4/6 Best Idea For The Week Ahead

This week’s best idea is a leader in its space, has a great activist involved and may be one of the few values left in this market. I have a plan to potentially buy it for less than one of the best activists ever while still capturing a ton of upside should it occur. From a risk/reward standpoint, I think the upside far outweighs the downside over a longer timeframe so it’s time to place bets but before all that I want to talk about the overall market.

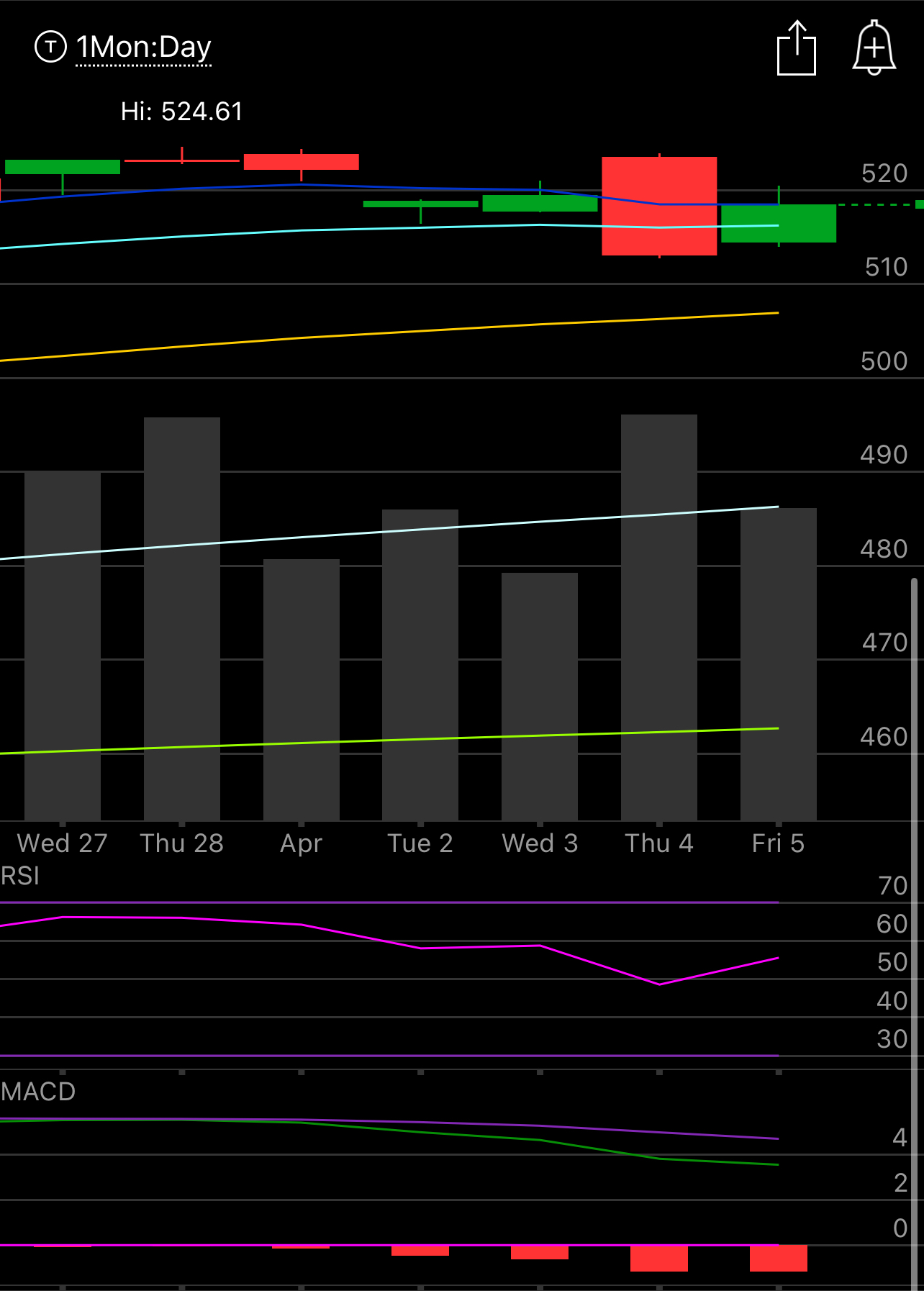

Yesterday was quite the session, look at this candle below on the SPY. We opened below the 21 ema for the first time in ages, which should’ve been bearish, but we tested all the way above the 8 ema and rejected lower and closed right at it. I don’t want to be bearish, but I’m just doing what you’re taught. There was a time where you didn’t buy names below the 200 day, you didn’t buy things when they broke certain moving averages, but we really are in a new market and you just buy everyday it feels like.

I’m going to stick with my thesis of the good names that make money will do much better than growth here. Some names like Google,Amazon,Meta all closed at their highest weekly closes ever, those are the clear leaders. MSFT was close, but did not close at a weekly ATH. NVDA shockingly closed with its 2nd straight red week and well off its highest weekly close. Tesla and Apple are the clear laggards.

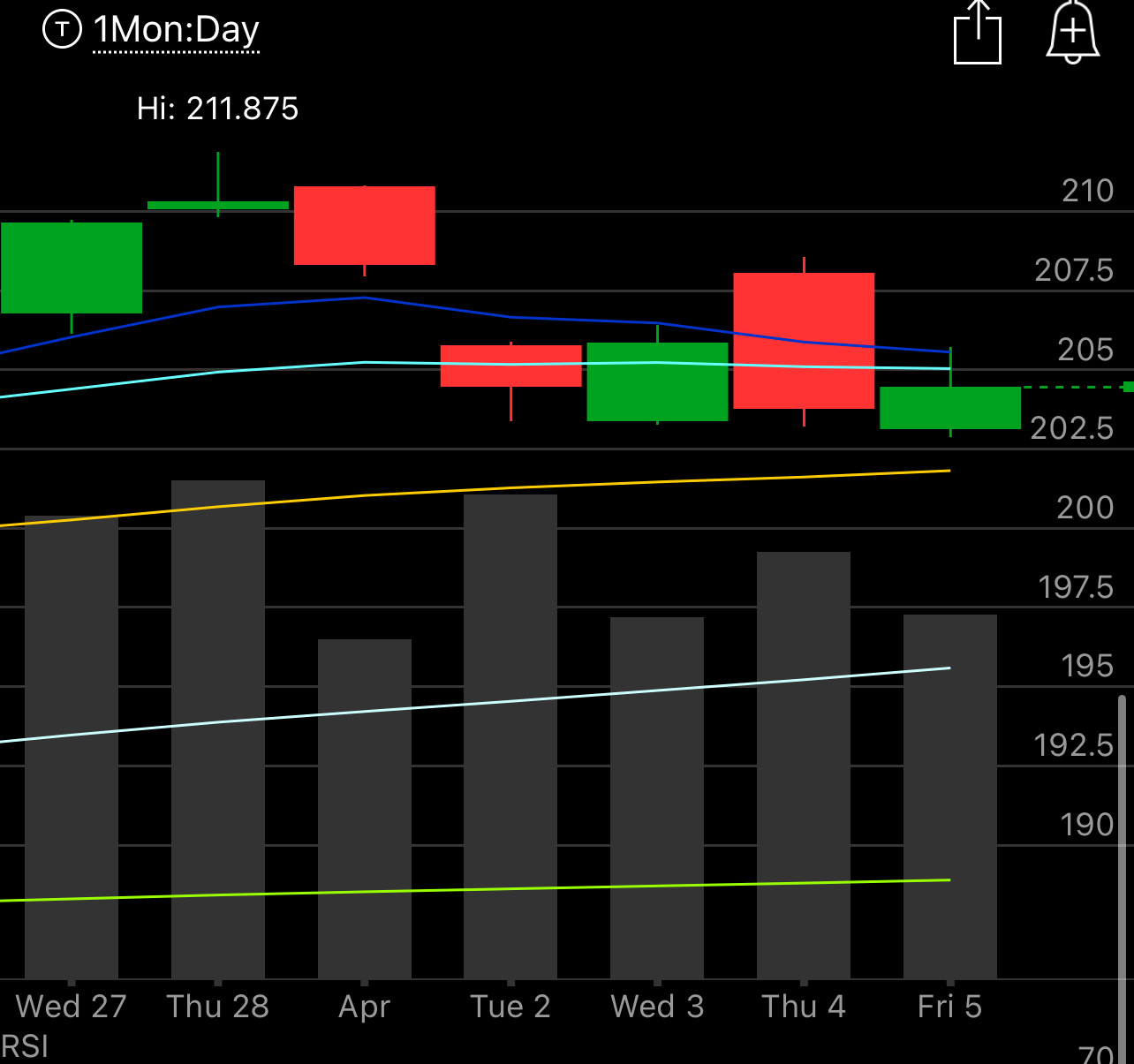

I don’t believe yesterday’s candle was bullish, the day before, we sold off on heavy volume, yesterday was just an inside candle, if you look at the IWM, small caps tried and rejected both the 8 and 21 ema yesterday and are now sitting right over the 50 day. It makes sense right, we’re now down to pricing in 2 rate cuts and the thesis of buy small caps because we’re cutting rates needs a timeframe adjustment after the hot jobs print.

Bottom line earnings season is here, it starts with banks this week, there’s always going to be a new batch of names that outperform, regardless of how the overall market is doing, my goal in here is to find those names and try to stick to them. You all know I’m a big believer in Post Earnings Drift and we will have to see what those new names that drift for the Q ahead will be in the weeks ahead. The pessimist in me says the SPY closing with a bearish engulfing candle on the weekly yesterday is not good, look at the chart below and the arrow I put in, the last time we did that was in mid 2023 and it signaled the start of a reversal. So like I said, keep an open mind, companies can be great and still go down for a little bit, it all starts with a trend break, for now the weekly is just riding that 8 ema higher since October.