4/26 Recap

The SPY has reclaimed the 21 ema for the first time in a couple weeks, let’s see where we close today before claiming the 3 week bear market over, there is still the 50 day above as a last spot of resistance but if that 8 ema crosses up through the 21 in the next few sessions, the scary couple week period could be over. Like I said yesterday it was prudent to wait and see what Google and Microsoft did because if those 2 were down big today, the market would have been hammered.

Interesting day in the markets, the dollar broke out to highs and stocks followed, that isn’t usually how it goes day to day, but this is a whole new market in 2024, nothing you were taught seems to matter anymore. Google and Microsoft both reported strong numbers yesterday, not really a surprise to anyone, Google even issued a dividend, which also was expected from most and the market loved it sending Google up 10% today. I’m happy for Google shareholders who’ve wanted this, I know other Google shareholders who are exiting today as this is the first step in a transition from a growth company to a mature dividend payer. For me, I’m a little confused at how we’re told we’re at the start of the biggest capex war in history with all the megacaps needing capex galore for AI and everyone simultaneously wants dividends. META gave bulls a dividend last quarter and the next quarter it said mea culpa and needed more capex and the bulls were upset and sold it off. What petulant children.

As for what I said above, I am not a fan of dividends. They take money out of a company, even mr dividend himself Warren Buffett, he loves to tell you how great dividends are, but he himself won’t pay one out at Berkshire, ever. Why is that? He’s sitting on well over $100B in cash. He knows that he is a better capital allocator than you are, and he thinks money in his hands is better than it is in yours. He isn’t wrong.

Recent Trades

I have 2 today to discuss

Last friday in the 4/19 Recap I highlighted a weird risk reversal that came in on IRDM. This thing is up 15.5% in a week since with 6.5% up today. What did they do or say? I don’t know. I don’t even know what this ticker is, its a $3.5B communications company. It is always fun when these names that nobody follows see the odd option flow right before the “surprise” move.

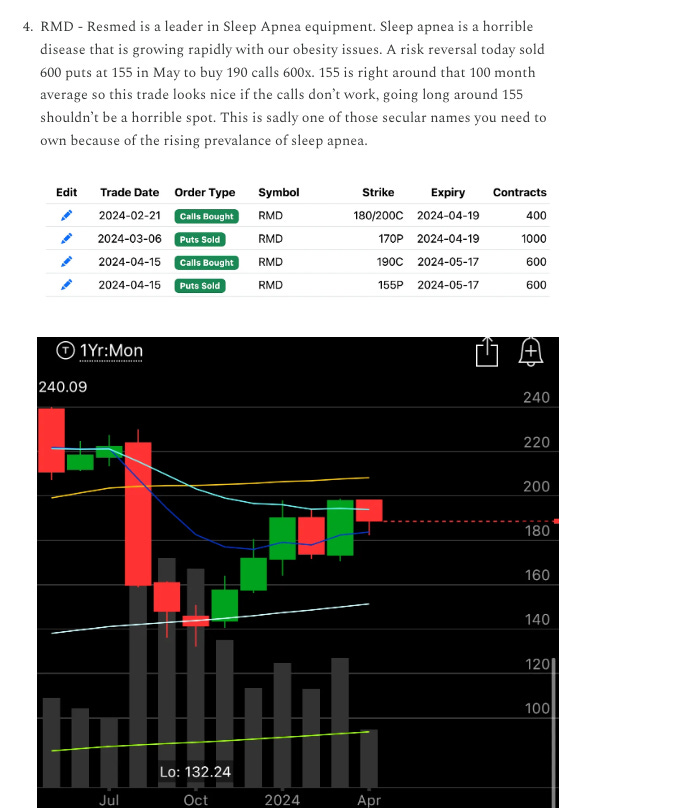

On 4/15 I highlighted this risk reversal on RMD when it was $190, it is soaring up nearly 20% today to $216+. Great move, congrats if you tagged along.

Trends

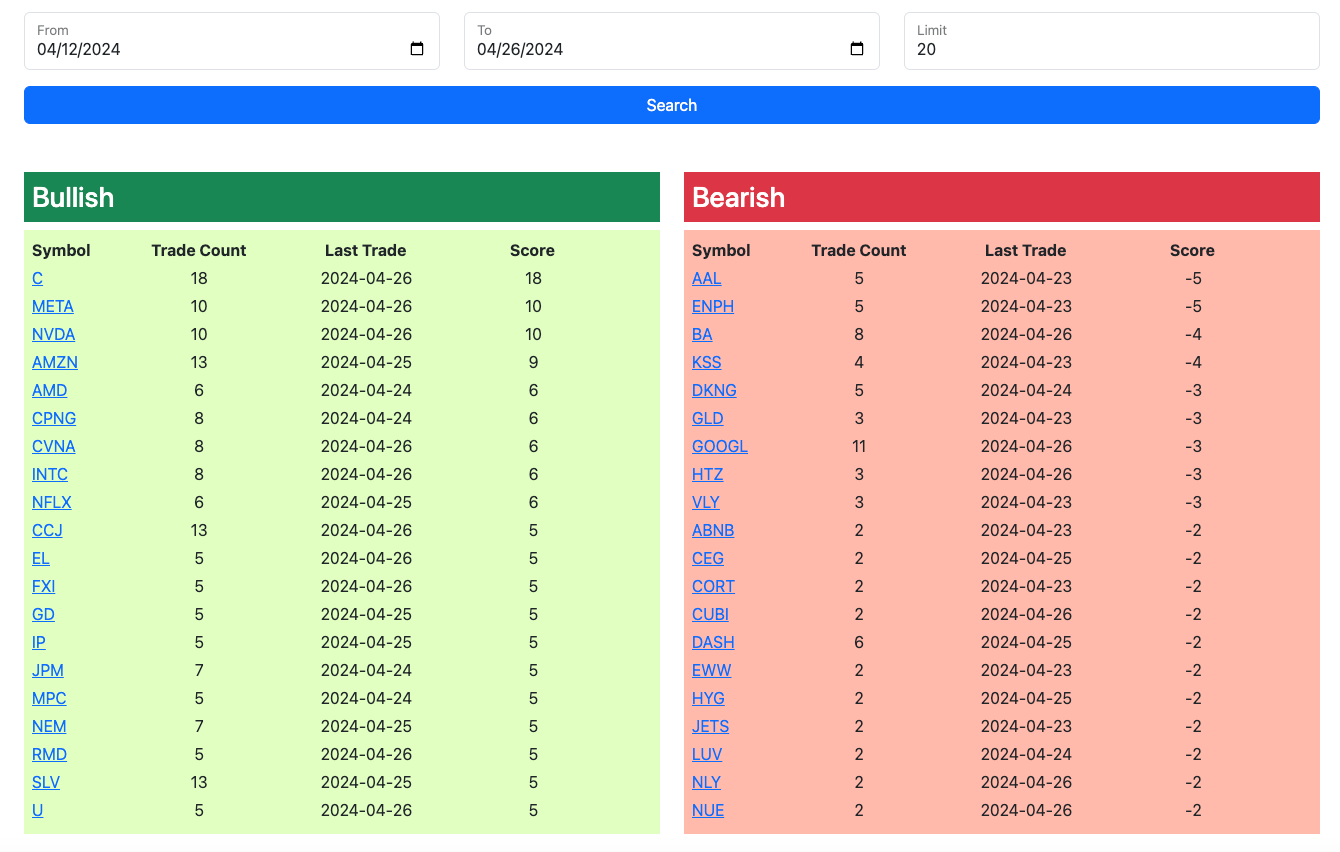

1 Week

2 Week

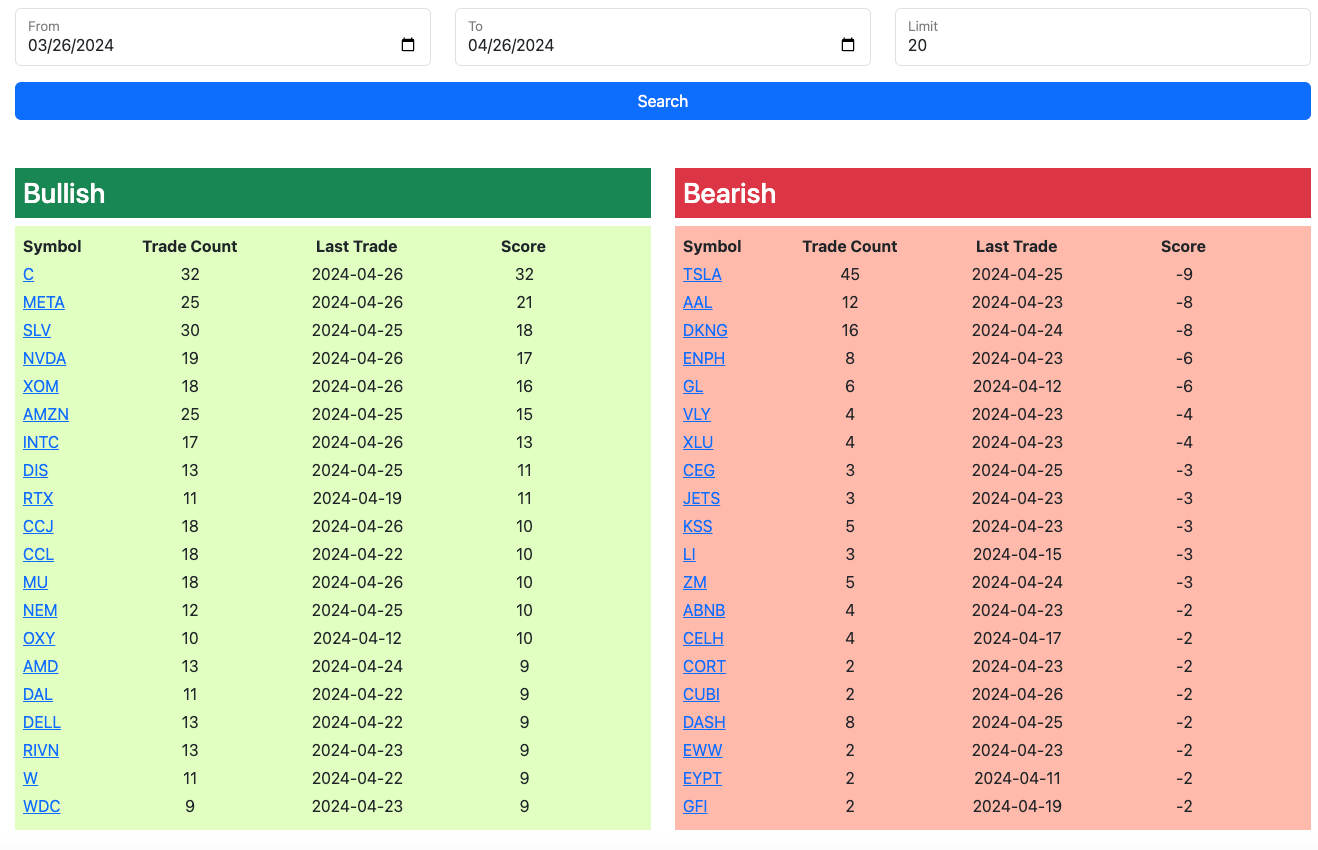

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be open over the weekend and will expire monday at the open. I will have the rest of today’s trades added in by the afternoon