5/31 Recap

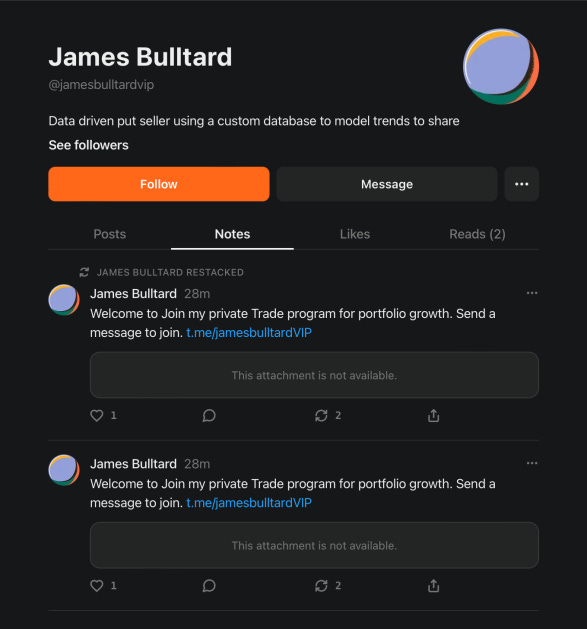

I had a small emergency so I’m getting this out very early. So I wanted to start this with the below. I got a few messages overnight that some got followed by this account below and telling them to sign up there. I have no other account, it seems like substack is entering the twitter phase of fake accounts and its a shame because substack takes so much from us, over 10%, that they should have a better grip on things. I emailed them this morning, but nobody replied to me yet. Just know there is only 1 account for me, here and on twitter, anything else is a just a scammer.

As for today I’m wrapping up early, I apologize, I know I mentioned a long time ago my dad was battling merkel cell carcinoma and we got the all clear in March but unfortunately by the end of April it was back for a 3rd time in a year. He isn’t reacting well today to his chemo and my mother had to take him to the ER so I have to rush over there now. I feel bad because I know so many of you depend on this data, but I tried to stay as late as I could even though she called me early in the morning. I wanted to get something out to you because I know today is a pretty significant day with the end of the month and the market breaking down.

So let’s talk about the charts and I’m going to post up a link to the database for the weekend and I will have it updated whenever I get home whatever time that may be tonight.

The daily on the SPY closed below the 21 ema yesterday. That light blue line was the level I mentioned the last few days and we finally broke it. The followthrough today wasn’t shocking. Investors always want an answer to “why” and the “why” doesn’t really matter, what matters is the computers that run the market were just programmed to unload below that 21 ema and they did just that. Now we enter our second downtrend in the last 45 days. This won’t resolve quickly, you have to now wait for at a minimum the 8 ema to flatten out and be reclaimed before its time to start buying again. So just like last month, we had ample time to get out of short term things, the reason investors get crushed is because they stay levered up into these breakdowns. As long as you see them, adjust your book by selling things, selling covered calls, buying puts, etc you will be ok. Never in the history of markets have markets dumped while staying above the 21 ema. It isn’t possible which is why it is my barometer of when to reduce leverage.

On a longer timeframe, the monthly, the SPY looks ok, look at the monthly below. It’s over all the moving averages, it is going to close this month a few dollars from its highest monthly close ever and it just remains in a sideways consolidation. Short term we have some headwinds.

This morning CNBC anchor Carl Quintanilla posted this chart that breadth is as bad as its been since the GFC 15 years ago. Basically other than a handful of stocks, nothing is being bought. This is more bearish something like RSP, the equal weight S&P. The SPY is of course heavily weighted to the 6 stocks that we mostly do buy anyways ie Apple,Microsoft,Amazon,Google,Nvidia, and Meta. Those comprise over 30% of the index, which is why “the market” remains elevated even though interest in most companies seems non existent.

Again this move lower was fairly telegraphed like last month, we saw the weakness the last few sessions creeping up. From there it is a pretty simple rule of thumb in the market, anytime any ticker is below the 21 ema, you just don’t buy it if short term matters to you. Obviously you don’t create a tax liability selling a long term position for such a thing but you don’t want to add any for the short term for sure. If you do decided you want to fight gravity, in theory if you wait long enough it will likely work if its a quality name because most names eventually go up, but outperformance comes from pressing it in good times, and reducing positioning and leverage in bad times. For me, the short calls I have on my leaps, this is what they’re there for. I’m not closing them up, but they’re there to offset the weak times.

Yesterday we were on the edge, today you have your confirmation, the market is now in a downtrend, how deep or shallow it is will only be known in time when various moving averages are reclaimed. For now, all you can do is sell covered calls on your book and start to generate income while you wait. Many like to sell calls and then use the proceeds to buy puts the same way when things are bullish and people sell puts to buy calls. This is where options work in your favor to the downside even if you’re long term bullish, which almost everyone is.

Again, I really apologize for leaving early today, I will have a best idea for you all this weekend, I always try to get it out on saturday but if not I will get it done by Sunday at some point before the market opens monday.

Here is the link to the database for the weekend.