4/5 Recap

As exciting as today’s session was, the options side of things was pretty slow, I didn’t even log 80 unusual trades so far today, so I’m sending this out just a few minutes earlier than usual. I don’t even know what to say, we need to see how today’s candle closes before I say anything on direction but so far it seems like we’re recovering from yesterday’s trend break. It is still way too early in the session to say anymore because this could very well reverse and close below the 21 ema still. So we really have to wait till then to see the trend but so far an incredible recovery.

I sent out a second note AH just to tell everyone to be cautious because when a major trend breaks, that is when you have to shift your priorities from being levered long to being cautious. Caution never sent anyone into bankruptcy. I also had alot of people tell me I was wrong and the sell off wasn’t Kashkari, so here is my explanation of why I thought it was. For starters all these companies DCF changed the moment he said no rate cuts. We have gone from 7 cuts at the start of the year to 3 before yesterday to 2 now. In all likelihood if jobs numbers stay strong like today, we beat by 100,000 jobs, the fed would look ridiculous cutting rates. So now everyone front running rate cuts has to adjust their models and things like say Amazon lost $90B intraday in value on nothing. If yesterday was really about WW3 potentially beginning, the VIX wouldn’t have been 16 and TLT wouldn’t have been 92. I don’t really care what the bond market says because the bond market has been so wrong on when we’re cutting for a while now. Do we need to cut? Yes absolutely we do, we can’t issue much more debt at these rates, but cutting is going to send all assets to mars and then we will have a bigger wealth gap and bigger problems that emerge from that.

I don’t think Ukraine and Israel were relevant at all yesterday. First off Israel and Iran have been in a proxy war for decades, Israel has been battling the Iranian proxy Hamas and Hezbollah militants for years, so an escalation would surprise nobody. Ukraine joining NATO also seems like a farfetched thing because they could have done that before the war and spared so many lives, but now after everyone died, now Ukraine is set to join NATO and drag the rest of NATO into a Nuclear war with Russia where a potential nuclear winter and the end of humanity lies in wait? I’m going to say that probably isn’t going to happen, just a guess of course.

So in summary yesterday was a weird day, we had 3 major things occur, take your pick of what caused the selloff, it does not matter which one caused it, all that matters is the trend broke and it sent warning signs to lighten your portfolio. The reason investors get blindsided by selloffs is because they do not listen to the market. In the history of markets, nobody went broke riding an uptrend, and nobody went broke knowing when a downtrend was happening and lightening up. Today’s close will tell us more on whether yesterday was a one day thing or a new trend is developing.

Blinken said Ukraine will be joining NATO

Israel/Iran tensions flared up

Kashkari said the FED wouldn’t be cutting rates.

Recent Trades

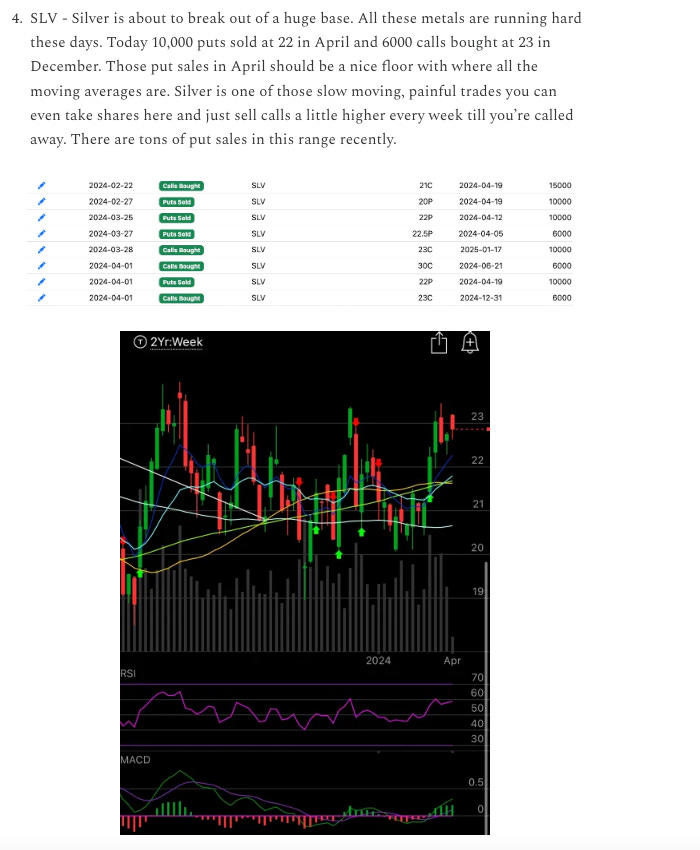

SLV - Silver doesn’t really move much, ever, but it is up about 10% from monday’s recap. It was just below 23 then and now it is up over 25. That chart breakout was the tell, great trade for those who played this or gold recently. Literally a once in a decade move on metals this week.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database it will be open all weekend until the market opens monday. I will have the rest of today’s trades posted by the afternoon