5/10 Recap

The SPY continues to trend higher over all the moving averages here, nothing to note really, it could be argued a lower high is forming unless we take out 524.61. For now things look ok, but alot can change between now and the close. The 21 ema is way lower at 411.53 so we have wiggle room to have a little pullback overall and still be ok.

We got some pretty terrible economic data this morning we need to talk about

U.S MICHIGAN CONSUMER SENTIMENT (MAY) ACTUAL: 67.4 VS 77.2 PREVIOUS; EST 76.2

U.S MICHIGAN CURRENT CONDITIONS (MAY) ACTUAL: 68.8 VS 79.0 PREVIOUS; EST 79.0

U.S MICHIGAN CONSUMER EXPECTATIONS (MAY) ACTUAL: 66.5 VS 76.0 PREVIOUS; EST 75.0

U.S MICHIGAN 1-YEAR INFLATION EXPECTATIONS (MAY) ACTUAL: 3.5% VS 3.2% PREVIOUS

U.S MICHIGAN 5-YEAR INFLATION EXPECTATIONS (MAY) ACTUAL: 3.1% VS 3.0% PREVIOUS

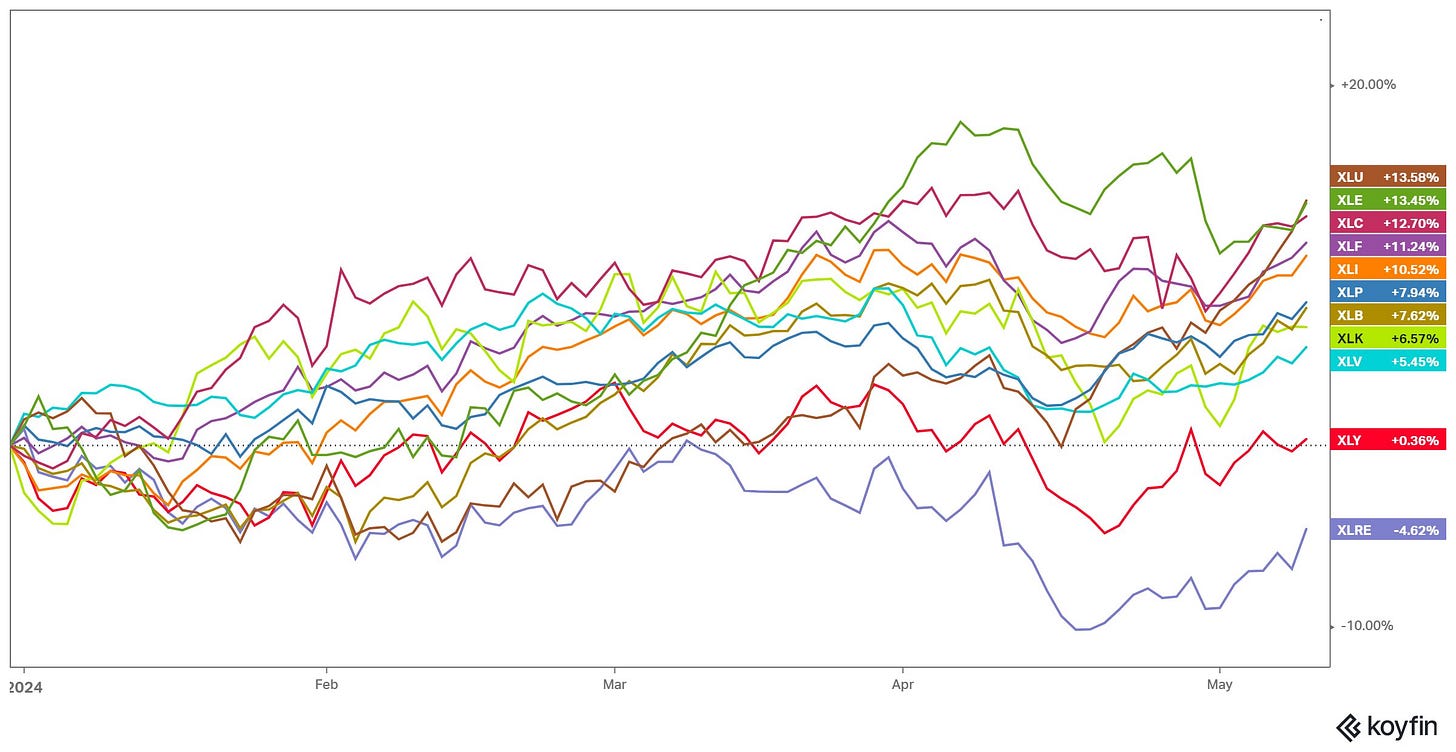

Inflation expectations up and consumer sentiment down is the worst outcome for everyone. This makes sense with what we’ve been seeing with the consumer discretionary XLY really underperforming this year even with 25% of its weighting, Amazon, up 30%. Mike Zaccardi had this post on Twitter today and its impressive how much consumer names have underperformed. Utilities are leading us this year followed by energy, tech isn’t even in the discussion as the XLK is in 8th place.

It’s always difficult to say anything macro wise because nothing ever seems to matter. They always keep telling us how good things are and how everything is going as planned then yesterday you get the highest jobless claims and today this awful consumer data. The reality is the data we just got today is really bad, how the government spins it is a whole different topic. As traders, we’re just here to trade price action and like a few weeks back, until we break below some key moving averages, we are technically bullish. Under the surface, you’re seeing certain segments that are outperforming and that’s the goal here to always try to find those and focus on them. The macro people can have fun pontificating over what may or may not happen to the economy, but the stock market is not the economy and price action is all that anyone concerned with trading should focus on.

Recent Trades

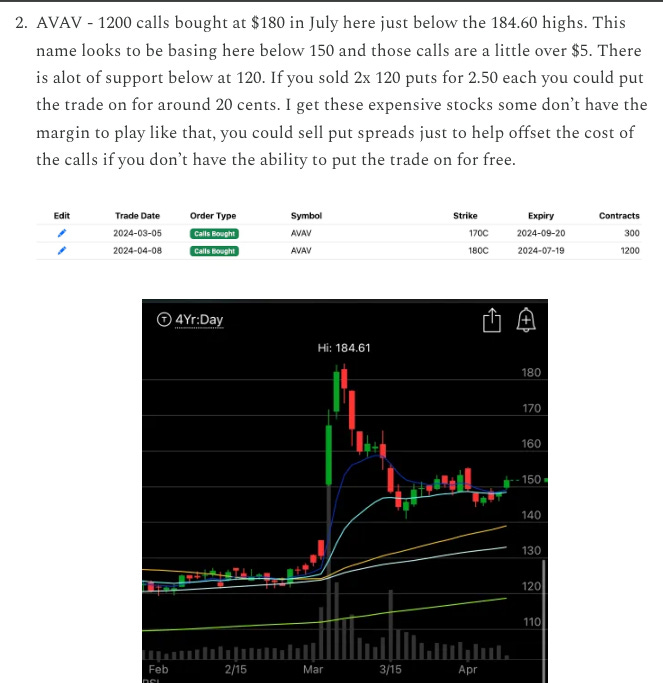

AVAV - On 4/8 I highlighted AVAV with it just over 150, it is up 25% in the month since up to 184.50 today. That risk reversal I drew up below is up a fortune right now. The player who bought the July $180 calls made alot as they went from $5 to $18.50 but if you threw in that wrinkle I mentioned with the risk reversal, they went from .20 to $18.50 for another near 100 bagger like the CPNG trade I drew up a while back. That is the power of properly utilizing a risk reversal and why I love to offer up potential scenarios involving them daily.

Trends

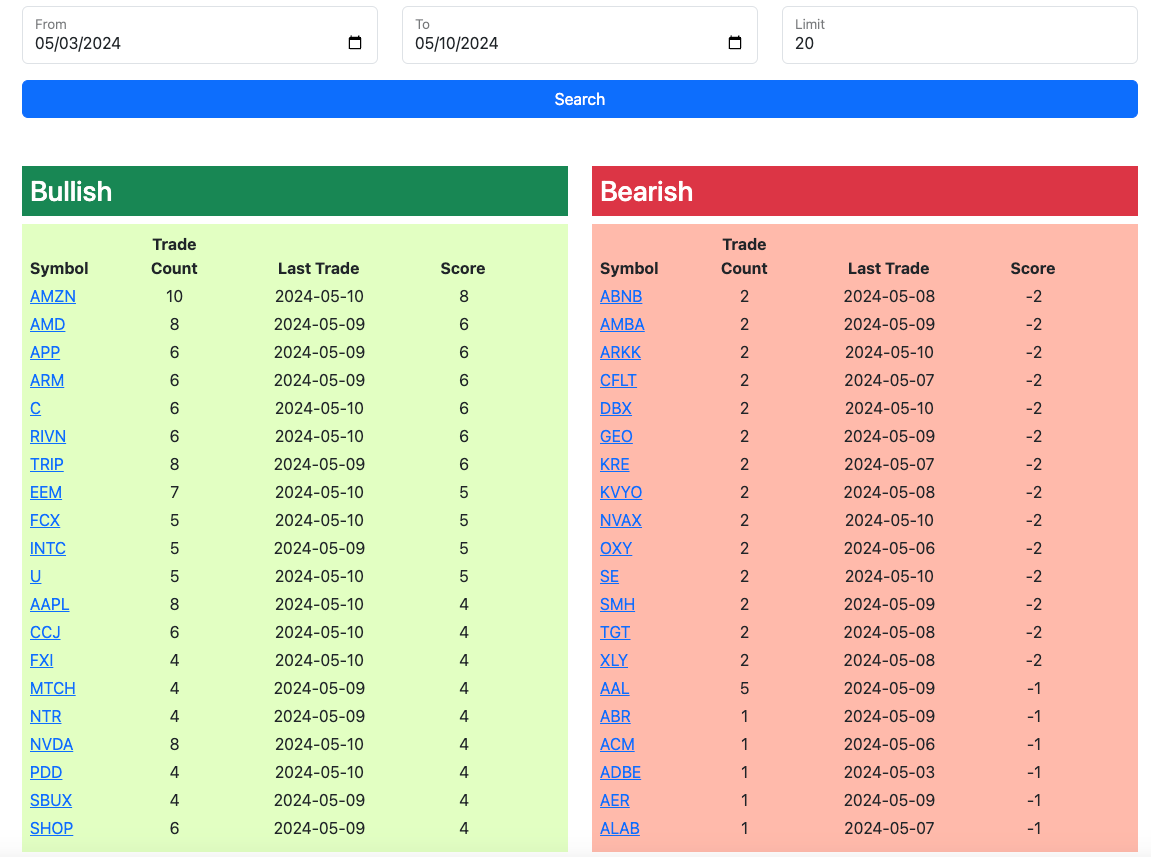

1 Week

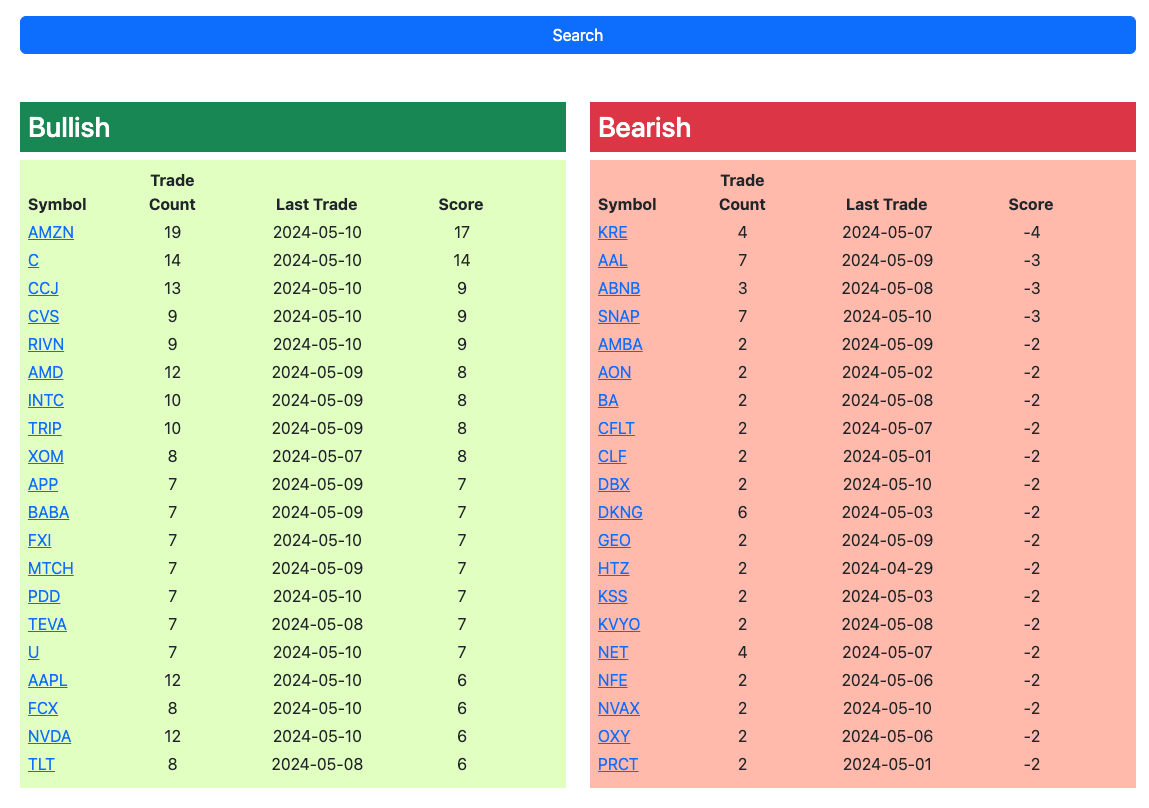

2 Week

1 Month

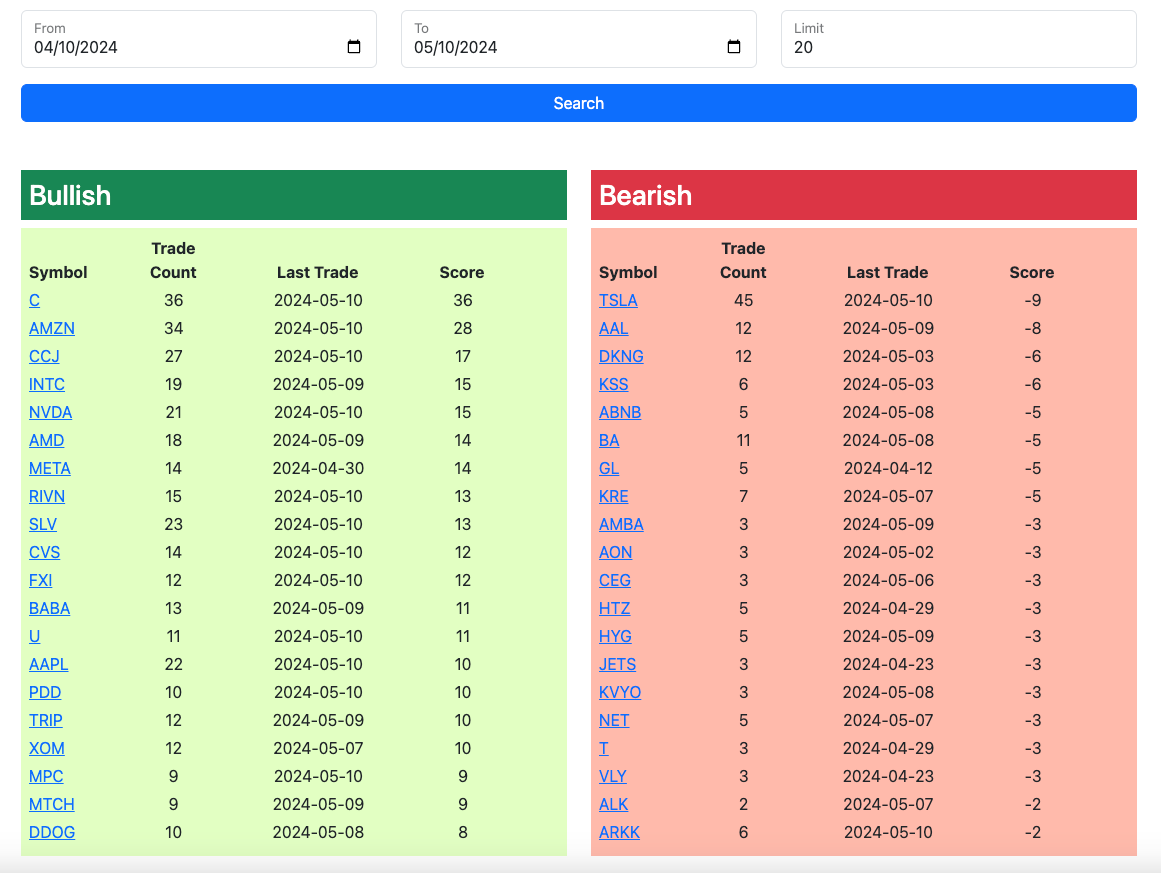

Today’s Unusual Options Activity

Here is today’s link to the database, it will be all weekend until the open monday morning. I will have the rest of this afternoon’s trades added throughout the rest of the session so check back below for the updated trades and trends.