5/20 Recap

We continue this slow melt up in the market today. Impressive strength, we haven’t touched the 8 ema on the SPY in 12 sessions, that is just remarkable coming out of that small 3 week breakdown we just had. This market looks fantastic right now. If NVDA has a strong reaction this week, I’m not sure what the next catalyst to slow it down is. This morning you had Mike Wilson at Morgan Stanley who was the biggest bear on the street for years just give up and say stocks were going higher after a multi year call for stocks to go lower. You now have clear support lower at the 100 day to sell puts at just over 500..

Recent Trades

WIX - Up 25% so far today. I wrote this up in the March 12 recap, at the time someone had bought a huge lot of 145/175 calls for $9, those calls are now up over 100% at $18+ each. Back to my post from this weekend about utilizing risk reversals, had you used the one below that I mentioned, those are up nearly 10x right now from $2 to $18+. Thats just the power of leveraging into the right direction on a bet.

Trends

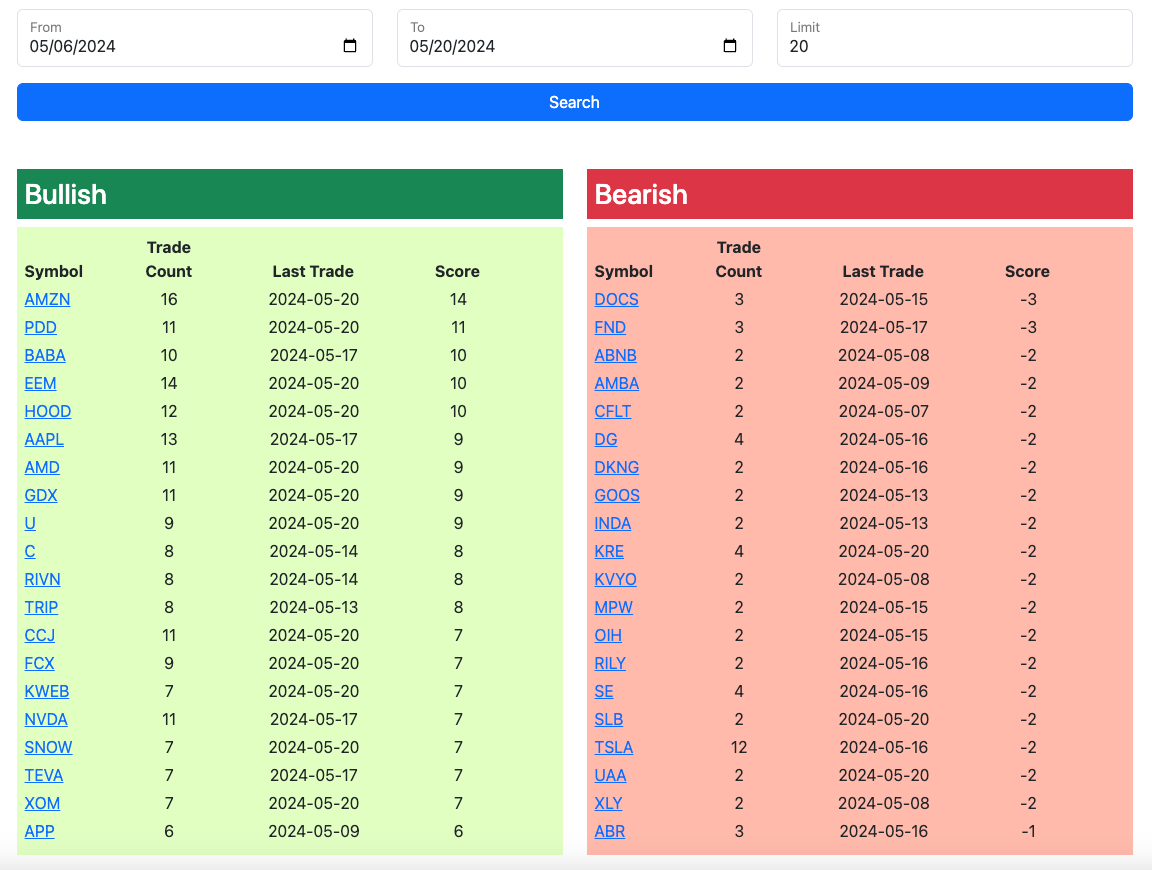

1 Week

2 Week

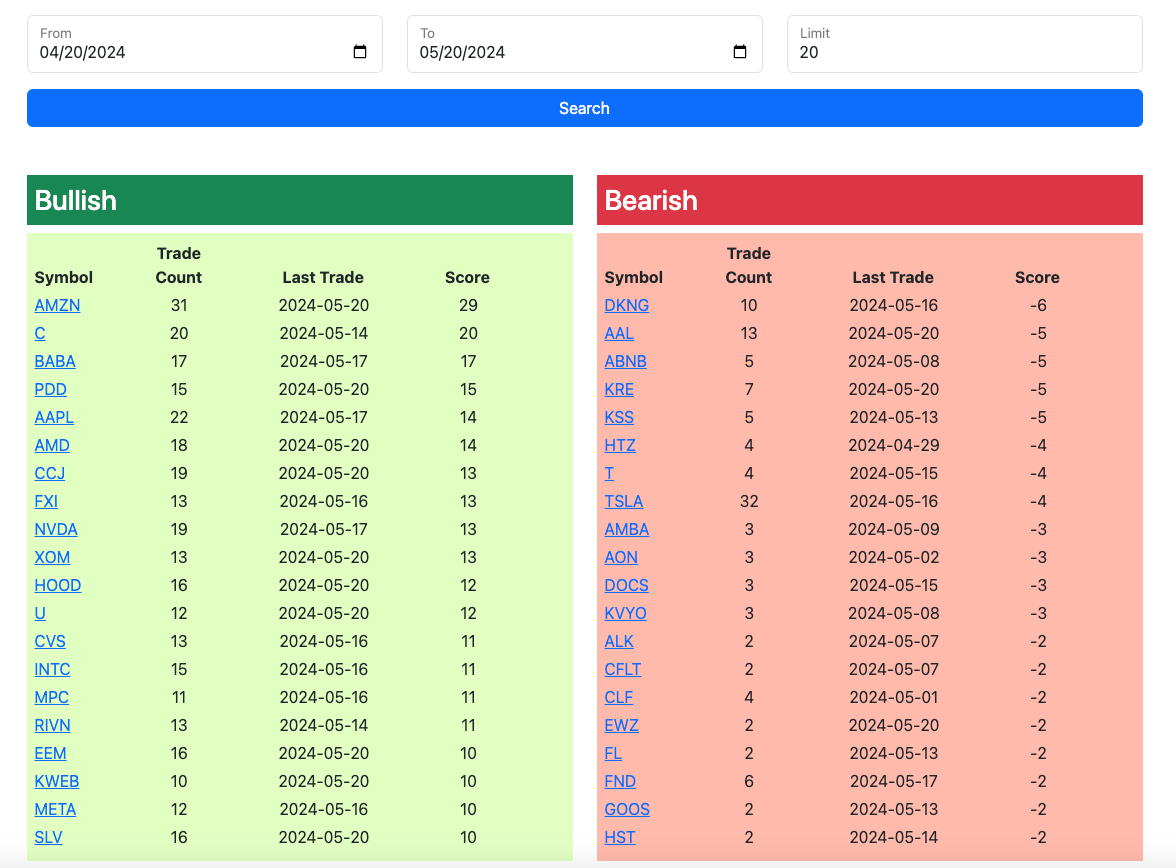

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always this will expire tomorrow morning at the open. I will have the rest of today’s action added throughout the afternoon. Again the graphic below doesn’t fit everything so the link below is always best to check all the trades.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.