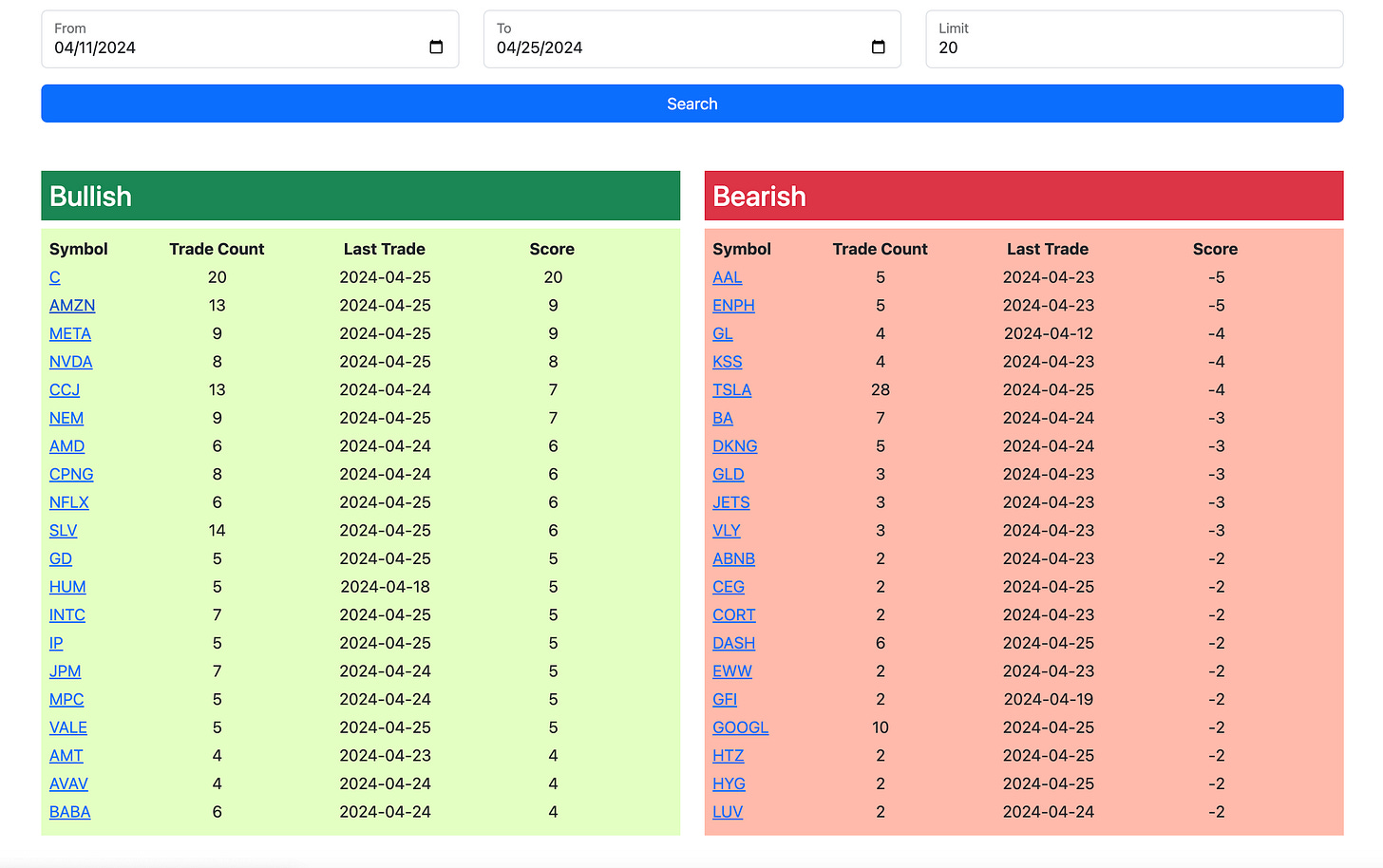

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires tomorrow morning and I will have the rest of today’s action posted by the afternoon. For those of you that are new, you can search ticker by ticker for all the flow I’ve posted, under the rankings you can click and see all the action within a name. The tables here are just for those who want to read through it quickly.