5/23 Recap

An orderly pullback so far to the 8 ema on the SPY. Nothing overly bearish, just normal pullback within an uptrend move. Until we see some closes below 412.5 I wouldn’t be too bearish. The meetings are still ongoing within our government and the truth is nobody knows what will happen, we are all pawns in this silly political game both sides play. Obviously cuts need to be made, but nobody can agree to what it is that needs to go. In the end, I think most believe we will have some panic here and there but ultimately a deal is made at the last minute, as usually is the case.

The weekly on the SPY is stalling out at a key spot as you can se below. Short term this is going to be a big battleground at 4200 and until we decisively go through it, it will be a solid risk/reward place to put on shorts.

The dollar is now continuing its recent breakout which should continue to weigh on equities. The dollar will have stiff resistance up near that 105 level, but it can run a little more from here.

Trends

Some of these longer term trends are finally playing out. Schwab was at multi week highs today. Uber nearly hit $40 in the premarket. Amazon dominated the last 2 days option flows and it’s relative performance today isn’t that surprising, there were a couple very large trades today that I have more on down below. AMD continues to also outperform being green in today’s tape. ALB another one that was my best idea last week that also continues outperforming in this weak tape up 5% in today’s session.

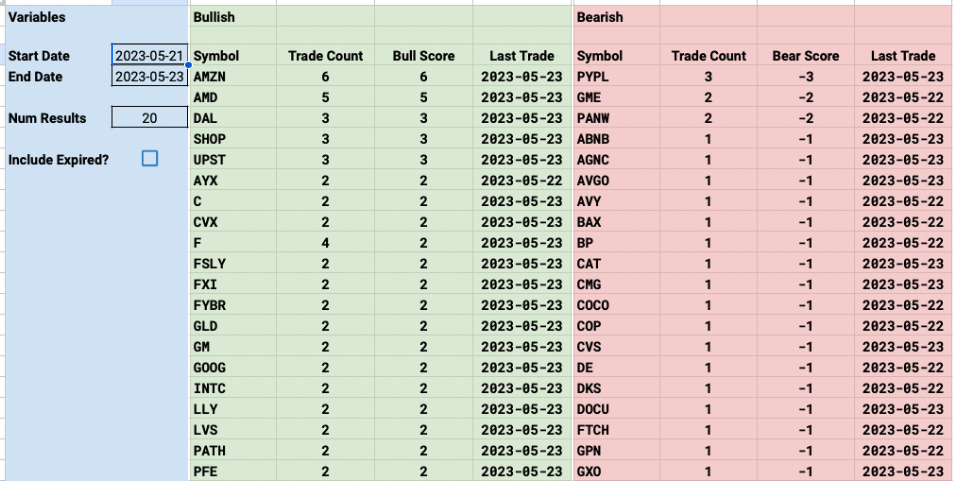

Week To Date

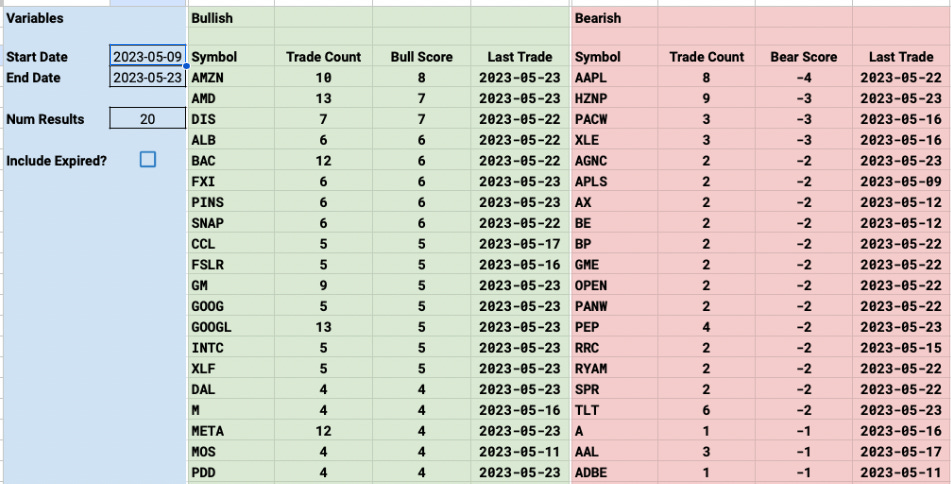

2 Week

1 Month

2 Month

Today’s Unusual Options Activity & What Stood Out

123 Trades