4/6 Recap. The Jobs Number Looms Large.

Tomorrow morning we get the big jobs number everyone has been waiting for and unfortunately the market is closed. This week has been different than weeks past where bad news was actually viewed as bad news. Is the market finally starting to price in the hard landing? It’s very possible. We’ve gotten some scary news out of commercial real estate analysts this week and while everyone is happy equities keep rising, there has never been a time where the yield curve un-inverts and pain is not felt. We are still inverted so we haven’t seen it yet, but it feels like the time is approaching as earnings estimates are coming down and people are slowly realizing the fed can’t really do much at this point.

The SPY for now came down and bounced perfectly off the 8 EMA, if this move holds into the close it bodes well for the bulls, but tomorrow is a binary event, it can change all this in a flash but the fact that the SPY has been over the 8 day for 7 sessions now is a testament to the buying pressure we are seeing.

Trends

1 Week

2 Week

1 Month

2 Month

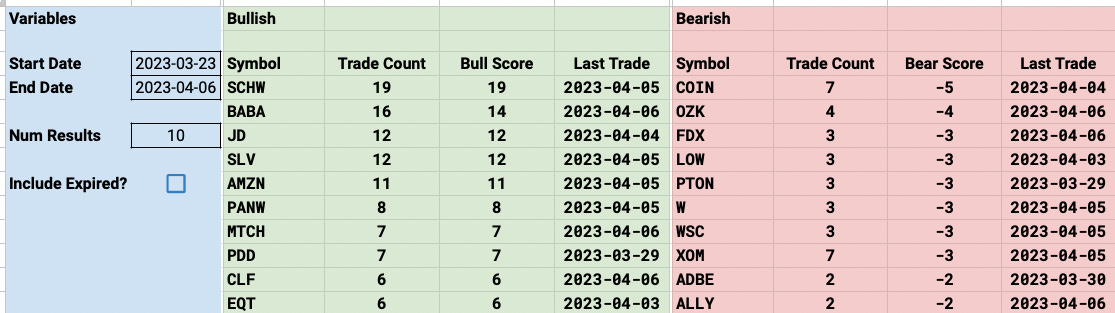

Interestingly I see OZK has zoomed up the list on the bearish side. Here is all the action I’ve noted on it recently, it is a smaller bank, Bank of the Ozarks. Have to wonder if something is brewing there look at all the put buying going on.

The chart remains very weak on this one hanging below all the key averages

Today’s Unusual Options Activity & What Stood Out