5/16 Recap

The SPY continues to drift higher, you have to believe soon it will pull back to that 8 ema as it always seems to but it has been 10 days since it touched the 8 ema, incredible strength and it is broadening as tech isn’t doing all the lifting this time. We are hitting max overbought levels on the rsi now so just another small thing to watch out for as far as a small pullback is concerned.

I think what you’re going to see from here is more normalcy. The big moves of the last 3 years down in 2020, up big in 2020, down big in 2022, and then up big again in 2023 are mostly over. We had a lot of uncertainties over those years and now all the big moves in megacaps have been had. From here names will probably grow inline with earnings growth, which is completely normal. What isn’t normal is those outsized moves we’ve had the last few years.

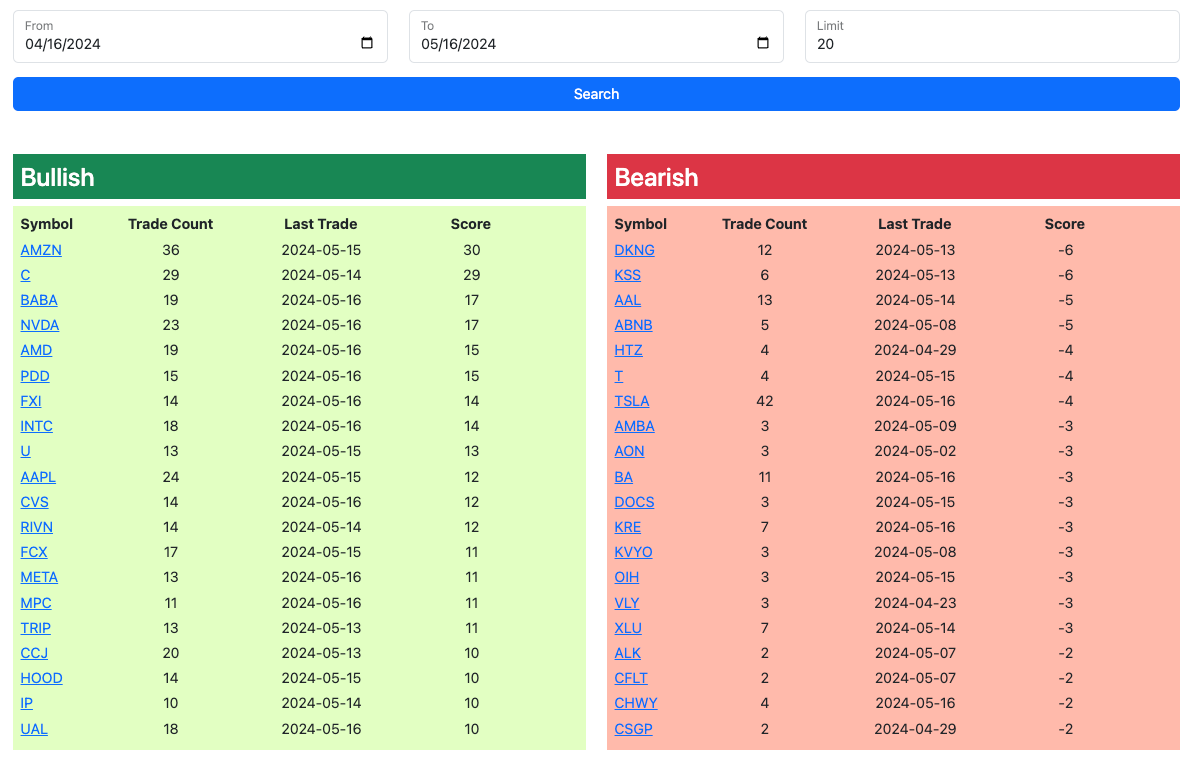

So for the moment the big trade everyone is piling into appears to be China, we’ve seen those flows in here for a long time. Yesterday alot of fund managers disclosed big positions in China and if you can stomach it, alot of those names are dirt cheap. The issue with China was always more that everything basically trades on the whims of a dictator and nothing from option flow to charts to fundamentals matters. When Xi singlehandedly crashed Alibaba a couple years ago by disappearing Jack Ma, you got all you need to know about investing in China. As a trade, from what I’m seeing, and there was a ton today, that looks like where you want to be playing right now. I don’t think it is wise to deploy much capital there because anything can happen, but if you’re feeling brave, go for it. FXI and KWEB are there 2 big ETF and those have seen inflows forever, look at the massive trades in my database. Money just rotates around to what is undervalued and right now, American megacaps are still the best assets in the world, but they’re mostly fairly valued for now until each passing quarter where they report bigger and bigger numbers.

As for Amazon, I got alot of emails this week regarding it lagging. Look, Amazon is up over 20% YTD, it is outpacing the market by alot. The big issue with Amazon is management has been horrible for years and once again this week in a major way. The job of good management is to make sure the story is clean and no question marks exist. Amazon has question marks galore now. You have leaked Bezos emails asking where the customers are on AWS regarding AI, you have the AWS CEO “resigning” the day before that with a nonsensical explanation which now looks like he was fired, and you have open ended capex spend, a big no no when you overspent on warehouses in 2021. Doesn’t it worry you to see the chairman sit on his yacht completely out of the loop and now question the growth in AI when they’re spending record capex on AI?

Investors now have concerns that management seems a bit aloof, can you blame them? I’m not adjusting my position yet because this is all speculation for now, and Google/Apple both underperformed early in the year and are now leading. I still believe nothing has more potential than Amazon. There’s always a rotation in megacaps and Amazon is unfortunately caught up in one for now until management clears up some things which likely won’t happen now until the next call in July. The stock is likely weak for a bit, definitely not a buy until it gets a weekly close over 190 which is a breakout. No sense in deploying new money in the next $4 range if you want my opinion. We’ve caught 95% of the big move to this point over the last 12 months, the next big move begins over 190. Just my honest take and I still think it probably ends the year where I’ve always said 220 or so assuming management clears things up.

Recent Trades

ARWR - I highlighted this 2 sessions back in the 5/14 recap and the name is up 9% since, those calls are up around 35% now and I would cash these in if you have them. These biotechs mostly all seem like trading instruments and nothing more, this was one where if you caught on after this player had this big trade you made some money quickly and should probably exit.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires tomorrow at the open and I will have the rest of today’s trades added by the afternoon