5/15 Recap

Before I get into the charts today, I had this flurry of new people over the last 2 weeks and there are just so many questions so let me explain the goal here. I’ve told you all many times, the names that I highlight everyday are where I think all the alpha is in the market. If you focus on these with commons, short puts, calls, you will do fantastic. I know there’s lots of other services that simply show option flow, I’m biased but I think I have about as good of a knack as anyone at sifting through all the option flows and knowing which ones to highlight to simplify your lives. You want some crazy stats? Look at the spreadsheet below where discord user Luckmaster tracks the 5 names I highlight everyday, we’re now 4.5 months into the year and 77 of the names I’ve highlighted this year are up over 15% in those 4.5 months, on the far left you can see how many days its been since I wrote it up and you can see the date to confirm in the recaps I wrote up. I try to give you trade ideas with all of these, but a simple strategy of just buying commons would have yielded some very big returns.

I’ve now highlighted 361 trades this year in his data and 77 are up 15%+ from the time they were highlighted. That is over 21% that have gone for an outsized move. So focus on those and you will get the absolute most of this.

Even look at random names like Sleep Number I highlighted 2 days ago, it is up over 5% since, or Cushman Wakefield, below, last week I highlighted it on 5/7 and it is up 11% since. That’s not the kind of name that moves like that, it is a commercial realty company. There was not a single other trade in my data on that one. That’s just the order flow of the market, big players, make big bets, you see it in the options flow before a move up. In the megacaps it is tough bc so much option flow comes in both directions, it really is an efficient market so to speak with those. The smaller names I try to highlight are very inefficient and that is why you see such big gains in these random tickers that just see 1 trade.

CPI came in cool, retail sales numbers were bad but the SPY,below, is breaking out to new highs, it is official, that breakdown we had a month ago is officially over. We are now in blue skies above territory. We’re over all the short term moving averages and as long as we’re over the 21 ema, things are ok, we’ve now been over it for the last 9 sessions. The VIX is below 13, the fear is over, as far as stocks go. All the megacaps except NVDA have reported and everyone has been positive, even Apple with negative numbers was positive with the massive buyback they unleashed. Again it is important to remember, stocks are not the economy. Over 30% of the S&P is 6 companies, those 6 do not represent 30% of our economy, it is important to accept that reality when economic data continues to be mediocre to bad. Those 6 companies are unstoppable and as long as they can continue to buyback shares and push their equities higher, there isn’t much in the way of the market. When those companies go down, you get a down year in the market like 2022, but in normal times, they print money, they all buyback stock, except Amazon, and basically put a floor under our market.

The dollar, below, continues to breakdown and that’s a much bigger story, but for now, weak dollar means stocks up and all is well in the world of equities.

Recent Trades

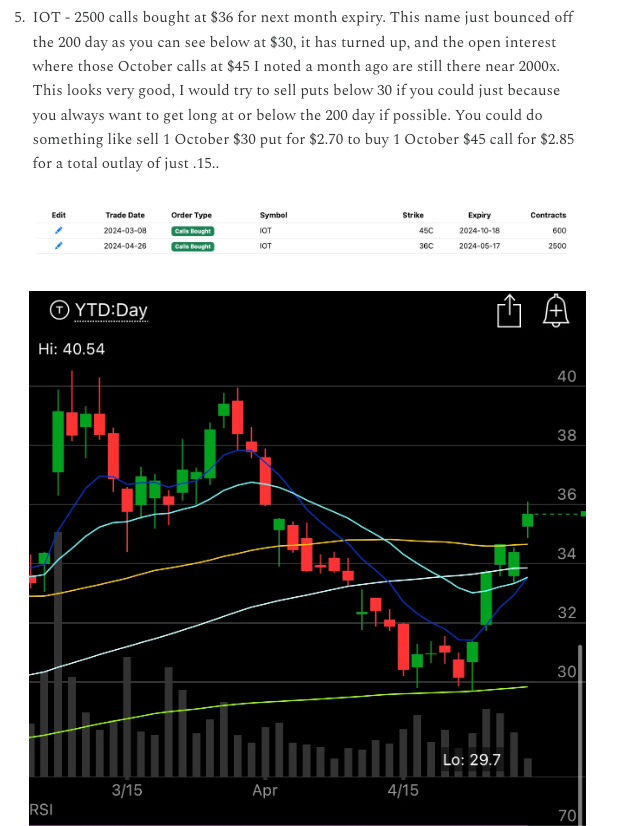

IOT - In the 4/26 recap I highlighted these calls below, the name is up 16% since to nearly 42. The risk reversal I drew up below, the short puts are up 50% and the long calls are up 100% with 5 months to go.

FOUR

As you all know I took a position in this in the past month, yesterday the CEO bought 85,000 shares and today the stock is up almost 8% to $70. That risk reversal below has played out nicely with the name up 16% from this post below on 5/7. I don’t add positions often and when I do sometimes it doesn’t work the next day. You all saw this last year with CVE where it went from 16 to 14 and panic ensued in the discord and ultimately it was nearly $22 a month ago. I’m trying to catch big moves on common, but I’m very honest with you on my thesis and you just have to be patient sometimes. We’re lucky FOUR worked out so quickly and the CEO buying is always a great sign. This remains a hold under 70 and it still remains a takeover candidate at levels over $100 according to the company as of last week.

Trends

1 Week

2 Week

1 Month

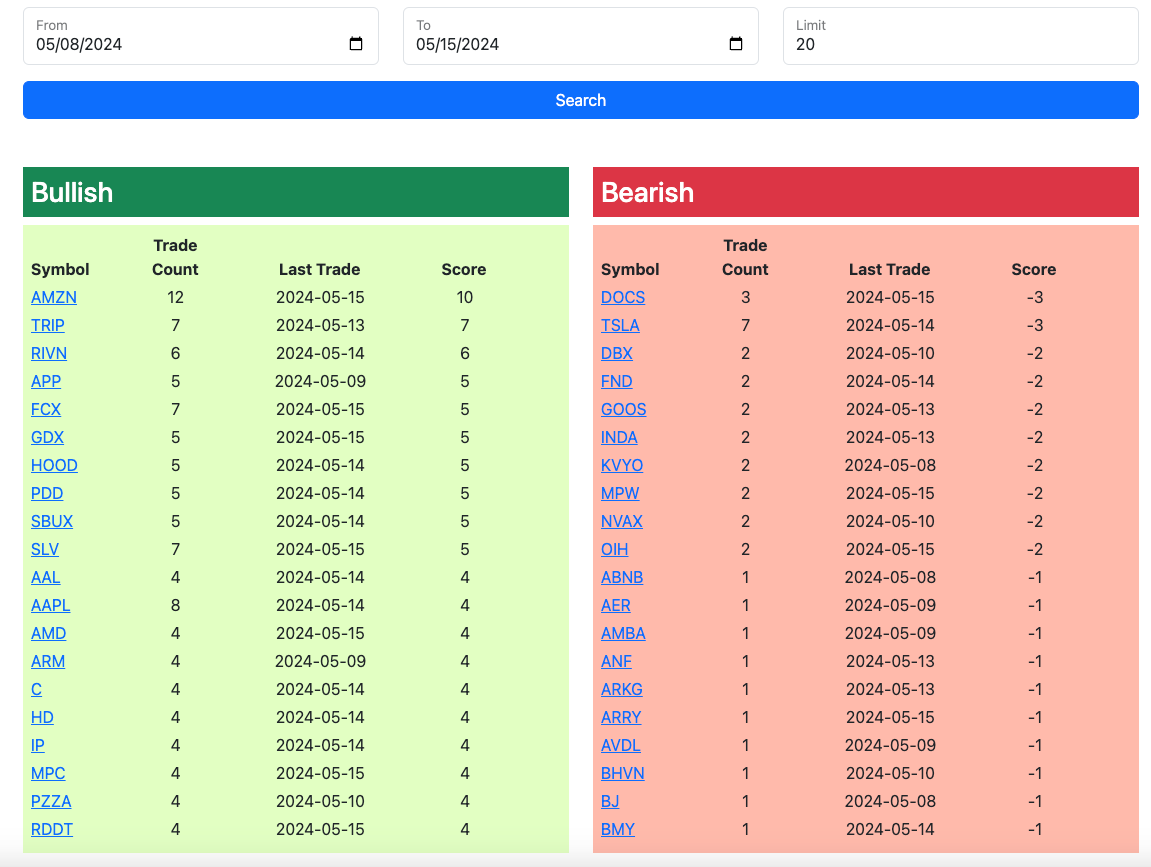

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow morning at the open for everyone not in the live tier. I will have the rest of today’s trades added throughout the afternoon so check back later on the app for the updates.