5/29 Charts Of Interest For The Week Ahead

Since there aren’t any notable earnings this week, I wanted to post some chart setups that look good. Typically I try to look for strong charts and sell puts below recent lows and use those as a stopping point. As long as recent lows aren’t taken out, names are typically fine for continuation.

KRE - the regional bank ETF has had it’s issues the last few months and likely still has a landmine or two ahead, but it appears to be bottoming out and the RSI is coming out of oversold levels. I think selling puts at the recent lows 34.52 and lower is ok, as long as those lows aren’t taken out, this should be alright, there is a big capitulation candle at the lows, look at the volume.

SCHW - Schwab has a similar chart to the KRE emerging from oversold territory, it had it’s first weekly close over the 8 since February. This name has seen lots of insider buys and option flows targeting $70+ in the next few months. Another name where you can sell puts at the recent lows of 45 and as long as those hold you are ok.

GS - One of the stronger financial names, you can see a clearly defined higher low that formed on the chart and the RSI. Another name that looks set for a run in the weeks ahead if the worst of the banking news is behind us. That is a big if.

BBY - Best Buy had a great reaction to earnings last week and is a candidate to drift for the coming quarter. It also just closed over the 8 week and has emerging strength. Selling puts below 68.43 and holding them as long as that holds is ok.

IBKR - Interactive Brokers is very close to breaking a long downtrend it has been mired in since March when the financials began having headwinds. The RSI is curling up and it just closed over a cluster of moving averages.

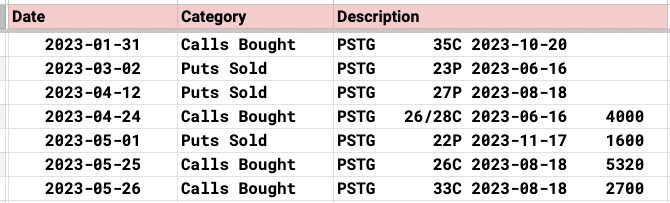

PSTG - Pure Storage has had an incredible 3 weeks bouncing off the 200 and fixing alot of technical damage. This name has seen alot of bullish options flow for weeks in my database and last week saw calls all the way out at 33 bought in August. Look at the chart below, over 28 it can get going.

PYPL - This is a broken chart. I would not long this right now. I get lots of emails asking about this. It just broke a base it had been holding for a year, you can see it clearly below. Until it forms a new base, it’s just a do not touch, look how much relative weakness it has had in this recent rally we’ve seen.

PANW had a fantastic reaction to earnings breaking out to ATH, this name should continue to drift higher but selling puts below the gap formed this week should be alright as a place to stop. Security is going to be a big theme for a long time to come.

DELL - not really a name many follow but look at this strength the last few months. It’s closing over some big averages and at it’s highest levels on a weekly basis in over a year. This looks like one huge base breakout.

SHOP - Shopify has been on a tear since announcing they would dump their low margin high capex logistics business. This name has been relatively weak recently, but that’s normal after such a huge move up. It’s flagging and prepping for another move up when the moving averages catch up. Selling puts below the recent earnings gap is prudent.

I hope you all enjoy your holiday and I will see you tomorrow.

Thank you James enjoy your Memorial Day with your family.