4/3/25 Recap

Sorry I’m a little late I had alot to write today.

Wow was I wrong. I had assumed that Trump would come in lighter than most feared and he did the complete opposite and was way harder on China than most anticipated. The 54% tariffs on China shocked everyone and sent the market into a tailspin because Apple,Meta, and Amazon all got slammed on those. The tariffs are his negotiation tactic, whether we agree or disagree, the likelihood that they are permanent is almost zero. Some countries will cave into his demands, others won’t, but the market did not like the shock of what was proposed yesterday. Even during the conference the market was up initially until the big numbers on China and other east Asian countries were revealed.

Right now the market has rallied a tad off lows, obviously with a huge gap down like that you’re going to have margin calls, panic selling, etc and we’re making new lows right now. This isn’t really the setup you want to be long any short term trades into. If we do not close above 550 today, which we had held twice in recent dips, you really want to not put on any short term longs until we reclaim the 8 ema which is just below 560 now and sloping down. This has been a terrible 2 months for the tech stocks which are most of the market, yesterday was a weird afternoon where SEcretary Bessent said this was a Mag7 problem not a MAGA problem. The problem with that statement is Mag7 is 35% of the S&P because the market is not equal weighted and the market is the president’s problem so without Mag 7 working, the market just will not work regardless of what other sectors work. Go back to 2022, many sectors did work, but without megacap tech, the market isn’t going up. So unless President Trump plans on just handing power over in 21 months during midterms, he eventually will have to realize a Mag 7 problem is his problem.

We’re now in wait and see mode in term of retaliatory tariffs and how long this will go on. From a technical standpoint this is getting uglier but it has been ugly ever since we broke the 200 day back in early March. I was definitely wrong in thinking this was first term Trump who focused on the market as his barometer of everything. It’s weird to see because his whole persona is different to where now he’s indifferent about the market but in term 1 he was quoting Dow Jones levels daily and telling everyone about his market. While he can pretend the market isn’t important to him, he is getting what he wants right now as rates are dipping, but at the end of the day, the US stock market will have to go up alot or his term will be considered a failure regardless of how much winning he tells us is going on.

Recent Trades

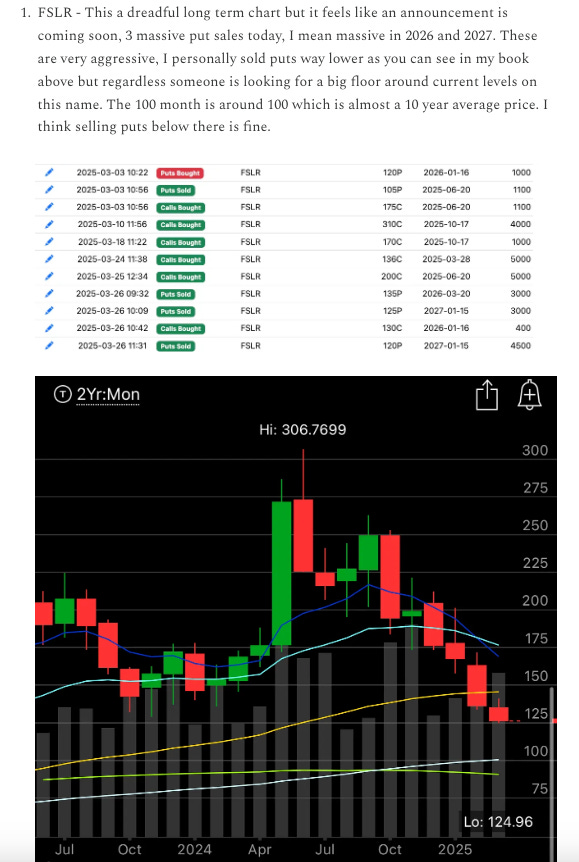

FSLR - Last week in the 3/26 recap here I noted 3 large put sales on First Solar that name is up 5% right now to 136.40 in this bloodbath, it was actually up over 8% earlier as the tariffs will keep the Chinese solar panels at bay. It was weird seeing that many put sales that far out on a name like this but today was what they were banking on as being the start of a nice trade.

My Open Book