4/29 Recap

The SPY is stuck right below the 50 day and we have a big week ahead with earnings from megacaps in Amazon tomorrow and Apple Thursday with a big day involving the fed on Wednesday. This week shouldn’t lack for action. Until those 3 events cross, it is hard to say the bull market is back on but the 8 ema is getting ready to have a bullish crossover with the 21 if they do. This would be the shortest bearish crossover we’ve seen in recent years at just 2+ weeks. Otherwise earnings have been coming in strong so far, even if reactions from META,MSFT, and GOOG have been somewhat lackluster, their actual earnings were amazing. Today we’re seeing a big rotation into the laggards of the year in Apple up 3% today and Tesla up 40% now in a week after reporting a disastrous quarter with negative FCF.

TNX broke below and my close below the 8 day for the first time in month, that lines up with stocks potentially flipping bullish again as yields fall. This is one to keep your eye on.

Recent Trades

APH - I highlighted this name twice in the past month, most recently on 4/23 at 113.xx it has been on a tear up near 122 now. All the calls below are up well over 100%.

Trends

1 Week

2 Week

1 Month

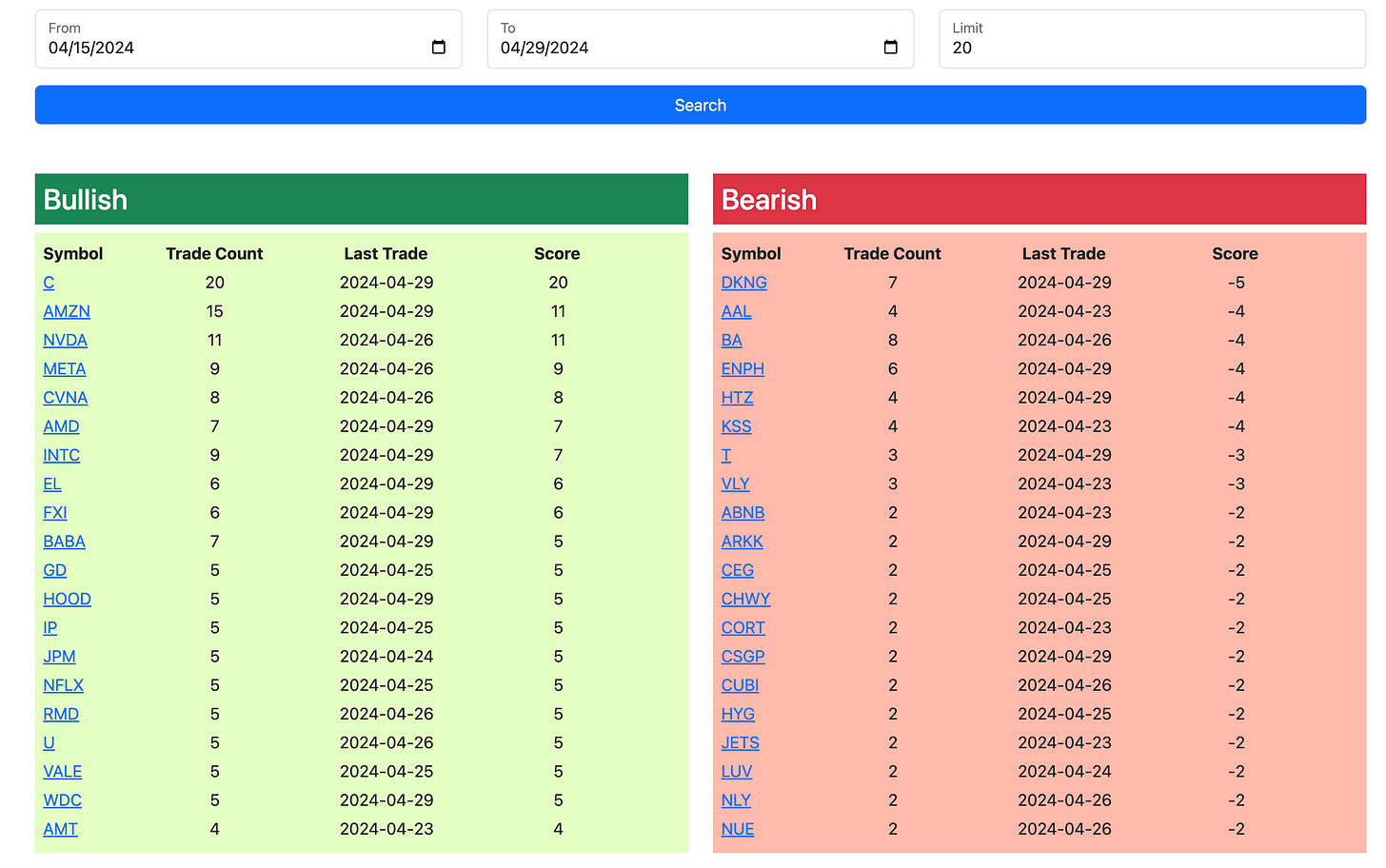

Today’s Unusual Options Activity

Below is today’s link to the database and I will have the rest of today’s action for you added by the afternoon so check back on the link then for updated trends.