5/15 Recap.

We woke up this morning to some more data that was beyond pitiful. Empire manufacturing missed by a mile, the forecast was -3.7 and we came in at -31.8. I really can’t recall one datapoint in months that didn’t say we were in a recession, but again, the market continues to ignore it all as it is “priced in” at 20x earnings.

Look at this move today. We flushed at the open and then rallied hard. Does that sound like a pretty common theme recently?

That’s because it is, we’ve done the same thing 4 days in a row and actually many more times over the last 3 weeks. We keep dumping and then we get some headline that pushes us higher. Today it was Biden and McCarthy meeting tomorrow for the debt ceiling.

Looking at the daily below, we continue to flirt with pain, that is 5 days in a row we’ve tested below the 8 ema, a sign of weakness, and every dip resolves higher. For me, I’m utilizing a hedge, I will go over it below and I will stop out over that recent high candle if we close up there. All I know is that everything I’ve ever learned regarding trading, trend lines, and how they all work together, has gone out the window this in regards to the short side. That is why I mostly dabble in selling puts, stocks just go up and to the right the bulk of the time, there’s always some pyramid below stocks and even the dips are instantly buying opportunities. I still am looking for 1 VIX panic move on the debt ceiling stuff, maybe fill that gap at 396 and that is it.

Trends

I don’t know if you remember SRPT but I mentioned it a few times recently, it was seeing all that bullish flow I noted, well today it is up 29% as I typed this. I mentioned this in the 5/5 Recap

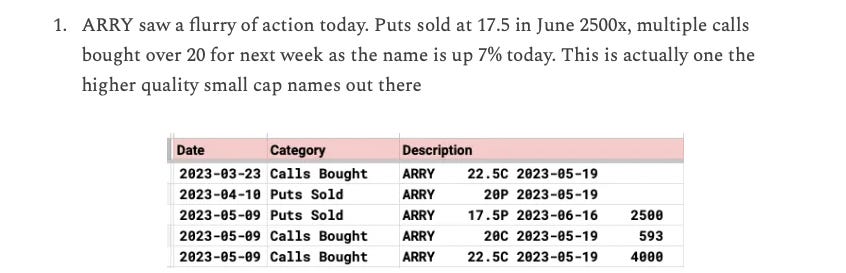

And last week I noted ARRY and that’s another name that’s up over 20% in a week since earnings. These unusual flows aren’t an exact science, but there are gems in there amongst all the hedges.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity & What Stood Out

104 Trades Today