5/7 Recap

The SPY has now firmly seen an 8/21 ema bullish crossover and we are now clear of all the moving averages. You could even say there is a clear double bottom below right over the 100 day moving average, the white line. It appears that for the time being, the bear market is now over in less than a month. More interesting is the fact we did it today without our leader, NVDA, which sold off on news that Stanley Druckenmiller sold his stake this morning while stating that AI was “Overhyped” at the moment. Those are some big words from the man I consider to be the best fund manager around when everyone is looking at AI as a secular story at the moment.

More than all the above the recent move back higher was simply because rates pulled back hard falling nearly 10% in the last 9 sessions as you can see TNX below. This whole market is one giant rate trade, nothing else matters. Rates go down, stocks go up, and vice versa.

New Users

I want to open this by saying I’m not sure what happened yesterday, I assume some tweet of mine went viral but there’s ALOT of new free subscribers today and I have some commentary on how to get the most out of all of this.

My goal here is to improve on the countless other options flow platforms. Everyone else is focused on posting all the odd sized option flow, my objective is to filter it down to my own parameters of what I consider odd and then highlight the 5 I think are the best of them daily using my expertise of how to structure trades properly. What I mean is to try and get you into names in a manner where your capital outlay is minimized while your risk is hopefully lowered in case you’re wrong and you’re still following these big trades. If a player buys calls on a name and it interests me, I usually highlight how to play it using risk reversals, ratios,etc to build a trade that hopefully costs you as little as possible or pays you to place it. I think that is what makes me unique vs all the others pushing “option flow”.

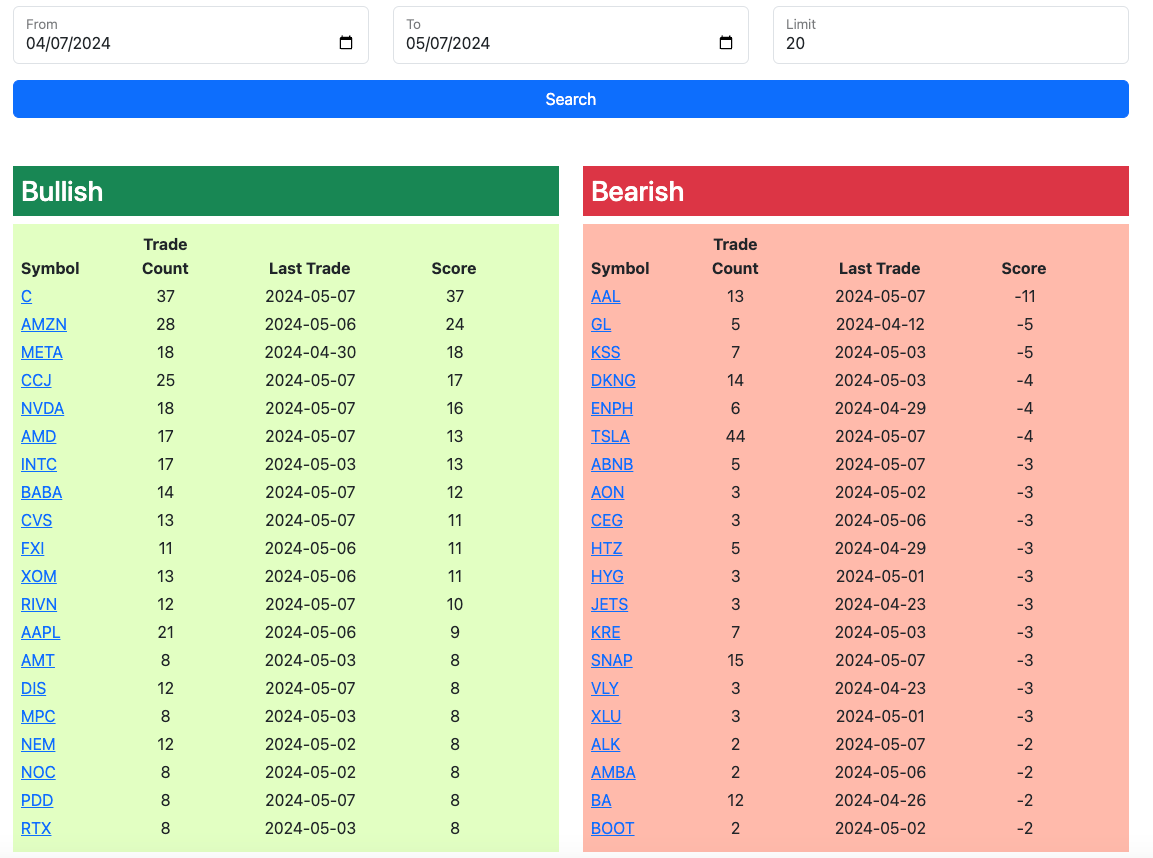

The trends table you’ll see below is just an aggregate of all the bullish/bearish trades that I’ve logged in my database. It’s nothing fancy but it can help you see direction in terms of what names are seeing bullish/bearish flow. At worst it can help you avoid names seeing bearish flow, at best it gives you a tool to buy names or sell puts into strength as you get used to it. Everyday you’ll see the trends and the unusual options table in here, but the best way to view it is in the app and the link is included daily, in there you can click on names and see all the trades I’ve logged for them.

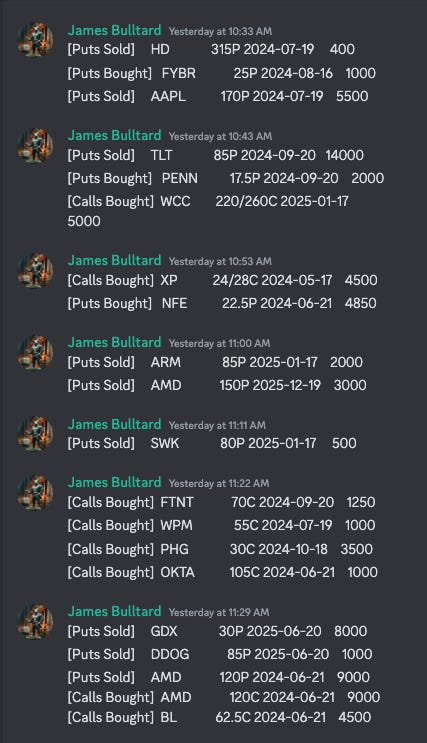

Aside from that, if you actually end up becoming a paid subscriber, there will be a link in the welcome email you get after you pay that will give you access to the community discord, there’s 700+ people in there and various channels where you can discuss a ton of different topics and ask questions. There are lots of great people in there and alot of professionals I know that I’ve brought in, that alone is a tremendous tool to utilize. There is also a live feed in the discord that you won’t see unless you’re in the live tier when you checkout and that data is simply what you get in the recap but live for those who are very active traders. These option prices move rapidly and even as quick as I get the recap out, nothing can compare to real time unfortunately. That section has its own separate chat as well. The live tier also gives you access to the database during market hours as I update it, otherwise I post a link below everyday that expires at the open. The live feed looks like this and is about as good a product as any retail trader at home has access to, it is what everyone else offers with all the junk filtered out, only the most notable trades I see.

Recent Trades

I have 2 to discuss today, one from yesterday and a longer term one.

WCC is up $8 from yesterday when I posted that really odd trade below to nearly 179. It’s odd enough for someone to buy calls on this ticker, but to go that far out of the money is another thing. This is a really encouraging first day with the stock up 3.5% so quickly on nothing those call spreads are up over 30% already. Will be an interesting one to watch in the coming weeks.

As for the longer term trade, we have to go back OSCR today because this is now a double on common from late January when I first highlighted it multiple times. I was actually up over 16% premarket but has faded to now being up just 6%. Most of those buys in January were for later in the year including that massive October 12.5/20 call spread which is up a fortune now. This was an impressive small cap move, up 100% in just over 3 months on a small health insurance name.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it expires at the open tomorrow and I will have the rest of today’s trades added by the afternoon. I keep updating the link below throughout the afternoon so you don’t miss anything, but in the interest of getting this out mid day so people have data they can trade intraday with, I send out my recap by 1:30 EST everyday.