4/8 Recap

As the market awaits CPI data this week on wednesday, we had another boring session of nothing so far. Believe it or not, the SPY isn’t even up 2% right now from early March, we’ve really done nothing in quite a while. I’m not sure how the market is going to react wednesday but I don’t see how CPI isn’t hot with the run we’ve had in commodities recently. Will it be “priced in” as usual? Banks kick off earnings season this friday, I would expect nothing material today or tomorrow until CPI. If anything tomorrow may see a sell off with everyone expecting a hot print on 4/10.

One thing to watch is clear market leader NVDA, which was up almost 100% in Q1, is now well below its 21 ema. A clear trend shift developing with possibly its 3rd close below the 21 ema in a row. This is with Nvidia getting a $1200 PT this morning and announcing 10% price hikes last night which should have been bullish with people adjusting numbers up, but the market did not care. If NVDA doesn’t reclaim this soon, it may have issues ahead.

One thing that stood out to me in today’s options table below is the amount of options bought in defense names, countless trades in multiple names. Are we gearing up for war? I hope not, but the bullish trades today seem to be positioning for one. The VIX was down today so it certainly isn’t looking for a war. We will have to watch what happens with that the next few days.

Recent Trades

FSLR - Last week in the 4/2 recap I noted the big put sale and call buy in FSLR and it is up 10% to nearly 180 in just 4 sessions since. Very nice move if you took part those put sales have gained 30% since.

Trends

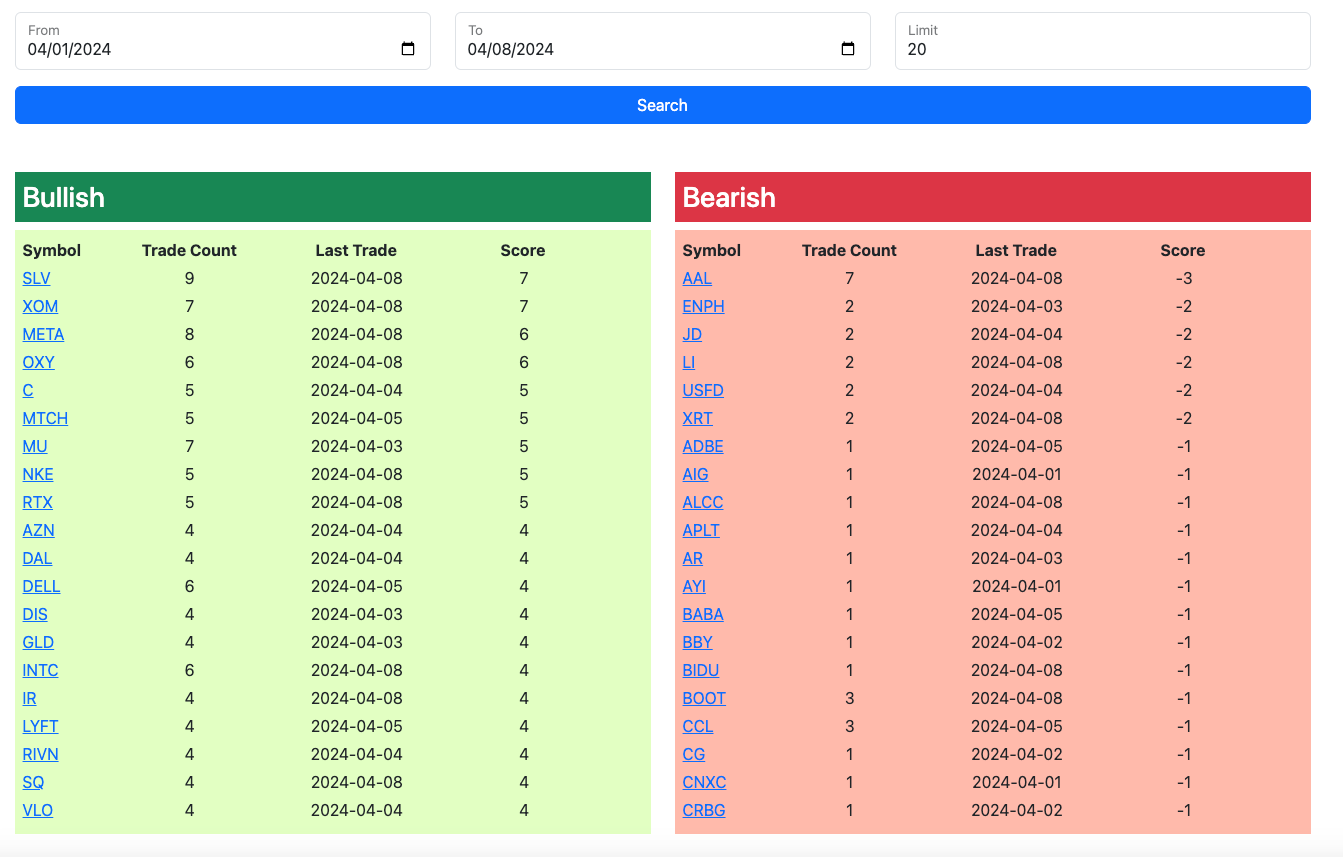

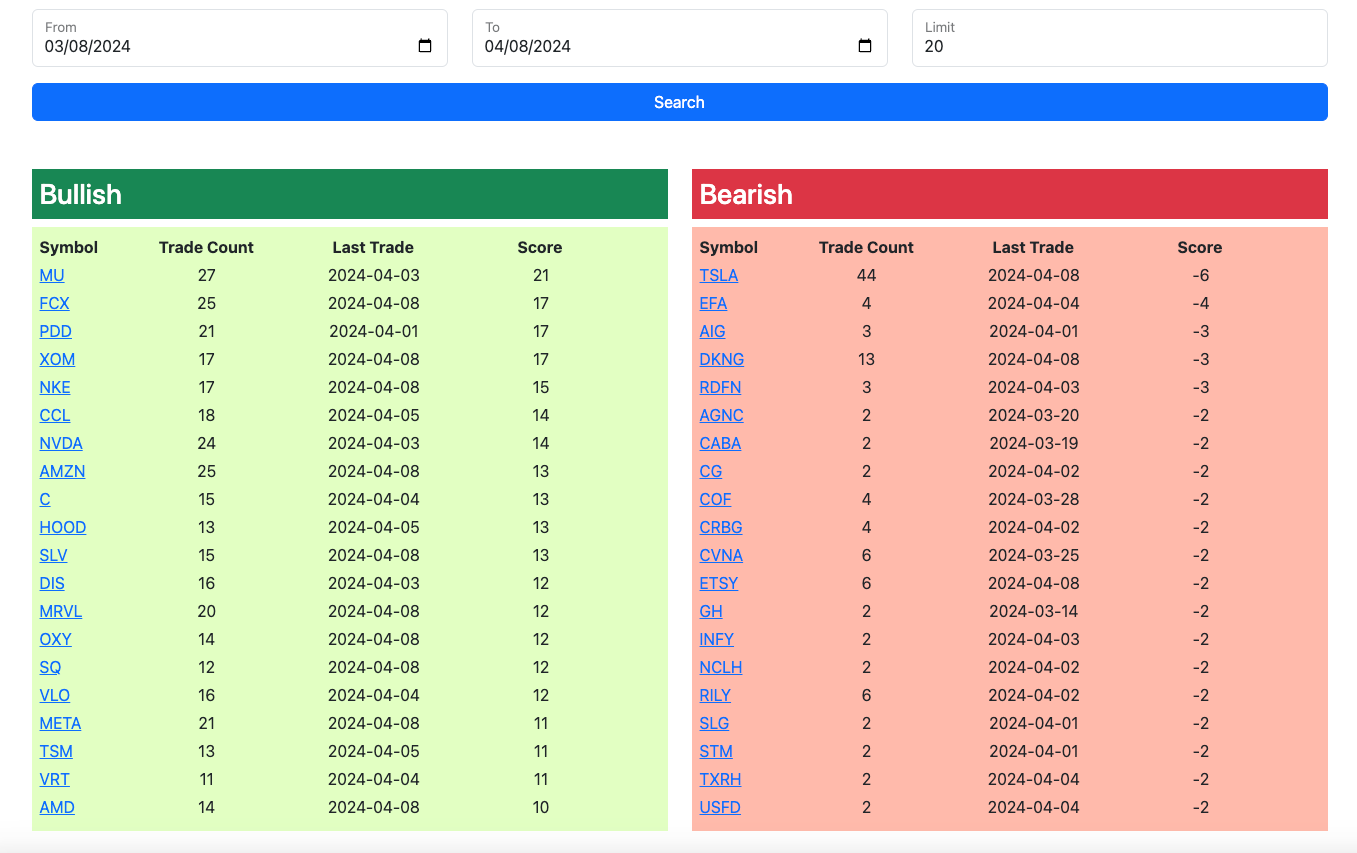

SLV is the leading trend the last week followed by XOM with META and OXY right behind, those were some of the best performers of the last week. Silver was nonstop up again today for 10% in just a few sessions. Over the last month no names had more bullish option flow than MU and FCX and both of those are up 20% in that timeframe. The names seeing the most flows continue to run the hardest.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, I will have the rest of the days trades added by the afternoon. Check back on the link below to catch the rest of the days trades and updated trends.