5/3 Recap

The market staged a comeback this week with Amazon and Apple posting strong reactions. Apple actually had pretty terrible earnings if you want my opinion, revenue declined again, I believe 5 out of 6 quarters or something atrocious like that. They did announce a massive buyback at $110B and the reality is Apple is now in the phase where it is pulling an Autozone which is the end stage for all these megacaps. Did you know buybacks were just not a thing before the 1980s? They were just consider stock manipulation because the money wasn’t being used for innovating at the end of the day the goal of companies is to invest for the future not just artificially pump a stock, right?

If you look at AZO, below, you’d be hard-pressed to find a better performing stock the last 20 years. If you add in the fact of how mediocre the company is it makes it that much more impressive. Autozone has probably the greatest buyback in the history of the market, and Apple is now accepting reality that they are a company that although in decline they still make alot of money but have no interest in innovating anything with all their cash. The market is a simple game if your only goal is stock price, you make money and buyback stock, reduce the float, and EPS goes up. This causes your stock to just be permabid on its way higher like Autozone. Lack of financial engineering is what attracts me most to Amazon. With the size they are, with all they generate, they still don’t financially engineer shares like every other big company on earth. That alone makes their ascent even that more impressive when you consider Google is nearly the same market cap and has been gaming their stock for a decade. One day Amazon will and it will be epic, for now they have real things to invest in like warehouses, datacenters, driverless cars, robots, etc and Apple, like Autozone simply does not have anything interesting to focus on, so this is the plan.

Don’t think I’m saying its bad, in fact I think Apple goes up a ton from here. I just wish companies would focus more on building real things like Amazon is doing with all that cash and record capex. If your business is growing nicely and you aren’t being wasteful, the stock will go up on its own. Apple realizes business is not growing, so instead of trying to create new things and spur growth, they just want to save the stock with all their money. Considering how many shares they’ve bought back the last 2 years and where the stock sits today after that massive buyback announcement, you could say Apple has been a giant failure especially with where their share count sits today. Has anyone actually wasted more capital than them while creating less?

The SPY, below, is stuck right under the 50 day right now but is reclaiming the 21 ema today. This is an impressive move, I’d like to see the 8 ema crossover the 21 first before I say this weakness is over, but we’re very close another few strong closes and we might. If it gets back over that 50 day the market is back over all the moving averages for the first time since we broke down almost a month ago. The funny part is we’re doing this on some pretty atrocious job numbers this morning, the more people that lose their jobs the higher stocks go because everyone is front-running the fed having to cut rates because of how poor the economy is. Amazing.

Recent Trades

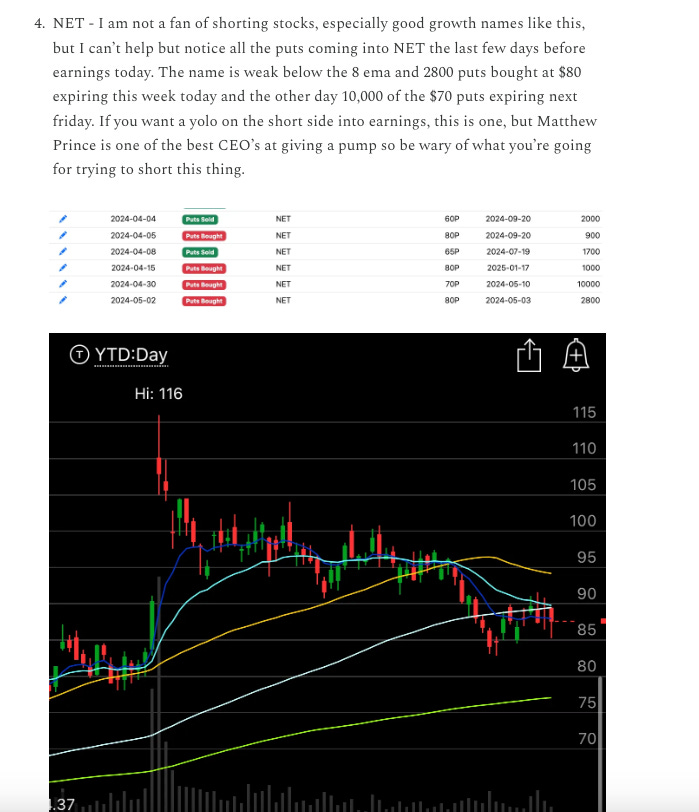

There’s so many to discuss when I look through my tracker I don’t even know where to begin. Last weekend’s best idea JWN looks like it is about to get to taken out after jumping 6% late day yesterday on rumors of a takeover. Those Apple risk reversals I highlighted yesterday are up a fortune today but the big winners I want to discuss are NET and TDW as the smaller names remain the pockets of most alpha.

Yesterday before the Cloudflare report I pointed to the recent flurry of put buying going on including that massive block of 10,000 $70 puts for next week and today NET was decimated down 18% right now to 72.xx and breaking the 200 day. Those weekly $80 puts bought yesterday are also up very nicely. I rarely point to bearish trades because being short is just so hard but these worked perfectly.

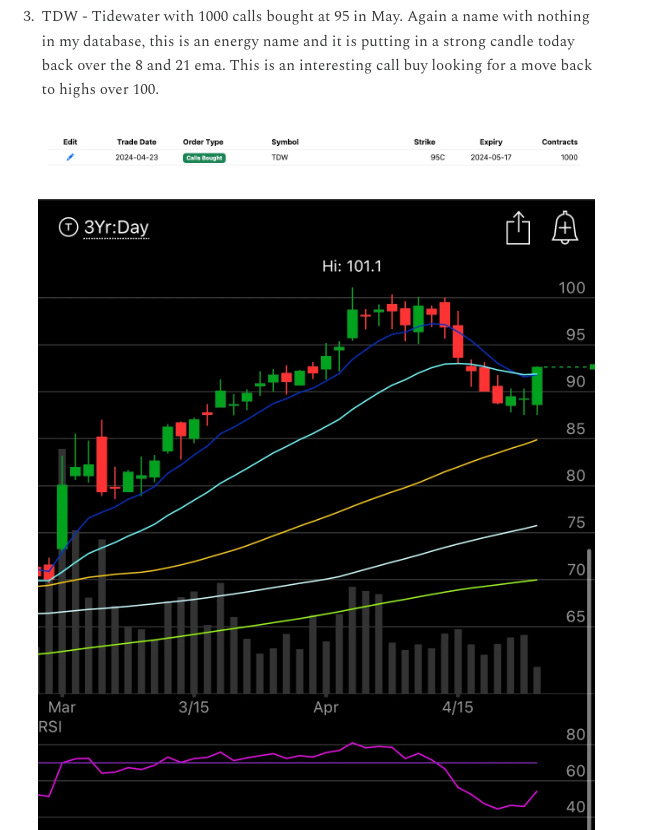

Another name I highlighted recently in the 4/23 recap was TDW, Tidewater, at the time I mentioned that there were no other calls in my database and sure enough today, 2 weeks before expiry TDW is up 12.5% to 106 and those $95 calls have gone up hundreds of percent. Amazing trade by this player and I don’t know the success rate but I only post 25 trades a week, the fact that there is constantly multiple names I can go back and highlight every week is just insane in showing how many of these odd trades work out.

Trends

1 Week

2 Week

1 Month

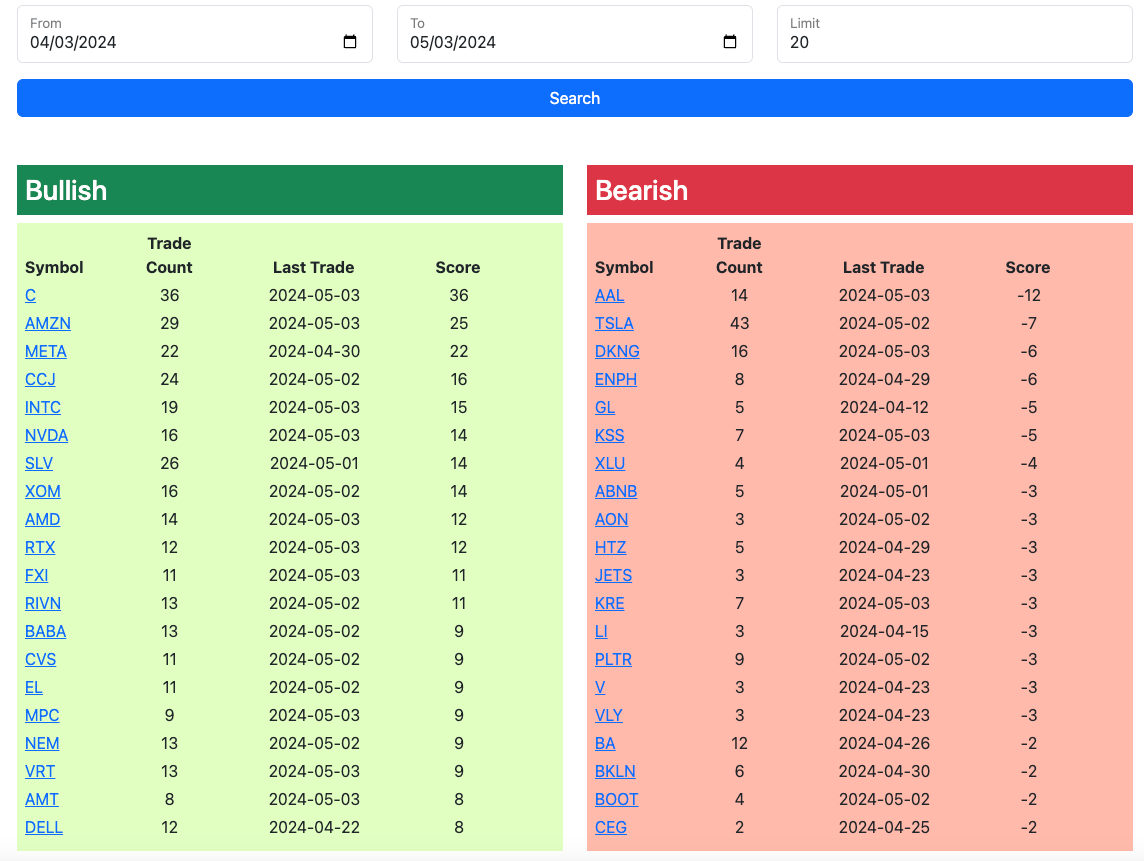

Today’s Unusual Options Activity

Here is the link to the database, it will expire monday morning at the open. I will have the rest of today’s trades added by the afternoon.