5/22/25 Recap

The SPY broke the 8 ema yesterday, that was your first warning sign of weakness, which is why I closed up alot of my longs and sent out that 2nd substack note yesterday. Today we went back up and perfectly got rejected on the underside of that 8 ema. So here is your second warning sign, again we’ve had a fantastic 45 days, stocks don’t have to go up in a straight line and right now you can see the macd rolling over and if I had to guess we test that 575 level where all those moving averages are converging right now. If we hold that, things are fine, if we don’t then you really need to derisk more. The big beautiful bill passed this morning and all you need to know is the bond market and yields hit new highs. We are having some frothy moves like WOLF filing bankruptcy and up 30% today or AAP missing earnings and up 60% today. None of this is healthy and the worst names in our market flying while the SPY rejects the 8 day is just uninspiring action.

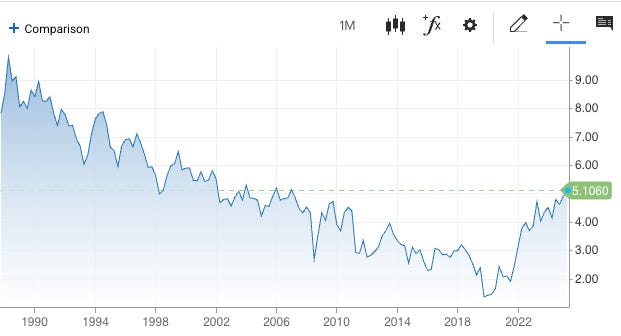

Speaking of bonds and what concerned me with yesterday’s auction is this below, if this was a stock chart, you would be buying it. The issue is, this is the 30 year and it is hitting levels we have not hit since 2007, 5.1% right now. The bond market is not at all happy with Trump and his spending or tariffs, yields have been soaring for a month. In a nation where borrowing is as important as it is for us, rates like this are crippling with home prices, car prices, etc all at record highs. Will it show up tomorrow? Probably not, but in 12 months? Most likely. So that is your answer to why I pulled back on my risk yesterday, I’m happy to be up 10% this year and now I can focus on selling puts lower since I’m not too comfortable with things.

My Open Book

I sold GOOG Jan 140 puts 400x, this is the hottest name the last 2 sessions and whatever happens with the market this should outperform. I had some other weekly trades I closed up for a profit because I’m not liking the 8 ema rejections.

I sold IBIT 55P for January 1500x, yes I exited my position yesterday but that’s because I don’t like the overall market, bitcoin continues to lead and I think will run into Bitcoin 2025 next weekend. If I can get back in over 10% lower than I sold it, great, if I can’t, I make almost $6/share. So I made alot of money with bitcoin the last month, I think it goes higher, if it does I will still do well without being long. If it stalls out, I will also do well getting long with a basis of 49 in January.