5/19 Best Idea For The Week Ahead

We closed last week at new highs on the SPY. There is just nothing bearish here, that breakdown we had in April went down, look at the perfect test of the 21 ema weekly and an immediate recovery and move higher. This week NVDA reports and that will have a major impact on many sectors but overall as long as you’re over the 8 ema(the dark blue line) there isn’t much to say other than be long. When that trend breaks, you lighten up/go short/whatever you want. This breakdown was by far the shortest one we’ve encountered in the past few years. Even at the time of the breakdown I told you to just lighten up short term positions but do not change your long term positioning because the reality is markets always recover, they have for nearly 200 years, why would this time be any different?

Before I get into this week’s best idea, I want to say that I’ve gotten feedback from so many of you and you want me to pick cheaper stocks to highlight simply because it is hard for alot of you to sell puts when stocks get pricey and while I hear that, I really have to focus on what the best setups are, I can’t just pick cheap stocks for the sake of it.

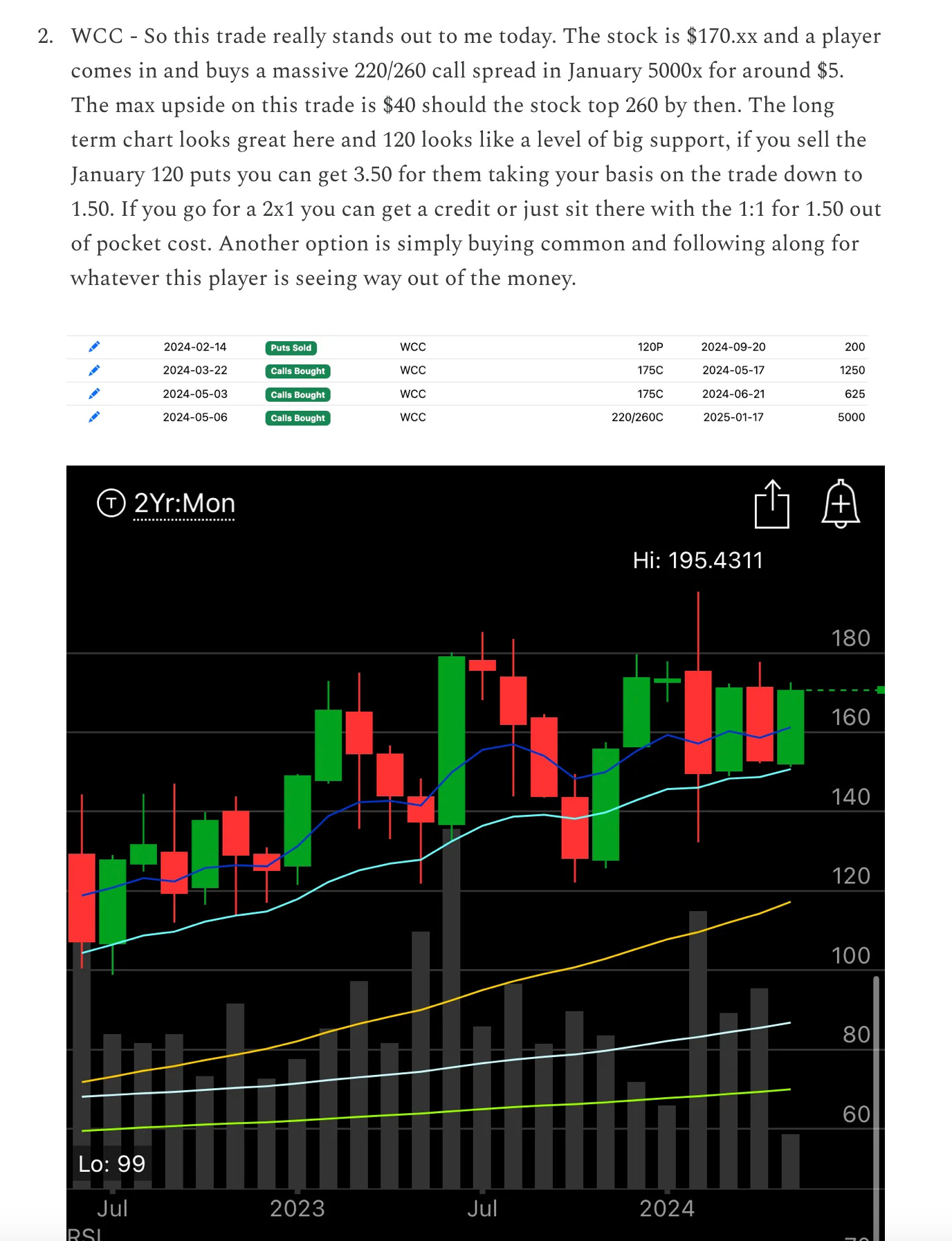

So with that said, my true best idea this week is WCC, I won’t go into more details on it, but there alot more trades added to the database since I marked the trade below on 5/6. The stock is up almost 10% since then to 185+. I think this probably still runs materially higher with those 220/260 calls out in January and I highlighted how to play it below. If you’re still in that trade, congrats. I think even commons are a solid buy here, still, with the direction of the flow.

With that out of the way, the best idea for this week is part of an emerging theme that is just booming right now and this breakout has been a long time coming with alot of upside potential left. I’m going to highlight a conservative way to attack it and a super aggressive way, take your pick.