5/21/25 Recap

The SPY is rolling over now into that 8 ema, it needs to hold and bounce off that dark blue line or the door is open for a move lower to that cluster of support at 575. Again we have a long weekend coming up, alot of people are going to be taking profits into that. That 575 level just looks like a massive level of support and I think you can sell puts into next week there and try to get long at the 100 and 200 day and the 21 day should be through there shortly. 575 next week friday on May 30th are 1.43 right now, you could sell a 575/570 put spread for next friday for .52 risking 4.48 for an 11% return in around a week with the SPY at 591.80 right now.

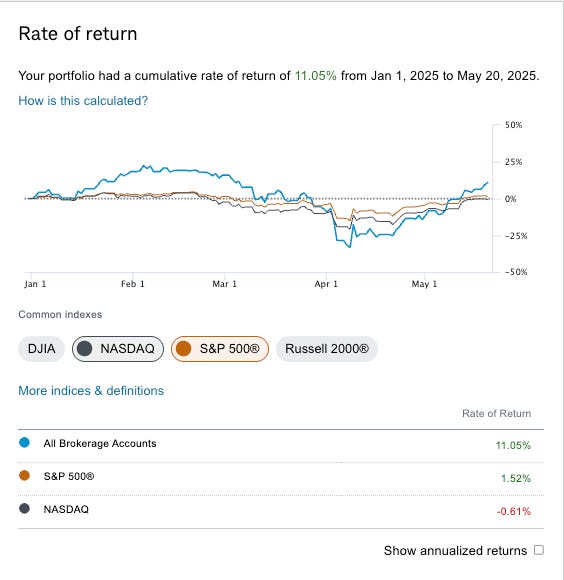

This has been quite the rally the last 45 days or so, if you want to take some or alot off, nobody is going to fault you. I know for me this has been a rollercoaster year. I started off with that huge outperformance in the early part of the year with that big META risk reversal trade I put on and even though I timed the exit on that and AMZN leaps well, I had too much leverage on and flipped deeply negative with that sharp downturn that caught me offguard in just 4 sessions. I’ve rallied back to +11% on the year before today’s gains with the Nasdaq red on the year so I can’t really complain. This time around I’m going to be disciplined and if the market loses trend like it did earlier this year I won’t stick around with the notion Trump cares about stocks like he did his first term. I learned that lesson in April so I’m just keepin a tight leash on my positions now and the 21 ema on the SPY is trending up just under 575 now, the next break of it, I’m exiting everything and not partaking in continued trade war shenanigans.

My Open Book