5/23 Recap

Well NVDA earnings are out of the way and they were great with the stock soaring over 11% today. I mentioned the other day that NVDA wasn’t really concerning me because I was seeing at the money put sales and most people would never take a risk like that unless they felt the probability of working out was high. In the end it did go perfectly. NVDA has been one of the top trending names in my rankings everyday and all but 2 of the big lots I noted in the last month were bullish. It’s now up $100+ on the day.

As for the overall market, everything else not named NVDA is red today. Moreover, we are putting in a nasty bearish engulfing candle today. While we’re still technically in this flag sideways, you never like to see the market open high and reverse lower all day. It’s early still but we need to see where this closes today. We’re toying with losing the 8 ema for the first time in a while. You can see the yellow arrow I drew where momentum has been declining and a bearish divergence is forming. With all the megacaps out of the way now, the question to ask is, what is the next catalyst for this market?

Recent Trades

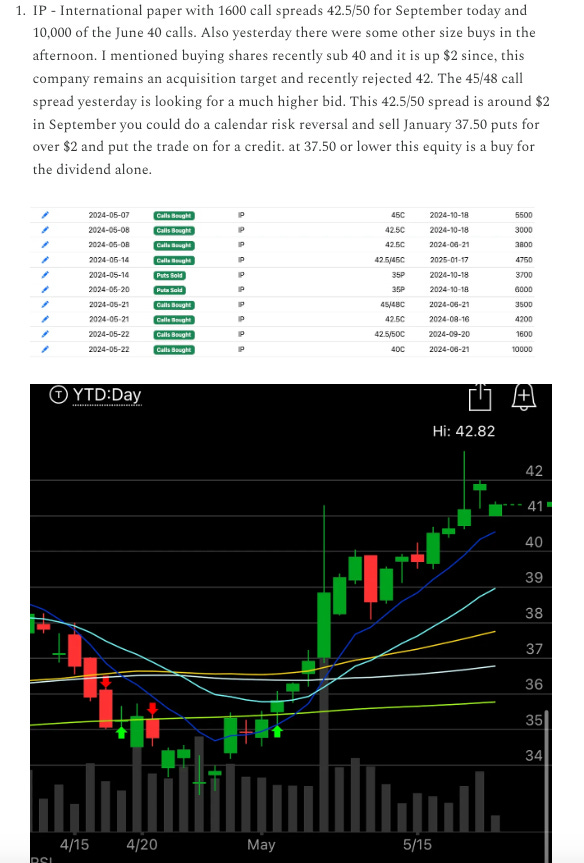

IP - up 4.5% so far today. I highlighted this in yesterday’s recap after a couple big buys came in. This morning Jeffries also upgraded it to $57. This remains one of my favorite under the radar long opportunities. You see almost nobody on fintwit discussing this name. It remains uncanny how the big call buys come in right before this huge upgrade.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow at the open and the rest of today’s trades will be added by this afternoon