5/6 Recap

I’m sending this out a little early as I have an appointment I have to go to. The SPY crossed over bullish again today for the first time in nearly a month. We gapped up over the 50 for the first time in 16 sessions. Is the mini bear market over? For the moment, yes, as long as we stay up over all these moving averages. This has been the shortest drawdown we’ve seen in a long time. The resilience of this market has been impressive.

Still though, I refuse to say everything is ok because as I mentioned on the weekend post, we did the exact same thing last August,below, before ultimately resolving lower. So be vigilant, don’t get too piggish yet, of course the long term trend is higher, but if you’re dabbling in short term calls it could get messy if we take a turn lower in a week or so on CPI. Just simple of thumb watch the short term moving averages, when we’re over the 8/21/50 then things are ok, but any move below and caution is warranted. Things look encouraging at the moment, the question is will we see a followthrough.

Recent Trades

Back in the 4/10 recap I highlighted some odd call buying going on in SMTC, a huge block of the 5/17 $45 call was bought. Those specific calls haven’t worked out even though the common stock is up nearly 25% in a month since that trade came in, they were just too far out of the money. They could still work as there are 2 weeks left, but this is why I always tell you to utilize risk reversals, it is the only way to ensure your basis is low or even a credit to you so this doesn’t happen when the IV crush hits. If you did the trade I suggested below those January $20 puts went fro $1.20 to $.80 now and you are still profitable at the moment. Again this player was directionally right and that’s why sometimes just buying common in the right direction of these odd trades is a good trade too.

Trends

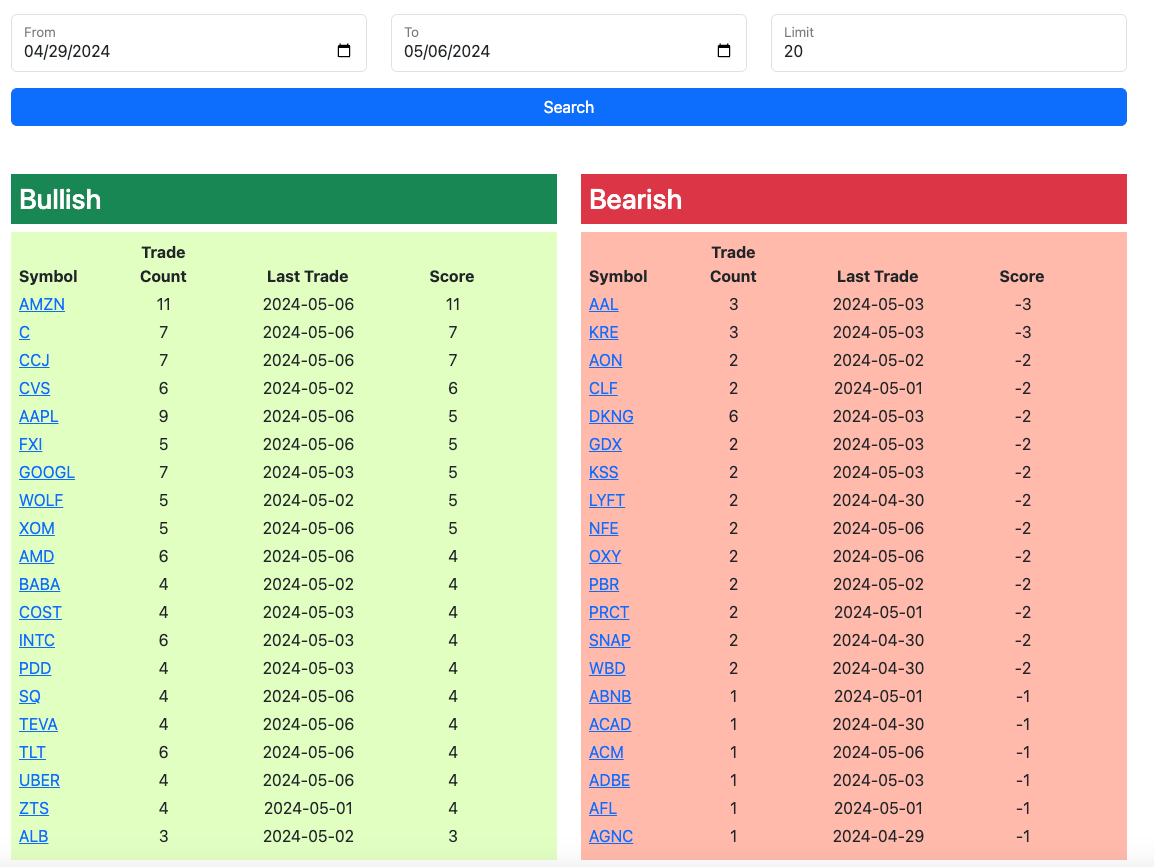

1 Week

2 Week

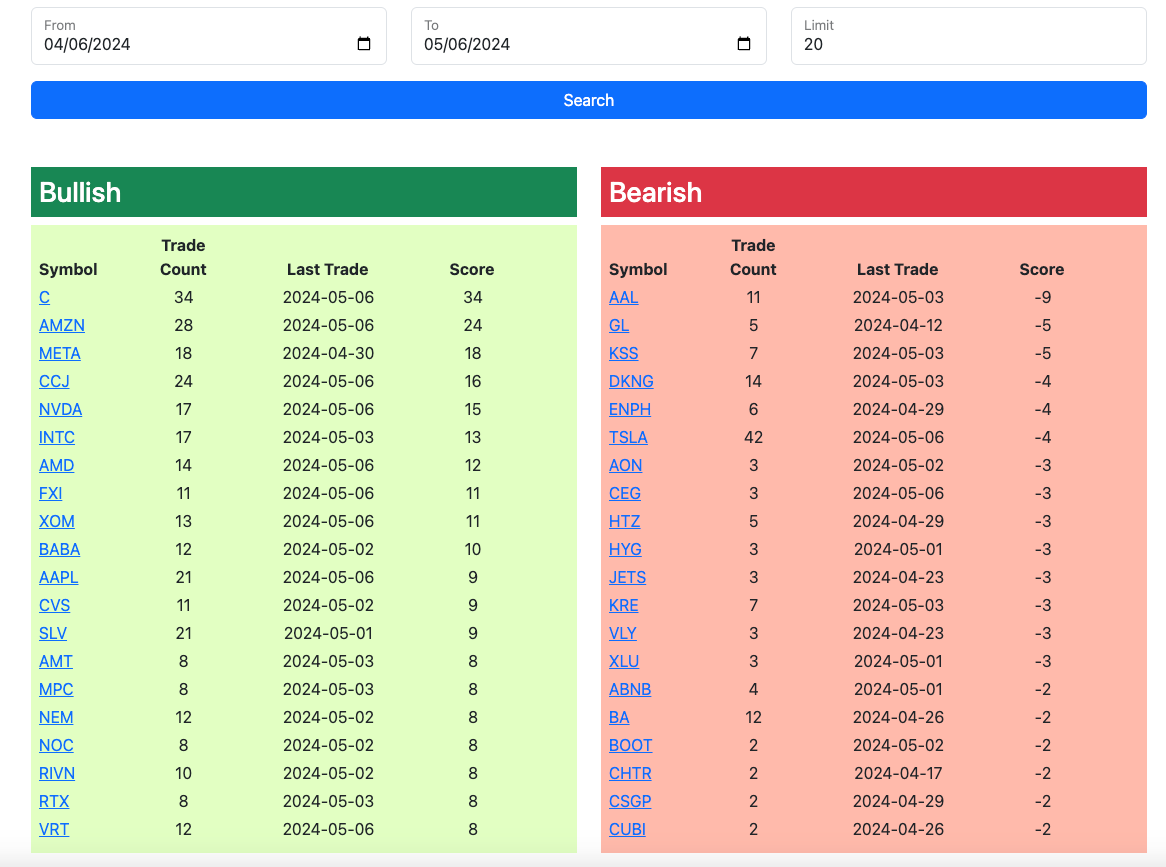

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires at the open tomorrow. I will have the rest of today’s action added by the afternoon.