5/21 Recap

Another sideways day well above the 8 ema, the whole market is waiting for NVDA tomorrow. My early feeling is that NVDA earnings will be fine, I’ve seen alot of at the money put sales the last 2 days and that isn’t really what you see when a name is about to crumble. Again the put sellers tend to be the sharper players in my experience. Who wants to take on the obligation of buying a ton of NVDA at 950 if you think it’s going to 850 tomorrow? Even today NVDA reversed that big red open and went green. Obviously earnings can change things but with the premiums involved the stock could drop 3-4% and those put sellers are fine, but overall they’re not scared of a big move lower. I wouldn’t expect much tomorrow from the market before that report, afterwards you’re going to see some big moves.

Recent Trades

In yesterday’s recap I didn’t highlight it but you can see in the table the big weekly call buy on LRCX, I thought that was a play on NVDA earnings so I didn’t highlight it even though weekly trades catch my eye usually, this morning they announced a split and the stock gapped up over 970 and those calls were up huge at the open.

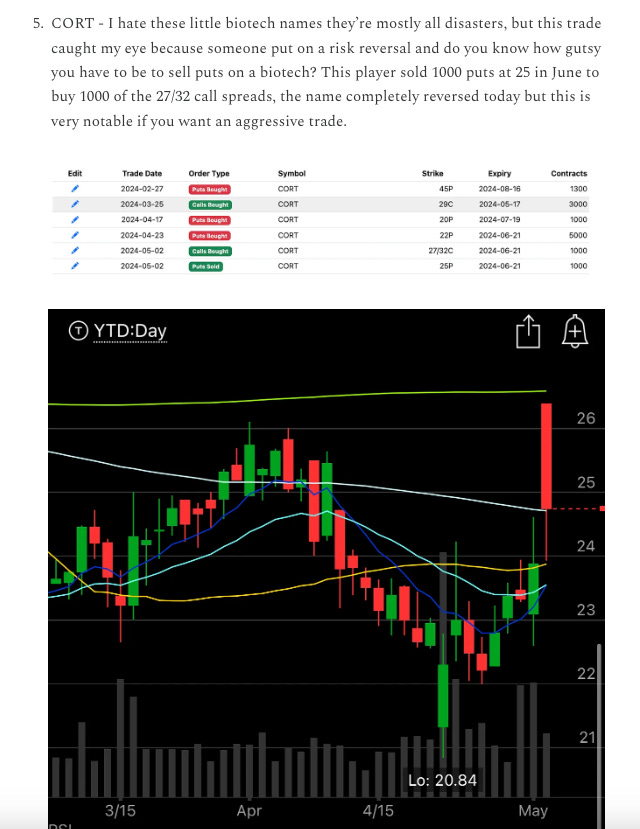

The one I want to highlight is from the 5/2 recap I noted this smaller biotech company CORT and I specifically said the trade was so odd because the player used a risk reversal on a name with no volume. Again I dont trade biotechs but most seem to have that bad day and go -80%, not exactly they kind of instrument you want to be selling puts into. So when this player put that on, it caught my eye. Cort has gone from 24.xx to nearly 29 for a 16% return in less than 3 weeks. Impressive trade and I would say if you ever see puts sold on a biotech in size, follow them, because the person putting it on is nuts and likely has a reason to do so.

Trends

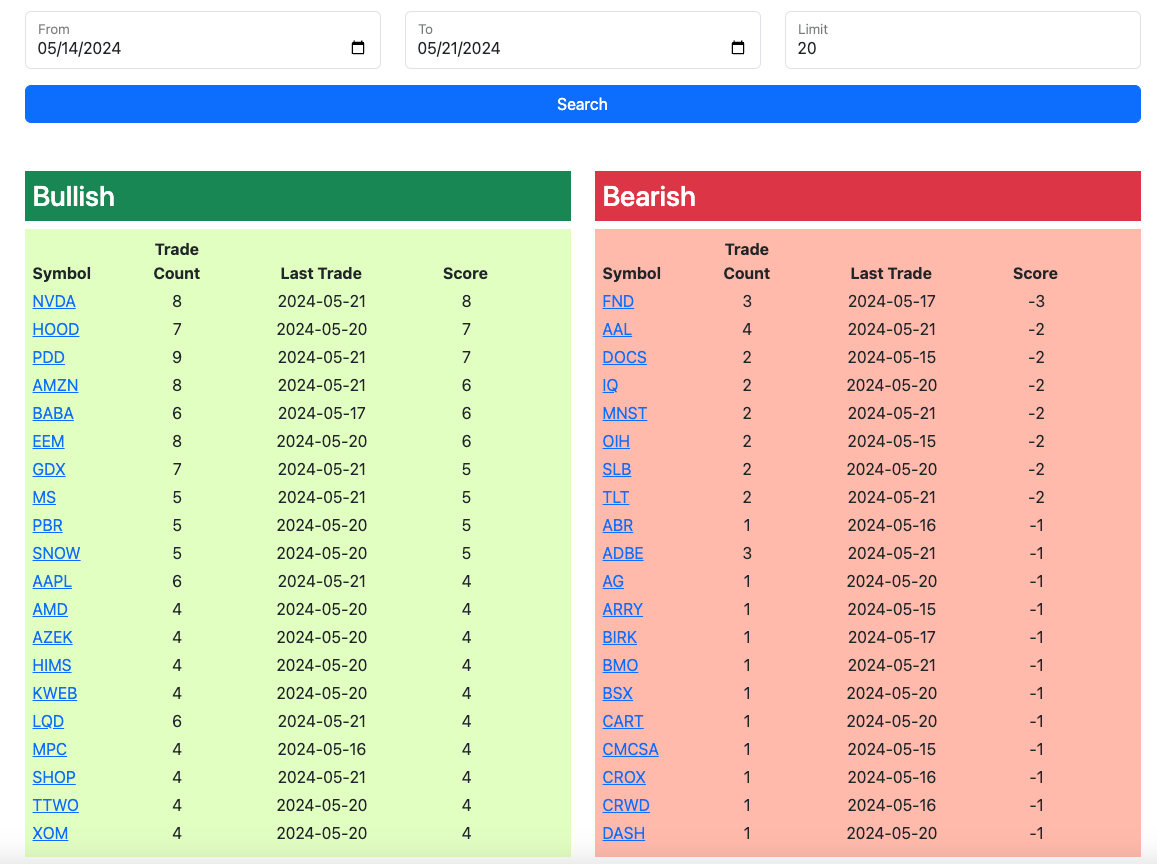

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow morning at the open and I will have the rest of today’s action added throughout the afternoon.