5/2 Recap

I wanted to get this out a little early because it is storming here and I didn’t want the power to go out on me. First off, sorry for yesterday, I’ve been doing this for almost 2 years now and I was surprised it took so long to finally have an issue. That was why I did not want to share my database all this time until January when I finally did. I woke up yesterday morning to like 30 unsubscribes and I usually have maybe 1 or 2 a week, I figured well Amazon had a bad reaction, everyone hates me.

It turns out there was a link to a duplicate of this substack inside the discord. So, I had to spend some time yesterday to make sure the clone of this was taken down, it was a nuisance more than anything else but it is taken care of now. Again I get emails from you all about other substacks using my charts and options data and I don’t really care about any of that because at the end of the day all this stuff is public data, sure I have my own parameters to cut through the junk, but I just pull it together and organize it, that is nothing special.

What I do care about is when people take my trade ideas word for word and post them elsewhere because I take alot of time and effort organizing this data and looking over charts to highlight ideas. You see how many of those trade ideas work very quickly in the recent trades section I post everyday. There’s countless services that just sell options data, I built this place into thousands of daily readers around my ability to not only find these little hidden gems but share my insights on how to actually use that information to make successful trades using charts and various options strategies.

Today

The SPY remains very weak below the 8 ema, this just isn’t a bullish setup in the market, Apple is likely our last chance to save this today or we have a little more weakness. If Apple does get a big move higher, considering its weighting, it likely lifts everything up and we could potentially be looking at a bullish crossover again.

Yesterday we had some big movers in some relatively tame names with SBUX and CVS both down 16%. Those sent shockwaves through the minds of investors in other “safe” stocks. CVS especially had been a “cheap” name, but it broke the 200 month moving average yesterday, that means it is basically below its average price of the last 20 years, that is some serious technical damage.

This has been an awful year so far for consumer names. Aside from those 2 NKE,LULU,MCD,TSLA pretty much everything in the XLY outside Amazon and Chipotle have been hammered this year. Even names like Netflix and Doordash that were up alot this year have given back much of it. The warning signs are everywhere that the consumer is just not doing well you even saw the slowest quarter in Amazon’s 3rd party business in a long time in terms of growth. This is a developing story we need to watch in the coming weeks.

Recent Trades

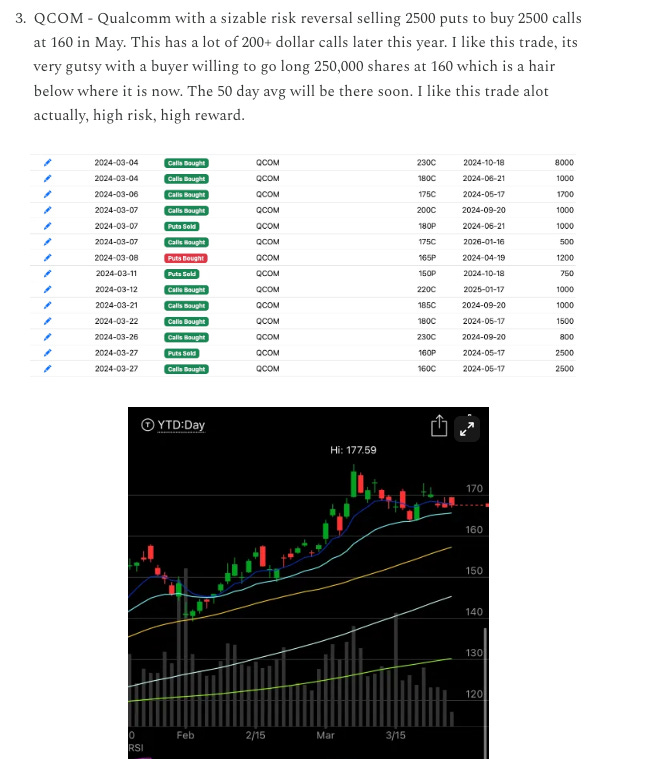

There’s a few to discuss today, let’s start with the big one QCOM, Qualcomm is up almost 10% today. On 3/27 I highlighted a big trade on it expiring in 2 weeks, the player put on a synthetic at 160 and today with the name 179 that is up a fortune.

Another one I highlighted recently was ZTS just a couple sessions back on 4-29. There was a sizable risk reversal in May and today it is up 7% on a very strong quarter. These risk reversals remain my favorite trade because when players are taking the massive double sided risk, they usually are doing so because they have an edge.

Lastly SFM, this was one I highlighted on 4-26 it was breaking out of a nice weekly base and someone stepped in selling 1000 puts for September at 60, it is up 15% today to just under $74. Monster move for a grocery store chain.

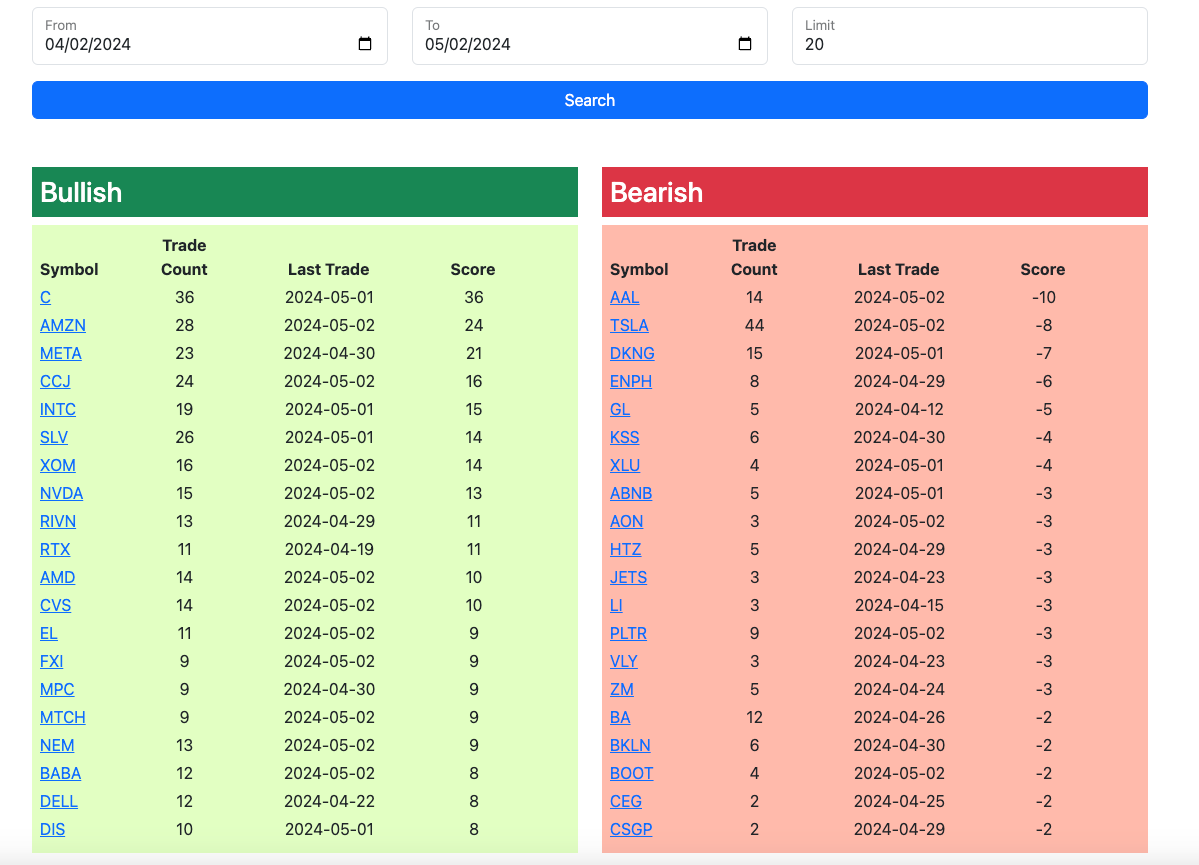

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database and I will have the rest of the days action posted by tonight.