4/3 Recap

There’s alot of new people in here, so I’ll go over what every section in here is as I go. I usually wrap up by 1:45 pm CST so I can write this and get it out by 2:30 CST giving you 30 minutes in the trading day to look over the day’s odd action and execute on it. Today I’m wrapping up a little earlier.

The SPY is looking good for now, you see can see the 8 ema curing up along with the rest and as long as the market is over all those moving averages and that white uptrend line, you really cannot be bearish for the time being.When we break below a few of those, that’s when you get bearish. I would look for dips off that white trendline to be bought if we really are resuming an uptrend and this isn’t a head fake, so use that as your spot to maximize risk/reward. The MACD is showing strength, but do take note that the RSI is nearing max overbought. So while we are strong, typically when RSI hits max overbought is when you will start to run out of steam.

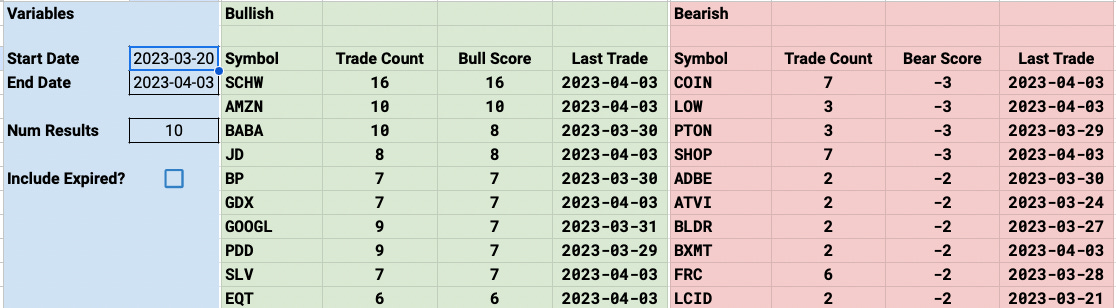

Trends

Here I post the trends from various timeframes(the dates are on the left) just so you can get a feel on what names are seeing the most unusual activity whether bullish or bearish in my database. This helps me with selling puts into strong, trending names. You can see that over 2 months on the bottom, Amazon has been the name with the most bullish trades that aren’t expired. On a 1 week timeframe, it’s SCHW that has that designation. SHOP has the most bearish trades over the past week.

1 Week

2 Week

1 Month

2 Month

Today’s Unusual Options Activity & What Stood Out

This is where I post the most unusual trades I came across today, below them I will highlight a couple and all the flows in my database, but all these names below saw unusual action based on historical action within the particular name.