5/30 Recap

The SPY is teetering on the edge. Either it bounces right here or it will be breaking the 21 ema soon. I talked about this yesterday when we were finally breaking below the 8 ema and that bearish divergence was getting stronger. It’s early in the session still but we’re sitting right ontop of the 21 ema and if if it breaks down and closes below it today, that’s your sign that we’re in a new downtrend for a little bit. Now again stocks have been up and to the right for 200 years, don’t go panic sell, these are just normal trend shifts, it’s just important to realize when you’re in one and just not use short term calls or leverage because you can really get hurt. Long term positioning I would not adjust.

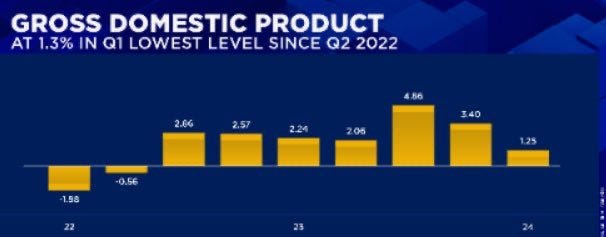

As for the why? Where do we begin, the GDP number this morning was the worst since 2022, the economic data has just been so awful for so long. This is just another point in the corner of those who say the recession is here.

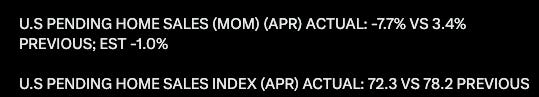

Then a few minutes into the market open we got the next whammy when pending home sales were a disaster. It’s important to realize how important real estate is to our economy, this right here by itself is begging for a rate cut to happen.

To me, all this data today says one thing, we have to print more, there really is no other solution. The fed keeps giving us this nonsense about 2% inflation as the target which no person with a brain thinks is achievable except apparently the fed. The reality is we will soon be normalizing higher inflation but the implications to the markets will be very big. The fed has no choice. The world has become accustomed to cheap money and without it nothing can seemingly function. Whether Biden or Trump wins this November, both are going to be like throwing gasoline on a fire in regards to our debt with their spending. Politicians only seem concerned with staying in power and could care less about future generations, their whole objective is to keep asset prices elevated today to keep the populace happy so any sign of weakness in home prices or stocks is met with more stimulus. Today’s pending home sales number says things are not pretty right now in the world of home sales.

This has led me to add IBIT this morning, no I’m not a fan of Bitcoin, I hate all the illicit things it gets used for, but it is as good a bet as we have on the money printing ramping and the debasing of our currency. They just approved all these ETF this year finally and IBIT to me seems like the best one. Aside from that it is the best performing asset by a mile in the recent era. I added a decent bit below 39, I just see more adoption to these ETF’s in the coming months and years in general, but more than anything it is just a bet that soon we’re going to do something dumb like cut rates and print more money because that is always our solution to every economic crisis. Also yes I fully know how to buy bitcoin directly, but, I did that 7-8 years ago and it is a pain in the ass to put into cold storage on coinbase, write down a very long code to give your wife incase you die, and hope she remembers what that is when its time, etc. The ETF charges a small fee to simplify your life and I’m ok with that if I’m placing a big bet, I’m more concerned with the direction it goes, not the small fee involved. Lastly, I’m happy to be able to do it straight from my brokerage account.

Recent Trades

This wasn’t a trade from recently, this was a trade from today that I wanted to discuss. I get the question alot when people sign up of what’s the difference between the recap and live. So this morning at 8:55 my time, this trade came through. You can see the volume was 11,000 and BAC was 38.72. This is how the trades look before I put them in the database for you.

I instantly thought it was odd because Bank of America does not move much and these were expiring tomorrow so a minute later I mentioned it in the live discussion on the discord because I felt they were really weird.

Not even an hour and a half later something happened, I assume news dropped, I don’t know nor do I care, but you can see BAC plunged to 37.59 and those puts went from .18 to over $1 as you can see below.

Just an incredible trade by whoever put that on. So you will see these puts in the table below, but they’ve already and the problem with markets is they’re constantly and if I log a trade in the database by the time I send the recap out, which could be a few hours later, even if its mid day, the trade might have moved. The volume on those puts above today is 30,000 so that player likely already cashed in those puts that were bought. It’s disgusting how insider trading occurs and nobody does anything about it, but those are things you see in the options market that you won’t see anywhere else.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire at the open tomorrow and I will have the rest of today’s action added by the afternoon. Days like today there’s too many calls so I can’t fit the whole table here so please check the database to get the full view